Irs Payment Login

What is irs payment login?

IRS payment login refers to the process of accessing the online platform provided by the Internal Revenue Service (IRS) for taxpayers to make payments electronically. It allows individuals and businesses to conveniently and securely submit their tax payments, track payment history, and view payment options.

What are the types of irs payment login?

There are several types of IRS payment login options available:

Electronic Funds Withdrawal (EFW): This option enables taxpayers to authorize the IRS to withdraw the funds directly from their bank accounts.

Credit or Debit Card Payment: Taxpayers can make payments using their credit or debit cards. However, there may be additional fees associated with this method.

Electronic Federal Tax Payment System (EFTPS): This service provides a secure means for individuals and businesses to make federal tax payments online or via phone.

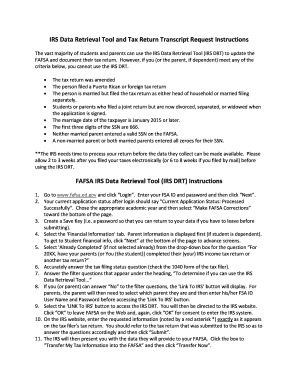

How to complete irs payment login

To complete the IRS payment login process, follow these steps:

01

Visit the official website of the IRS and locate the login page.

02

Enter your username and password to access your account.

03

Once logged in, navigate to the payment section.

04

Choose the desired payment method from the options available.

05

Provide the necessary payment details and verify the information.

06

Review the payment summary and submit the payment.

07

After completing the payment, you will receive a confirmation.

08

Keep a record of the payment transaction for future reference.

pdfFiller empowers users to create, edit, and share documents online, including IRS payment forms. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users seeking to efficiently manage their documents.

Video Tutorial How to Fill Out irs payment login

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What form is needed for IRS payment plan?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

How do I send IRS payment electronically?

Credit card, debit card or digital wallet: Individuals can pay online, by phone or with a mobile device through any of the authorized payment processors. The processor charges a fee. The IRS doesn't receive any fees for these payments. Authorized card processors and phone numbers are available at IRS.gov/payments.

How do you make a payment to IRS?

The IRS offers various options for making monthly payments: Direct debit from your bank account, Payroll deduction from your employer, Payment by EFTPS, Payment by credit card or debit card via phone or Internet, Payment via check or money order, Payment with cash at a retail partner.

How do I start a payment tracker with the IRS?

To start a payment trace: Call us at 800-919-9835. Mail or fax a completed Form 3911, Taxpayer Statement Regarding RefundPDF.

Related templates