Irs Payment Address

What is irs payment address?

The IRS payment address is the designated address where individuals and businesses can send their payments to the Internal Revenue Service. It is important to use the correct payment address to ensure that your payment is received and processed correctly.

What are the types of irs payment address?

There are different types of IRS payment addresses depending on the type of tax return and payment you are making. Here are some of the common types of IRS payment addresses:

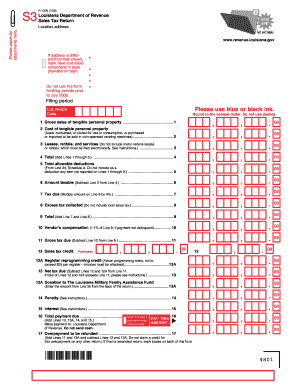

Form If you are filing an individual income tax return, the payment address can be found on the IRS website or in the instruction booklet for Form 1040.

Form For corporations filing their income tax return, the payment address can be found on the IRS website or in the instruction booklet for Form 1120.

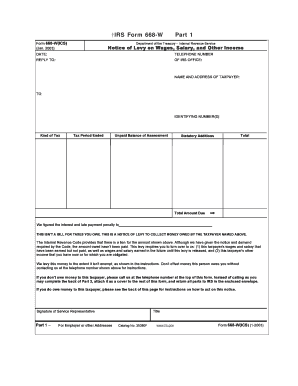

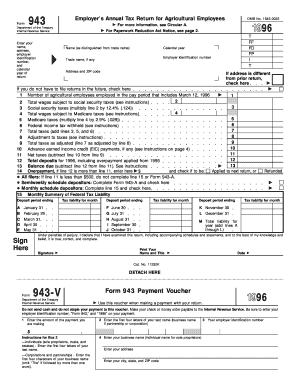

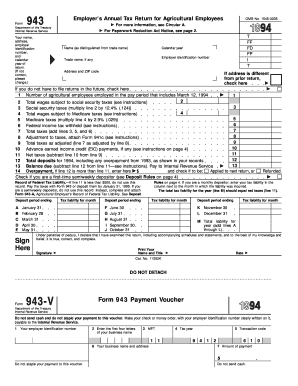

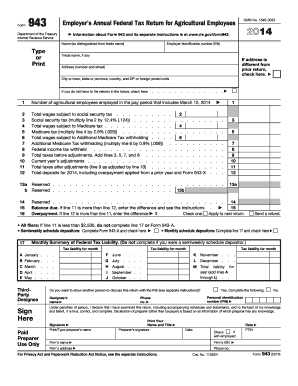

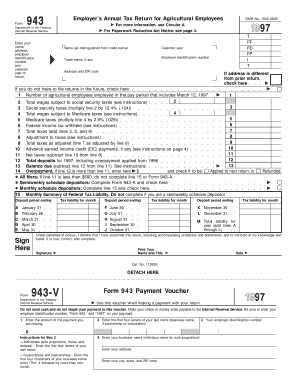

Form Employers who are submitting payroll taxes must use a different payment address, which can be found on the IRS website or in the instruction booklet for Form 941.

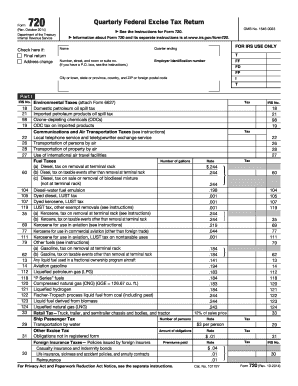

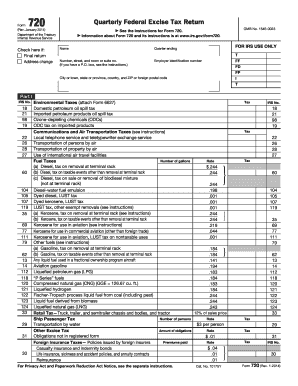

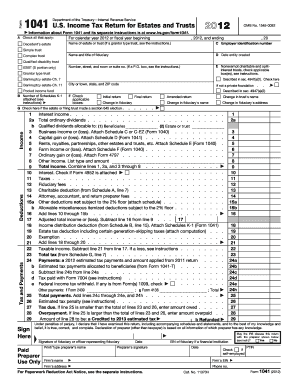

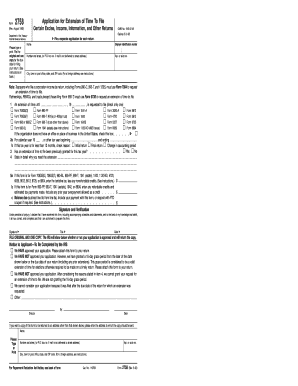

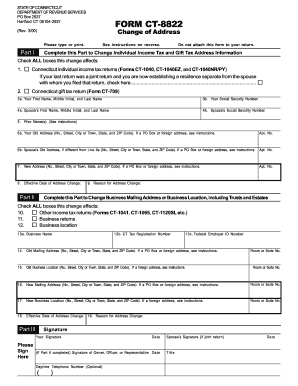

Other tax forms: Depending on the type of tax you are paying, there may be specific payment addresses for different forms. It is important to check the instructions or the IRS website to find the correct address.

How to complete irs payment address

Completing the IRS payment address is a straightforward process. Here are the steps you can follow:

01

Find the correct payment address: As mentioned earlier, the payment address depends on the type of tax return and payment you are making. Make sure to find the correct address by referring to the IRS website or the instructions for the specific form you are using.

02

Write the address correctly: Double-check the payment address to ensure there are no errors or typos. It is crucial that the address is accurate to avoid any delays or misplacements of your payment.

03

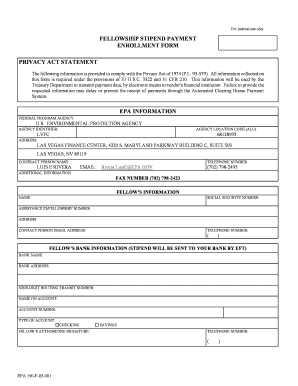

Include necessary information: Along with the payment address, you may need to include additional information such as your name, social security number or employer identification number, and the tax period for which you are making the payment. Make sure to provide all the required information to facilitate the processing of your payment.

04

Send the payment: Once you have completed the payment address and provided all necessary information, you can send your payment to the designated address. It is recommended to use a secure and traceable method of delivery, such as certified mail or a reputable courier service, to ensure the safe arrival of your payment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out irs payment address

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does IRS require a physical address?

The IRS wants to know where the business is physically located. This does not have to be a U.S. address. it can be an address anywhere in the world. Even if the business is an internet business, the IRS still requires the physical location of your business.

How do you address mail to IRS?

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

What is the payment address for the IRS?

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

How do I submit payment to IRS?

How to pay your taxes Electronic Funds Withdrawal. Pay using your bank account when you e-file your return. Direct Pay. Pay directly from a checking or savings account for free. Credit or debit cards. Pay your taxes by debit or credit card online, by phone, or with a mobile device. Pay with cash. Installment agreement.

How do you address an envelope to the IRS?

1:46 7:57 How To Mail Documents to the IRS - Bulletproof Method - YouTube YouTube Start of suggested clip End of suggested clip And then you're going to put the certified mail number right down in this spot. Here you can writeMoreAnd then you're going to put the certified mail number right down in this spot. Here you can write it in or. You can just peel it right off of the certified mail receipt.

Where do I mail my 2022 IRS estimated tax payment?

payment with the estimated tax payment voucher. voucher to the following address. Internal Revenue Service P.O. Box 1303 Charlotte, NC 28201-1303 U.S.A.

Related templates