Get the free PROPERTY TRANSFER REQUEST - saddleback

Show details

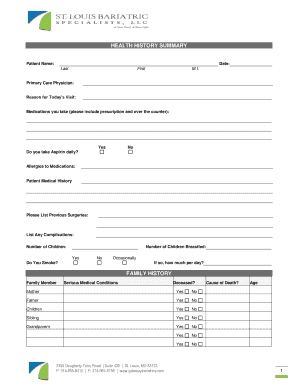

This document is used to request the transfer of property or report lost, stolen, or destroyed fixed assets within the South Orange County Community College District, detailing instructions for completion

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property transfer request

Edit your property transfer request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property transfer request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property transfer request online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property transfer request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property transfer request

How to fill out PROPERTY TRANSFER REQUEST

01

Obtain the PROPERTY TRANSFER REQUEST form from your local property office or their website.

02

Fill in your personal information including your name, address, and contact details.

03

Provide the details of the property being transferred, including the address, property ID, and legal description.

04

Indicate the reason for the transfer (e.g., sale, gift, inheritance).

05

Enter the details of the new property owner, including their name, address, and contact information.

06

Sign and date the form to certify the accuracy of the information provided.

07

Submit the completed form along with any required documentation to the appropriate property office.

Who needs PROPERTY TRANSFER REQUEST?

01

Individuals transferring ownership of real estate.

02

Gift givers transferring property to family or friends.

03

Heirs who are inheriting property from a deceased person.

04

Real estate agents facilitating property transfers.

05

Legal representatives handling property matters.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to transfer a deed in MD?

Transfer tax is at the rate of . 5 percent of the actual consideration, unless they are a first-time Maryland home buyer purchasing a principal place of residence, in that case the transfer tax rate is . 25 percent of the actual consideration.

Do I need an attorney to transfer a deed?

A transfer deed is a document that acts as the proof of conveyance. In other words, it's the transfer of the ownership of a property. It has a property description that adheres to legal norms and identifies the current and subsequent owners.

What is the best way to transfer property title between family members?

To officially transfer ownership, the executor must prepare and file a new deed with the local land records office. This document legally names the new owner(s) of the property. Ensure that all taxes, such as property taxes and estate taxes (if applicable), are paid prior to completing the transfer.

How do I transfer ownership of a property in Maryland?

Value while it's possible to transfer a deed without a lawyer there are risks. Involved if the deedMoreValue while it's possible to transfer a deed without a lawyer there are risks. Involved if the deed is not prepared correctly. It could lead to legal challenges or disputes in the future for instance

How to transfer a house deed to a family member in Maryland?

To add a name to a deed in Maryland, you must prepare a new deed that includes both the current owner's name and the new owner's name. The current owner is the grantor, and the new owner is the grantee. The new deed should include a legal description of the property.

How do I transfer property to a family member tax free near Maryland?

How Do I Transfer Property to a Family Member Tax-Free? Leave the House in Your Will. The simplest way to give your house to your children is to leave it to them in your will. Gift the House. Sell Your Home. Put the House in a Trust.

What is the easiest way to transfer ownership of a house?

A Quitclaim Deed is used to transfer a title or whatever interest the owner (grantor) may have in property to another person (grantee) without any war A Contract for Sale of Real Estate is used to document the purchase and sale of real property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROPERTY TRANSFER REQUEST?

A PROPERTY TRANSFER REQUEST is a formal document submitted to request the transfer of property ownership from one party to another.

Who is required to file PROPERTY TRANSFER REQUEST?

Typically, the current property owner or their authorized agent is required to file a PROPERTY TRANSFER REQUEST.

How to fill out PROPERTY TRANSFER REQUEST?

To fill out a PROPERTY TRANSFER REQUEST, provide the current owner's details, the new owner's details, description of the property, and any relevant transaction information such as sale price or consideration.

What is the purpose of PROPERTY TRANSFER REQUEST?

The purpose of a PROPERTY TRANSFER REQUEST is to officially document and facilitate the legal transfer of property ownership, ensuring that the change is recorded in public property records.

What information must be reported on PROPERTY TRANSFER REQUEST?

The information that must be reported includes the names and addresses of the grantor (current owner) and grantee (new owner), the legal description of the property, the type of transfer (e.g., sale, gift), and any applicable consideration or payment details.

Fill out your property transfer request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Transfer Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.