Get the free Customs Regulations for Imports - iamovers

Show details

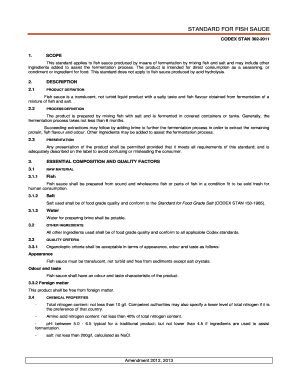

This document provides essential information regarding customs regulations for importing household goods, personal effects, pets, motor vehicles, restricted items, and prohibited items into the United

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs regulations for imports

Edit your customs regulations for imports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs regulations for imports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customs regulations for imports online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit customs regulations for imports. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

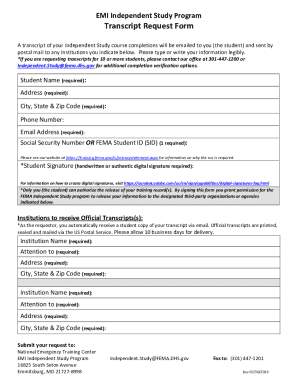

How to fill out customs regulations for imports

How to fill out Customs Regulations for Imports

01

Gather necessary documentation: Ensure you have all required documents, such as invoices, bills of lading, and any import permits.

02

Identify the correct Harmonized System (HS) code: Research and determine the HS code that applies to the products you are importing.

03

Fill out the Customs Declaration Form: Complete the form accurately, providing details such as product description, value, and origin.

04

Calculate duties and taxes: Use the HS code and consult the customs tariff to calculate any applicable duties and taxes on the imported goods.

05

Submit the declaration: Present the filled-out form and supporting documentation to customs authorities either electronically or in-person, following your country's specific procedures.

06

Pay any applicable customs duties and fees: Make the necessary payments as instructed by customs officials to clear your imported goods.

07

Await customs clearance: Monitor the status of your import until customs releases your goods for delivery.

Who needs Customs Regulations for Imports?

01

Importers who bring goods into the country for commercial or personal use.

02

Businesses that engage in international trade and wish to comply with legal requirements.

03

Individuals traveling abroad who bring back goods exceeding allowance limits.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of customs?

In other words, customs means a place at a port, airport or frontier in which government officials control incoming goods, people (travellers) and other loads. Customs are government authorities in charge of issuing clearance for the importation and exportation of goods.

What are the examples of customs compliance?

Requirements for customs compliance includes: Accurate declaration of goods. Proper classification of goods. Payment of duties and taxes. Compliance with regulations and laws. Maintenance of accurate records. Obtaining necessary licenses and permits. Compliance with labeling and marking requirements.

What are customs regulations?

Customs regulations are pivotal in international trade, serving as a framework for controlling the flow of goods across borders. They ensure that goods entering or leaving a country comply with its laws and standards, including safety, health, and environmental protections.

What are import rules?

Customs rules are regulations that govern imports and exports of certain goods. These rules may vary depending on various factors such as trade policy, environmental protection, health, and safety. Special restrictions may be imposed to ensure compliance with these aspects.

How do customs work in Brazil?

Foreign exporters and Brazilian importers must register with the Foreign Trade Secretariat (SECEX), a branch of the Ministry of Industrial Development and Commerce (MDIC). Companies seeking to import goods into Brazil must obtain a RADAR licence.

What are the requirements for customs?

The basic requirements include a bachelor's degree from an accredited university, good physical fitness and at least one to three years of professional work experience in law enforcement, security or criminal investigation. Pursuing a degree in law or criminal justice typically provides a competitive edge.

What do you mean by customs regulations?

"customs laws and regulations" means laws and regulations concerning the. importation, exportation, transit of goods, or any other customs procedures, whether. relating to customs duties, taxes or any other charges collected by the Customs.

What is the import customs duty in Brazil?

Rates usually vary between 10% and 35%. The IPI is a tax levied on finished products (whether foreign or domestic), resulting from some sort of industrial process. The IPI is not considered a cost for the importer, since the value is credited back to the importer. IPI rates range between 0% and 15%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Customs Regulations for Imports?

Customs Regulations for Imports are the rules and guidelines established by a country's customs authority that govern the importation of goods into that country. These regulations are designed to control the flow of goods, ensure compliance with laws, and protect national interests.

Who is required to file Customs Regulations for Imports?

Anyone who imports goods into a country is required to file Customs Regulations for Imports. This includes individuals, businesses, and freight forwarders, who must provide necessary documentation to customs authorities.

How to fill out Customs Regulations for Imports?

To fill out Customs Regulations for Imports, importers need to complete specific forms such as the customs declaration, providing detailed information about the goods, including descriptions, value, country of origin, and any applicable tariffs or duties.

What is the purpose of Customs Regulations for Imports?

The purpose of Customs Regulations for Imports is to facilitate international trade while ensuring that imports comply with national laws, protect domestic industries, safeguard national security, and collect revenue through duties and taxes.

What information must be reported on Customs Regulations for Imports?

The information that must be reported includes the nature of the goods, their value, the country of origin, the importer's details, applicable harmonized tariff codes, and any necessary licenses or permits required for specific products.

Fill out your customs regulations for imports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Regulations For Imports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.