Get the free Canadian Council of Insurance Regulators Application for Insurer’s Licence

Show details

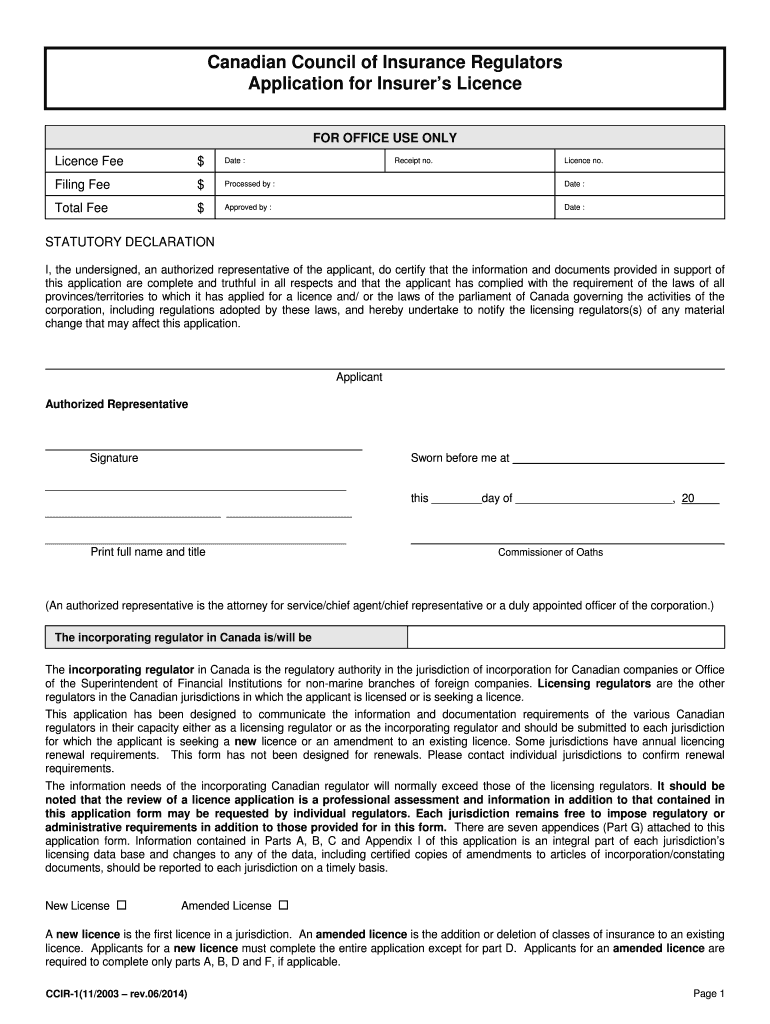

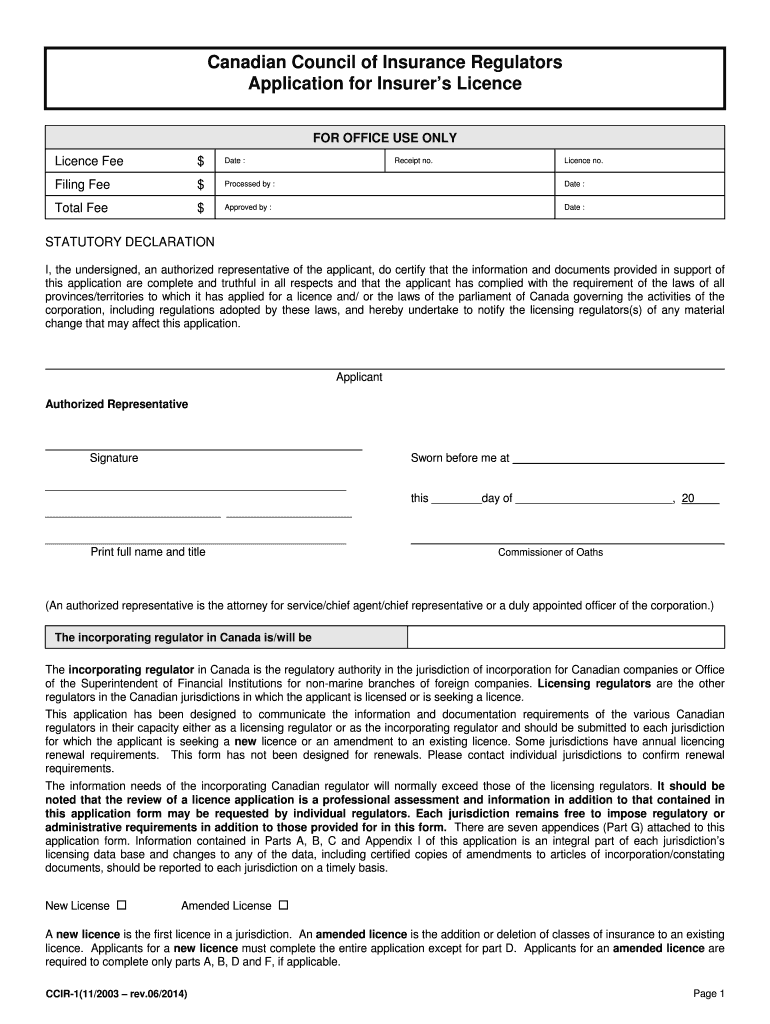

This document is an application form for obtaining an insurer's license in Canada, including a statutory declaration and various parts requiring information about the applicant and the classes of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canadian council of insurance

