What is Donation Receipt Letter Template?

A donation receipt letter template is a document that organizations use to acknowledge and thank individuals or businesses for their contributions or donations. This letter serves as proof of donation for the donor and can be used for tax purposes. It also helps build a positive relationship between the organization and the donor.

What are the types of Donation Receipt Letter Template?

There are different types of donation receipt letter templates available, depending on the organization's needs and the type of donation. Some common types include:

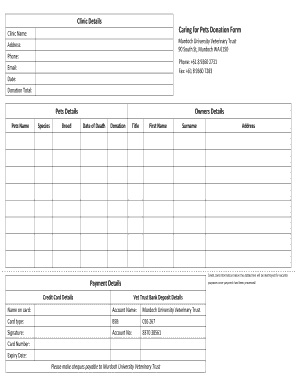

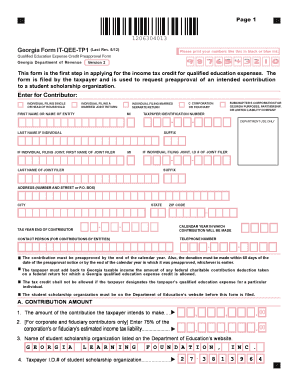

Standard Donation Receipt Letter: Used for general cash or check donations.

In-Kind Donation Receipt Letter: Used for donations of goods or services instead of cash.

Monthly Giving Receipt Letter: Used for recurring monthly donations.

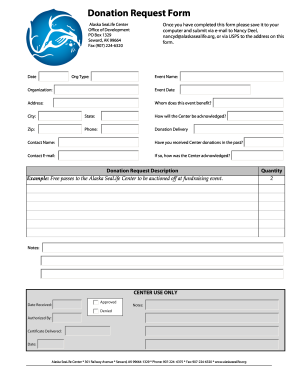

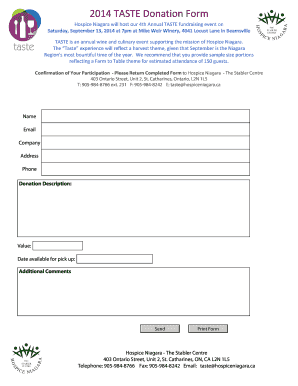

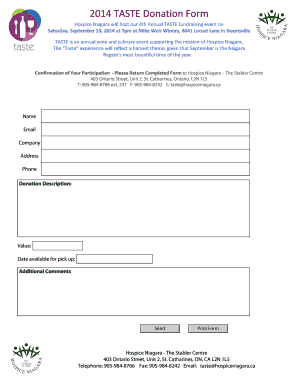

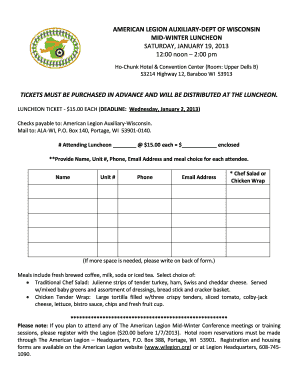

Event Donation Receipt Letter: Used for donations made at fundraising events.

How to complete Donation Receipt Letter Template

To complete a donation receipt letter template, follow these steps:

01

Start by opening the donation receipt letter template in a PDF editor like pdfFiller.

02

Fill in the organization's name, address, and contact information.

03

Enter the donor's name, address, and contact information.

04

Specify the donation amount or the value of the donated goods/services.

05

Include the date of the donation and the purpose or campaign it supports.

06

Personalize the letter by expressing gratitude and acknowledging the impact of the donation.

07

Sign the letter on behalf of the organization and include any necessary attachments, such as tax exemption information.

08

Review the completed letter for accuracy and make any necessary revisions.

09

Save, download, or print the donation receipt letter to share it with the donor.

pdfFiller empowers users to create, edit, and share documents online, including donation receipt letter templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for individuals and organizations to streamline their document workflows.