Get the free ASSESSMENT APPEALS BOARD - co mendocino ca

Show details

This document outlines the agenda for the Mendocino County Assessment Appeals Board meeting, detailing the order of agenda items, including approval of applications, stipulations, and public expression.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assessment appeals board

Edit your assessment appeals board form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assessment appeals board form via URL. You can also download, print, or export forms to your preferred cloud storage service.

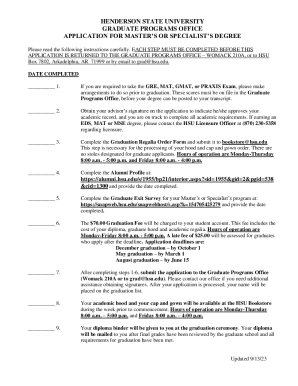

How to edit assessment appeals board online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit assessment appeals board. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assessment appeals board

How to fill out ASSESSMENT APPEALS BOARD

01

Obtain the Assessment Appeals Board application form from your local government office or their website.

02

Review the instructions carefully to ensure you understand the process.

03

Fill out the application form with accurate information regarding your property assessment.

04

Include any necessary supporting documents, such as property tax bills or previous assessments.

05

Specify the reasons for your appeal clearly and concisely.

06

Pay any required filing fees associated with the appeal submission.

07

Submit the completed application form and supporting documents to the Assessment Appeals Board by the designated deadline.

08

Attend the hearing scheduled by the Assessment Appeals Board to present your case.

Who needs ASSESSMENT APPEALS BOARD?

01

Homeowners who believe their property tax assessments are incorrect.

02

Business owners seeking adjustments on assessed value for their properties.

03

Individuals challenging the valuation of personal property for tax purposes.

04

Any taxpayer who receives a property assessment notice and wishes to dispute it.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a board of appeals?

The Board of Appeals is a quasi-judicial body that provides the public with a final administrative review process for appeals relating to a wide range of City determinations.

What is the best way to win a property tax appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

What is the jurisdiction of the local board of assessment appeals?

– The Local Board shall have original jurisdiction to hear and decide appeals of owners/administrators of real property from the action of the Provincial or City Assessors, or the Municipal Assessors in the Metropolitan Manila Area, in the assessment of their real properties, and from the action of the Provincial or

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ASSESSMENT APPEALS BOARD?

The Assessment Appeals Board is a local government body that hears appeals from property owners who disagree with the assessed value of their properties as determined by the local assessor.

Who is required to file ASSESSMENT APPEALS BOARD?

Property owners or their authorized agents who believe their property has been incorrectly assessed are required to file an appeal with the Assessment Appeals Board.

How to fill out ASSESSMENT APPEALS BOARD?

To fill out the Assessment Appeals Board application, property owners must complete the official application form, providing necessary details such as property information, the reasons for the appeal, and any supporting documentation.

What is the purpose of ASSESSMENT APPEALS BOARD?

The purpose of the Assessment Appeals Board is to provide a fair and impartial forum for property owners to contest and appeal property tax assessments.

What information must be reported on ASSESSMENT APPEALS BOARD?

The information that must be reported includes the property address, owner's contact information, the assessed value being disputed, reasons for the appeal, and any relevant evidence or documentation supporting the appeal.

Fill out your assessment appeals board online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assessment Appeals Board is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.