Irs Refund Payment

What is irs refund payment?

An IRS refund payment is a financial reimbursement issued by the Internal Revenue Service (IRS) to taxpayers who have overpaid their taxes. If you paid more taxes during the year than your actual tax liability, the IRS will send you a refund payment.

What are the types of irs refund payment?

The IRS offers different types of refund payments based on the taxpayer's preference and convenience. The main types of IRS refund payments include:

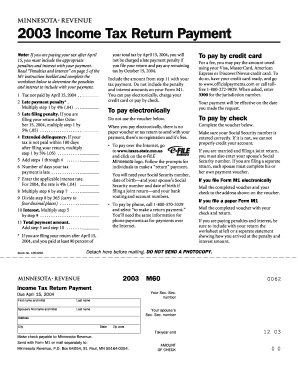

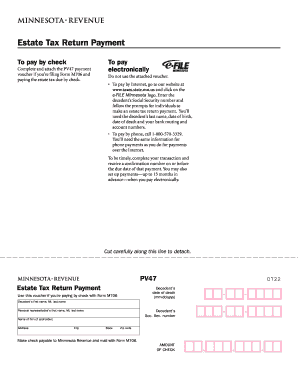

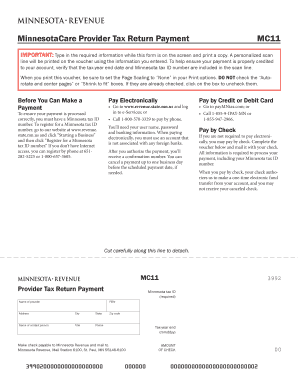

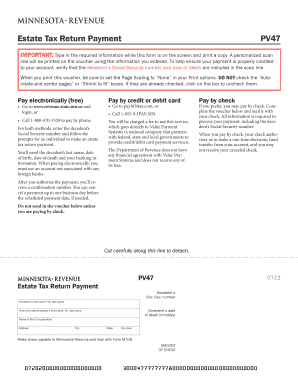

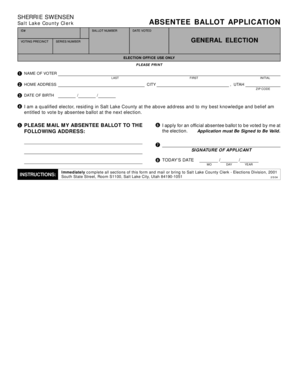

Direct deposit into a bank account

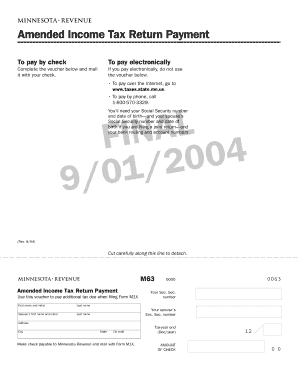

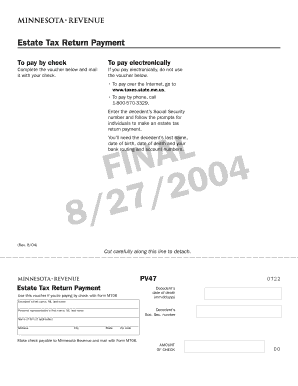

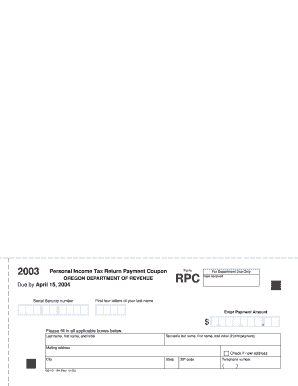

Paper check sent by mail

How to complete irs refund payment

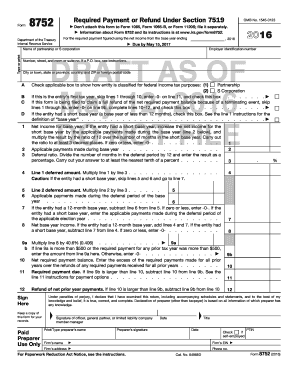

To complete an IRS refund payment, follow these steps:

01

Gather your tax information and calculate your overpaid amount.

02

File your tax return accurately and provide your bank account details for direct deposit, if preferred.

03

Wait for the IRS to process your return and verify the overpayment.

04

Receive your refund payment via direct deposit or a paper check in the mail.

pdfFiller is a trusted platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies document management and is an excellent choice for managing your tax-related documents seamlessly.

Video Tutorial How to Fill Out irs refund payment

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

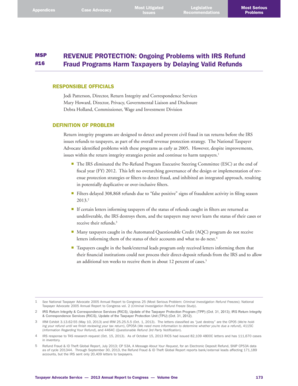

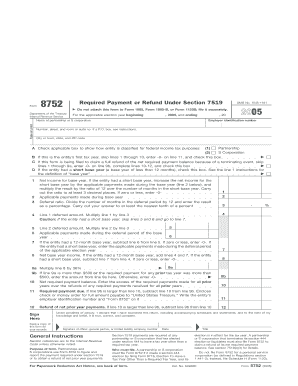

How do I set up an IRS payment plan?

What if I am not eligible or unable to apply or revise a payment plan online? Individuals can complete Form 9465, Installment Agreement Request. If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.

How do I pay tax owing to CRA?

You can pay your personal and business taxes to the Canada Revenue Agency (CRA) through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date.

What's the fastest way to receive a tax refund?

The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

How do I make a payment to the CRA?

Pay online Online banking. Interac Debit, Visa Debit, or Debit Mastercard (using. Pre-authorized debit (PAD) Credit card, debit card, PayPal, or Interac e-Transfer. Wire transfer. Financial institution (cheque or debit) Canada Post location (debit or cash) Cheque or money order.

Can you pay the IRS back online?

Credit card, debit card or digital wallet: Individuals can pay online, by phone or with a mobile device through any of the authorized payment processors. The processor charges a fee. The IRS doesn't receive any fees for these payments. Authorized card processors and phone numbers are available at IRS.gov/payments.

What is the easiest way to pay the government or to receive your refund?

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury's Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds.

Related templates