Get the free Reverse Exchange Worksheet for Personal Property

Show details

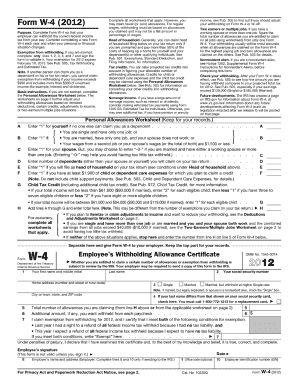

Reverse Exchange Worksheet for Personal Property Exchanger Information Exchanger is: Individual’s) Corporation Partnership Other Name: Mailing Address: City State ZIP Contact Person, if not an Individual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reverse exchange worksheet for

Edit your reverse exchange worksheet for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reverse exchange worksheet for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reverse exchange worksheet for online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reverse exchange worksheet for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reverse exchange worksheet for

How to fill out a reverse exchange worksheet:

01

Start by providing your personal information: Fill out your name, contact information, and any other requested details at the top of the worksheet.

02

Identify the property involved: Specify the property that you are seeking to exchange in a reverse exchange transaction. Include the address, legal description, and any other relevant information.

03

Determine the exchange dates: Indicate the desired exchange dates for the reverse exchange transaction. This includes the identification period (45 days from the start of the reverse exchange) and the exchange period (180 days from the start of the reverse exchange).

04

Provide information on the qualified intermediary (QI): A qualified intermediary is required in a reverse exchange to hold title to the replacement property. Include the QI's name, contact information, and any other requested details.

05

Document the estimated costs: Estimate the costs associated with the reverse exchange, such as the QI fees, professional fees, closing costs, and any other expenses related to the transaction.

06

Seek professional advice: It is recommended to consult with a tax advisor or real estate professional to ensure that the reverse exchange is structured correctly and in compliance with applicable regulations.

Who needs a reverse exchange worksheet:

01

Real estate investors: Investors who engage in 1031 exchange transactions may need a reverse exchange worksheet to efficiently manage the paperwork and requirements associated with a reverse exchange.

02

Individuals seeking asset flexibility: Those who desire to acquire a replacement property before selling their existing property may find a reverse exchange beneficial. A reverse exchange worksheet can help organize and track the necessary information for this type of transaction.

03

Tax advisors and professionals: Tax advisors and professionals, including attorneys and accountants, can utilize a reverse exchange worksheet to assist their clients in navigating the intricacies of a reverse exchange and ensure compliance with tax regulations.

In summary, a reverse exchange worksheet serves as a tool to guide individuals through the process of completing a reverse exchange transaction. It helps organize information, estimate costs, and maintain compliance. Real estate investors, individuals seeking asset flexibility, and tax advisors are among those who may benefit from using a reverse exchange worksheet.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get reverse exchange worksheet for?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the reverse exchange worksheet for. Open it immediately and start altering it with sophisticated capabilities.

How do I edit reverse exchange worksheet for online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your reverse exchange worksheet for to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the reverse exchange worksheet for form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign reverse exchange worksheet for. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is reverse exchange worksheet for?

Reverse exchange worksheet is used to document the details of a reverse exchange transaction where a taxpayer acquires replacement property before selling the relinquished property.

Who is required to file reverse exchange worksheet for?

Taxpayers engaging in reverse exchange transactions are required to file the reverse exchange worksheet.

How to fill out reverse exchange worksheet for?

To fill out the reverse exchange worksheet, taxpayers must provide detailed information about the replacement and relinquished properties, transaction dates, and any other relevant details.

What is the purpose of reverse exchange worksheet for?

The purpose of reverse exchange worksheet is to ensure compliance with IRS regulations and document the specific details of the reverse exchange transaction.

What information must be reported on reverse exchange worksheet for?

Information such as property details, transaction dates, and any related parties involved in the reverse exchange transaction must be reported on the reverse exchange worksheet.

Fill out your reverse exchange worksheet for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reverse Exchange Worksheet For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.