Get the free Credit Card Agreement - First Reliance Federal Credit Union - firstreliancefcu

Show details

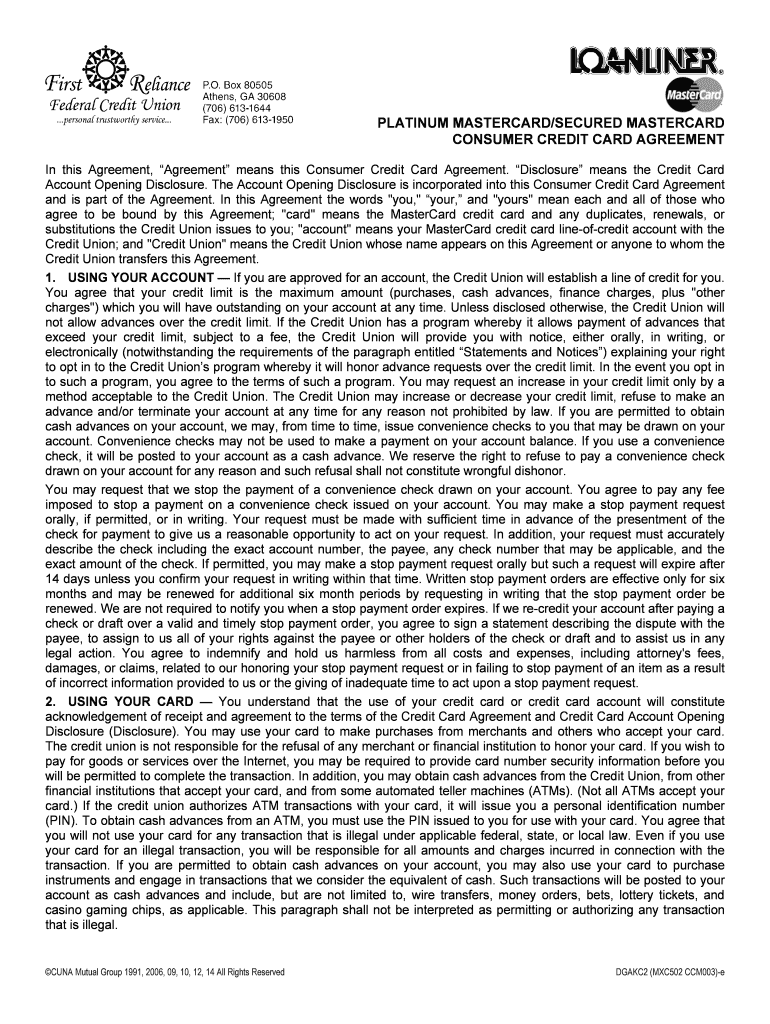

PLATINUM MASTERCARD×SECURED MASTERCARD CONSUMER CREDIT CARD AGREEMENT In this Agreement, Agreement means this Consumer Credit Card Agreement. Disclosure means the Credit Card Account Opening Disclosure.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card agreement

Edit your credit card agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card agreement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit card agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card agreement

How to fill out a credit card agreement:

01

Read the agreement thoroughly: Begin by carefully reading the credit card agreement provided by the issuer. Make sure to understand the terms, conditions, fees, interest rates, and any other important information mentioned in the agreement.

02

Provide personal information: Fill in your personal details accurately. This typically includes your full name, address, contact information, and Social Security number. The issuer requires this information to verify your identity and assess your creditworthiness.

03

Review the terms and conditions: Pay close attention to the terms and conditions section of the agreement. It outlines the rules, responsibilities, and rights associated with owning and using the credit card. Understand the payment due dates, interest rates, late fees, and other charges that may apply.

04

Decide on card usage: Determine how you plan to utilize the credit card. Will it be used for everyday expenses or specific purposes, such as building credit or earning rewards? Consider your financial goals and select a card that aligns with your needs.

05

Evaluate the credit limit: The agreement will specify your credit limit, which is the maximum amount you can spend on the card. It's important to understand this limit and avoid exceeding it, as doing so may result in over-limit fees or other penalties.

06

Understand the payment terms: Familiarize yourself with the payment terms outlined in the agreement. This includes the minimum payment due, the grace period, and the consequences of making late payments. Knowing these details helps you manage your credit card payments effectively.

07

Comprehend the liability for fraudulent charges: The agreement will explain your liability for unauthorized or fraudulent charges made on your credit card. Understanding your rights and responsibilities will help you protect yourself from potential fraud.

Who needs a credit card agreement?

01

Individuals applying for a credit card: Any individual who wishes to apply for a credit card will need to review and agree to the credit card agreement provided by the issuer. This ensures that both the cardholder and the issuer are aware of their rights and obligations.

02

Existing credit cardholders: Even if you already have a credit card, it's essential to familiarize yourself with the agreement. This helps you stay updated on any changes in terms, fees, or policies that may affect your usage of the card.

03

Financial institutions and credit card issuers: The credit card agreement serves as a legal document that protects the interests of the financial institution or credit card issuer. It outlines the terms under which they provide credit to individuals and helps establish a clear understanding between the parties involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card agreement?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific credit card agreement and other forms. Find the template you need and change it using powerful tools.

Can I sign the credit card agreement electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your credit card agreement and you'll be done in minutes.

How do I edit credit card agreement on an Android device?

You can edit, sign, and distribute credit card agreement on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is credit card agreement?

A credit card agreement is a legally binding contract between a credit card issuer and a cardholder that outlines the terms and conditions of the credit card account.

Who is required to file credit card agreement?

The credit card issuer is required to file the credit card agreement with regulating authorities.

How to fill out credit card agreement?

Fill out the credit card agreement by providing all necessary information requested by the credit card issuer, such as personal information, financial information, and agreeing to the terms and conditions.

What is the purpose of credit card agreement?

The purpose of a credit card agreement is to establish the rights and responsibilities of both the credit card issuer and the cardholder in the use of the credit card.

What information must be reported on credit card agreement?

The credit card agreement must include terms such as interest rates, fees, credit limits, payment due dates, and dispute resolution procedures.

Fill out your credit card agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.