Get the free REQuiRED DoCuMEntation ShoRt-tERM FinanCing ... - CAE Capital

Show details

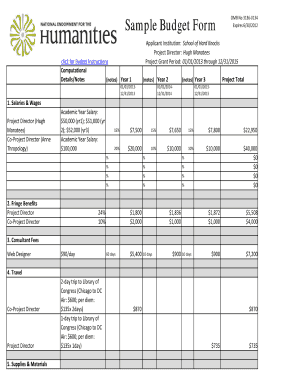

Required Documentation Shorter Financing Form SERVED Tax Credits 1. Financial statements for the last three years 2. Copies of T2 and CO17 tax returns for the last three years and the current year

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign required documentation short-term financing

Edit your required documentation short-term financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your required documentation short-term financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit required documentation short-term financing online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit required documentation short-term financing. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out required documentation short-term financing

Point by Point: How to Fill Out Required Documentation for Short-Term Financing

01

Gather all necessary financial information: Before filling out the required documentation for short-term financing, make sure you have all the relevant financial information readily available. This includes your current income statements, balance sheets, cash flow statements, and any other documents that accurately represent your company's financial position.

02

Identify the purpose of the loan: Clearly define the purpose of seeking short-term financing. Whether it is to cover operational expenses, fund inventory purchases, or manage cash flow gaps, understanding the purpose will help streamline the documentation process and ensure accuracy.

03

Prepare a business plan: In some cases, lenders may require a comprehensive business plan that outlines your company's goals, target market, competitive analysis, and financial projections. Create a well-structured and detailed business plan that showcases the potential for success and how the short-term financing will contribute to achieving those goals.

04

Determine the loan amount and terms: Assess your financial needs and determine the exact loan amount required. Additionally, consider the repayment terms that are realistic and manageable for your business. Understanding these details in advance will facilitate the completion of required documentation specific to the loan amount and terms.

05

Complete the loan application: Fill out the loan application form provided by the lender accurately and truthfully. Include all the necessary information, such as personal and business details, contact information, and any supporting documentation required for verification purposes.

06

Submit financial statements and supporting documents: Attach all relevant financial statements, such as income statements, balance sheets, and cash flow statements, along with any other supporting documents that were requested by the lender. Ensure that these documents are up-to-date, accurate, and organized to enhance the credibility of your application.

07

Provide collateral or personal guarantee: Depending on the lender's requirements, you may need to offer collateral or a personal guarantee to secure the short-term financing. Be prepared to provide details of any assets you are willing to pledge as security, or be ready to demonstrate your personal commitment to repaying the loan.

08

Review and double-check the documentation: Before submitting the required documentation, review each form, statement, or agreement thoroughly. Double-check for any errors, missing information, or inconsistencies that could potentially impact the approval process.

Who needs required documentation for short-term financing?

01

Small businesses: Small businesses that require immediate access to capital to fund their daily operations, manage cash flow gaps, or handle unforeseen expenses often seek short-term financing. They need to provide the required documentation to demonstrate their financial stability, repayment capacity, and the purpose for which the funds will be used.

02

Start-ups: Start-up companies usually face challenges when it comes to securing long-term loans, making short-term financing an attractive option. Start-ups seeking short-term financing will need to provide documentation that showcases their potential for growth, profitability, and ability to generate consistent cash flow.

03

Established companies: Established companies may also require short-term financing for various reasons, such as funding inventory purchases, managing seasonal fluctuations in cash flow, or taking advantage of growth opportunities. These companies need to provide the necessary documentation to demonstrate their financial health and ability to repay the loan on time.

In summary, filling out the required documentation for short-term financing involves gathering financial information, identifying the purpose of the loan, preparing a business plan, determining the loan amount and terms, completing the loan application form accurately, submitting financial statements and supporting documents, providing collateral or personal guarantee if necessary, and reviewing the documentation before submission. Small businesses, start-ups, and established companies often need to provide this documentation when seeking short-term financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get required documentation short-term financing?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific required documentation short-term financing and other forms. Find the template you need and change it using powerful tools.

How do I fill out required documentation short-term financing using my mobile device?

Use the pdfFiller mobile app to fill out and sign required documentation short-term financing on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit required documentation short-term financing on an iOS device?

Use the pdfFiller mobile app to create, edit, and share required documentation short-term financing from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is required documentation short-term financing?

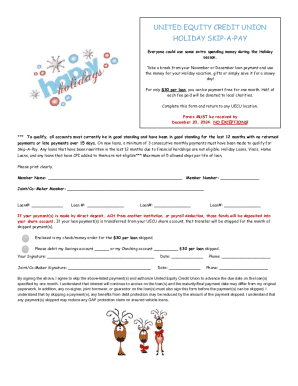

The required documentation for short-term financing typically includes financial statements, cash flow projections, and information about the purpose of the loan.

Who is required to file required documentation short-term financing?

Companies and individuals seeking short-term financing are required to file the necessary documentation.

How to fill out required documentation short-term financing?

Required documentation for short-term financing can be filled out by providing accurate financial information and details about the loan purpose.

What is the purpose of required documentation short-term financing?

The purpose of required documentation for short-term financing is to assess the financial stability and creditworthiness of the borrower.

What information must be reported on required documentation short-term financing?

Information such as financial statements, cash flow projections, and details about the loan purpose must be reported on required documentation for short-term financing.

Fill out your required documentation short-term financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Required Documentation Short-Term Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.