Get the free CHARITY ADVERTISING Request for Zero-Rating

Show details

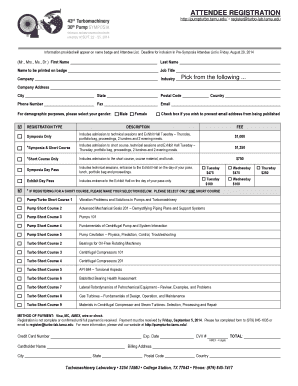

This document is a request form for charities to apply for zero-rating relief from VAT for specific goods and services they are purchasing or importing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charity advertising request for

Edit your charity advertising request for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charity advertising request for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charity advertising request for online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charity advertising request for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charity advertising request for

How to fill out CHARITY ADVERTISING Request for Zero-Rating

01

Begin by gathering all necessary documentation and details about your charity.

02

Access the CHARITY ADVERTISING Request for Zero-Rating form from the appropriate agency or organization's website.

03

Fill out the charity's name and registration number in the designated fields.

04

Provide a brief description of your charity's mission and objectives.

05

Indicate the advertising methods you plan to use and the intended audience.

06

Specify the duration for which you seek zero-rating on advertising.

07

Include any additional information or attachments that support your request.

08

Review all entries for accuracy and completeness before submission.

09

Submit the completed form through the specified method (online, mail, etc.) as per the guidelines.

Who needs CHARITY ADVERTISING Request for Zero-Rating?

01

Non-profit organizations looking to promote their causes without incurring significant advertising costs.

02

Charities aiming to increase visibility and reach to attract donations and support.

Fill

form

: Try Risk Free

People Also Ask about

Do charities pay VAT on print?

Certain supplies of printed matter are zero rated. This is a general concession which is available to all VAT registered entities, not just charities. Typical goods include books, booklets, brochures, pamphlets and leaflets, newspapers, journals, and periodicals.

Do you pay VAT on ads?

VAT is charged on digital services like advertising. Since Google Ads is a digital advertising platform, VAT often comes into play, but how it's handled depends on where your business is located and whether you're VAT-registered.

Do charities get free advertising?

For example, charities may invest in television commercials, radio spots, print advertisements, online banners, and social media promotions. Each of these channels comes with its own costs, such as airtime fees, printing expenses, and digital ad placements.

What is the difference between 0 rated and exempt?

What is the difference between VAT-exempt and zero-rated? Zero-rated goods are not taxed during sale, but producers can claim a credit for the value-added tax paid on inputs. On the other hand, exempt goods are not taxed either, but producers cannot get a credit for the VAT paid on inputs.

Is advertising exempt or zero rated?

Advertising covering any subject, including staff recruitment, in a third-party medium can qualify for zero rating, including advertisements on television, cinema, billboards, buses, in newspapers, programmes, annuals, leaflets and other publications, and on Internet sites.

Do you charge VAT on advertising?

VAT is added onto goods and services at every stage of its production and sale, which affects the pricing of online advertising and campaigns. In the UK, the standard VAT rate is 20% and applies to advertising including display ads, search engine marketing and social media promotions.

Is advertising zero-rated or exempt?

Advertising covering any subject, including staff recruitment, in a third-party medium can qualify for zero rating, including advertisements on television, cinema, billboards, buses, in newspapers, programmes, annuals, leaflets and other publications, and on Internet sites.

Are leaflets zero-rated?

Most Flyers & Leaflets are usually zero rated for VAT, which means you don't need to add VAT to the prices listed. But there are a few exceptions: VAT is chargeable if the Flyer or Leaflet is designed to be written on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHARITY ADVERTISING Request for Zero-Rating?

CHARITY ADVERTISING Request for Zero-Rating is a formal application process that allows nonprofit organizations to request exemption from certain advertising fees, enabling them to promote their charitable activities without incurring costs.

Who is required to file CHARITY ADVERTISING Request for Zero-Rating?

Nonprofit organizations and charities that wish to benefit from advertising exemptions on specific platforms are required to file the CHARITY ADVERTISING Request for Zero-Rating.

How to fill out CHARITY ADVERTISING Request for Zero-Rating?

To fill out the CHARITY ADVERTISING Request for Zero-Rating, organizations need to provide detailed information about their charitable mission, advertising plans, and any relevant documentation proving their nonprofit status.

What is the purpose of CHARITY ADVERTISING Request for Zero-Rating?

The purpose of CHARITY ADVERTISING Request for Zero-Rating is to support nonprofit organizations by reducing their advertising costs, thus allowing them to enhance visibility and engagement for their charitable causes.

What information must be reported on CHARITY ADVERTISING Request for Zero-Rating?

Organizations must report their legal status as a nonprofit, the nature of their advertising campaign, estimated budget, target audience, and how the campaign aligns with their charitable objectives on the CHARITY ADVERTISING Request for Zero-Rating.

Fill out your charity advertising request for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charity Advertising Request For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.