Edit your canadian council of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canadian council of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing canadian council of insurance online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit canadian council of insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canadian council of insurance

How to fill out Canadian Council of Insurance Regulators Application for Insurer’s Licence

01

Obtain the application form from the Canadian Council of Insurance Regulators (CCIR) website or contact their office for a copy.

02

Gather required documents such as business plans, financial statements, and proof of compliance with regulatory requirements.

03

Complete the application form with accurate information about your business, including details about ownership, governance, and operational plans.

04

Ensure that all supporting documents are attached to the application, as incomplete applications may delay the process.

05

Review the application for accuracy and completeness before submission.

06

Submit the application along with any required fees to the CCIR either electronically or by mail, depending on their guidelines.

07

Await confirmation of receipt and further instructions from the CCIR regarding the assessment process.

Who needs Canadian Council of Insurance Regulators Application for Insurer’s Licence?

01

Individuals or businesses looking to operate as insurers in Canada are required to fill out the Canadian Council of Insurance Regulators Application for Insurer’s Licence.

02

Companies seeking to provide insurance products and services to consumers in Canada must obtain this licence to comply with legal and regulatory standards.

Fill

form

: Try Risk Free

People Also Ask about

Who licenses insurance agents in Canada?

Insurance is regulated at both the federal and provincial level in this country. The federal level is focused on ensuring the financial stability of insurance companies, and the provincial level deals with the licensing of individuals. Each province and territory has its own insurance regulator.

How are insurance brokers regulated?

The Financial Conduct Authority (FCA). They set stringent regulations that anyone who wants to sell, arrange, or advise on insurance must meet.

How is insurance regulated in Canada?

All insurance companies must follow the rules and regulations of the province or territory where they carry on business. Provincial and territorial insurance regulators enforce consumer protection laws. They also oversee the licensing and conduct of insurance agents and brokers in their province or territory.

Who regulates insurance agents in Ontario?

All entities or individuals wishing to conduct insurance business in Ontario as an insurance company, insurance agent or a corporate insurance agency must be licensed with the Financial Services Regulatory Authority of Ontario (FSRA).

Who licenses and regulates insurance agents in Canada?

Insurance is regulated at both the federal and provincial level in this country. The federal level is focused on ensuring the financial stability of insurance companies, and the provincial level deals with the licensing of individuals. Each province and territory has its own insurance regulator.

What is the Canadian Council of insurance Regulations?

The Canadian Council of Insurance Regulators (CCIR) is an inter-jurisdictional association of insurance regulators. The mandate of the CCIR is to facilitate and promote an efficient and effective insurance regulatory system in Canada to serve the public interest.

Who regulates insurance in Canada?

The Canadian Council of Insurance Regulators (CCIR) is an inter-jurisdictional association of insurance regulators. The mandate of the CCIR is to facilitate and promote an efficient and effective insurance regulatory system in Canada to serve the public interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Canadian Council of Insurance Regulators Application for Insurer’s Licence?

The Canadian Council of Insurance Regulators Application for Insurer’s Licence is a formal application process required for insurance companies seeking to operate and provide insurance products in Canada. This application ensures that insurers meet regulatory standards and comply with applicable laws.

Who is required to file Canadian Council of Insurance Regulators Application for Insurer’s Licence?

Any insurance company or insurer wishing to offer insurance services in Canada must file the Canadian Council of Insurance Regulators Application for Insurer’s Licence. This includes both new and existing insurance providers seeking to expand their operations.

How to fill out Canadian Council of Insurance Regulators Application for Insurer’s Licence?

To fill out the Canadian Council of Insurance Regulators Application for Insurer’s Licence, the applicant must collect necessary documentation, provide details about the company's structure, ownership, financial standing, and submit this information through the prescribed format to the relevant regulatory bodies.

What is the purpose of Canadian Council of Insurance Regulators Application for Insurer’s Licence?

The purpose of the Canadian Council of Insurance Regulators Application for Insurer’s Licence is to ensure that insurance companies operate within a framework of accountability and consumer protection, by assessing their financial stability, governance practices, and compliance with industry regulations.

What information must be reported on Canadian Council of Insurance Regulators Application for Insurer’s Licence?

The application must report various information including the insurer's business plan, ownership structure, financial projections, management qualifications, compliance with regulatory requirements, and details of proposed insurance products to be offered.

Fill out your canadian council of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canadian Council Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.