Get the free Capital Gains Tax Act

Show details

This document outlines the Capital Gains Tax Act of Guyana, detailing its sections, provisions, and the administration of capital gains tax as applicable to individuals and entities within the jurisdiction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital gains tax act

Edit your capital gains tax act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital gains tax act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capital gains tax act online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit capital gains tax act. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital gains tax act

How to fill out Capital Gains Tax Act

01

Gather all documents related to the sale of assets.

02

Determine your total capital gains by calculating the difference between the sale price and the purchase price.

03

Identify any allowable deductions, such as improvements made to the asset and selling costs.

04

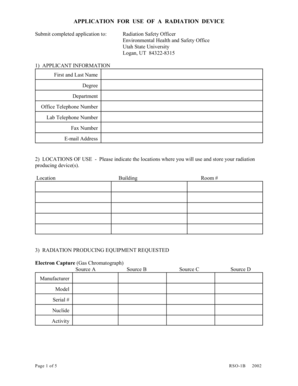

Complete the relevant sections of the Capital Gains Tax Act form, including personal details and asset information.

05

Report your total net capital gains after deductions.

06

Calculate the tax owed based on the applicable tax rates.

07

Submit the completed form to the appropriate tax authority by the deadline.

Who needs Capital Gains Tax Act?

01

Individuals or businesses that have sold assets such as real estate, stocks, or other investments.

02

Taxpayers who have realized profits from the sale of assets.

03

Residents and citizens who are subject to capital gains tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the capital gains exemption in the UK?

Capital Gains Tax allowances You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance (called the Annual Exempt Amount). The Capital Gains tax-free allowance is: £3,000. £1,500 for trusts.

What is the big loophole in capital gains tax?

The so-called 'Mayfair loophole' is part of the capital gains system and was agreed by the last Labour Government. It allows private equity firms to treat their profits as capital gains when there is capital at risk.

Which items are exempt from capital gains tax?

You do not usually need to pay tax on gifts to your husband, wife, civil partner or a charity. You do not pay Capital Gains Tax on: your car - unless you've used it for business. anything with a limited lifespan, like clocks - unless used for business.

What is the 6 year rule for Capital Gains Tax?

Exceeding six years – If you rent the property for longer than six years without moving back in, the excess period becomes subject to CGT. The taxable amount is worked out on a time-based calculation, so you may only pay tax on a portion of the capital gain.

What is capital gains as per Income Tax Act?

Capital gain is denoted as the net profit that an investor makes after selling a capital asset exceeding the price of purchase. The entire value earned from selling a capital asset is considered as taxable income.

What is the annual exemption for capital gains tax in the UK?

Individuals have an annual capital gains tax exemption of £3,000. If the total of all gains and losses in the tax year fall within this exempt amount no tax is payable. Gains in excess of the annual exemption will be taxable. The exempt amount cannot be carried back or forward.

What is the exemption of Capital Gains Tax per year?

At present, the long-term capital gain exemption limit is ₹1.25 lakh. Any capital gain exceeding ₹1.25 lakh is liable for a tax liability. Previously, the capital gain exemption limit was fixed at ₹1 lakh and a tax rate of 10%. However, the current tax rate is 12.5% for capital gains exceeding ₹1.25 lakh.

What is the 36 month rule?

The 36-Month Rule for Capital Gains Tax was a UK law that previously determined tax liability on property sales. It allowed sellers to claim CGT exemption for the final 36 months of ownership, even if they had moved out.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Capital Gains Tax Act?

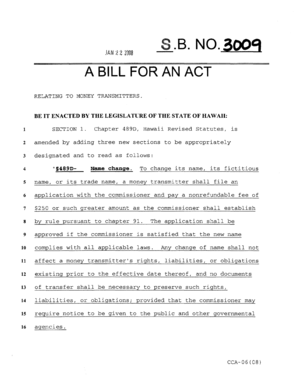

The Capital Gains Tax Act is legislation that governs the taxation of capital gains, which are the profits earned from the sale of assets such as stocks, real estate, and other investments.

Who is required to file Capital Gains Tax Act?

Individuals and entities that realize capital gains from the sale of assets are required to file under the Capital Gains Tax Act, typically those who have sold an asset at a profit.

How to fill out Capital Gains Tax Act?

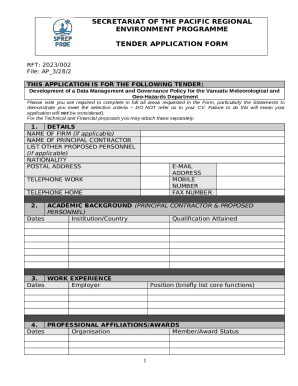

To fill out the Capital Gains Tax Act, taxpayers must report the details of the sold assets, including purchase and sale dates, purchase and sale prices, and any associated costs or deductions on the appropriate tax forms.

What is the purpose of Capital Gains Tax Act?

The purpose of the Capital Gains Tax Act is to ensure that profits from the sale of capital assets are taxed, thereby contributing to government revenue and discouraging speculative trading.

What information must be reported on Capital Gains Tax Act?

Taxpayers must report information including asset details, purchase and sale prices, dates of acquisition and sale, and any relevant deductions or exemptions when filing under the Capital Gains Tax Act.

Fill out your capital gains tax act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Gains Tax Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.