GA DoR IT-RD 2009 free printable template

Show details

IT-RD 2009 (1/10)

Department of Revenue

Taxpayer Services Division

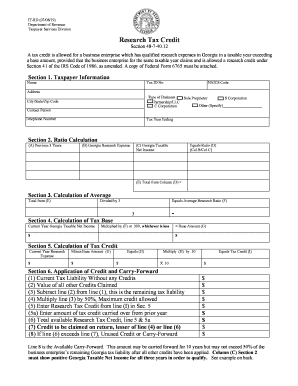

Research Tax Credit

Section 48-7-40.12

This form is to be used for taxable years beginning on or after January 1, 2009.

A tax credit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign it rd 2009

Edit your it rd 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it rd 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it rd 2009 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it rd 2009. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR IT-RD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out it rd 2009

How to fill out GA DoR IT-RD

01

Start by collecting all relevant information required for filling out the GA DoR IT-RD form.

02

Ensure you have the correct version of the form as per the guidelines.

03

Fill in your personal and contact details in the designated sections.

04

Provide a clear account of the incident or request, including dates, times, and any involved parties.

05

Ensure all necessary documentation is included to support your submission.

06

Review the completed form for any errors or missing information.

07

Submit the form as per the instruction provided, either electronically or via mail.

Who needs GA DoR IT-RD?

01

Individuals or organizations that have experienced a significant incident requiring documentation.

02

Anyone looking to formally report an issue related to IT resources or data.

03

Administrators who oversee compliance and incident reporting processes.

Fill

form

: Try Risk Free

People Also Ask about

How is COVID infection rate calculated?

To calculate the daily rate of new infections, we look at the average number of newly confirmed cases in the last 7 days per 100,000 residents. Using the population size in the calculation helps us more easily compare larger and smaller counties.

Can you learn R in one day?

R's basic data types are character, numeric, integer, complex, and logical. R's basic data structures include the vector, list, matrix, data frame, and factors.

Is the R&D tax credit still available?

You can still qualify for the Payroll Tax Credit. Companies with less than $5 million in gross receipts can use the R&D tax credit to offset payroll taxes up to $250,000 per year.

Is R easy to learn?

R also has two native data formats—Rdata (sometimes shortened to Rda) and Rds. These formats are used when R objects are saved for later use. Rdata is used to save multiple R objects, while Rds is used to save a single R object. See below for instructions on how to read and load data into R from both file extensions.

What is Python?

R Programming. Python is a general-purpose language that is used for the deployment and development of various projects. Python has all the tools required to bring a project into the production environment. R is a statistical language used for the analysis and visual representation of data.

Is R written in C++?

So in conclusion: while R itself is mostly written in C (with hefty chunks in R and Fortran), R packages are mostly written in R (with hefty chunks written in C/C++).

How much does an R-1 visa cost?

Applying for an R1 Visa will be $180. Paying this fee will ensure that you can proceed with the rest of the application, but there might be other fees involved. It all depends on what country you're coming from. There could also be a filing fee of $460.

What is used for?

R offers a wide variety of statistics-related libraries and provides a favorable environment for statistical computing and design. In addition, the R programming language gets used by many quantitative analysts as a programming tool since it's useful for data importing and cleaning.

How long does it take to get a religious worker green card?

The R-1 visa provides a convenient way for people to gain that two years of experience in the United States. A simple route to the green card for a religious worker, therefore, is to obtain the R-1 visa, work for two years, and then have the same or another employer start the green card process.

What is the R0 value?

R0, or the basic reproduction number/rate, refers to the contagiousness and transmissibility of infectious pathogens. R0 varies depending on a variety of factors and is critical in public health management to ensure infectious epidemics (or global pandemics) are controlled.

Is R&D taxable?

Is R&D tax credit taxable income? The R&D credit reduces federal taxable income, meaning that businesses receive a dollar-for-dollar tax credit and still get to deduct expenses related to research and development.

What is the RD tax incentive in Australia?

The Research and Development Tax Incentive (R&D Tax Incentive or R&DTI) helps companies innovate and grow by offsetting some of the costs of eligible research and development (R&D). the broader Australian economy. to grow and succeed. Companies take pride in their R&D.

How is transmission rate calculated?

The transmission rate is calculated by dividing incidence for a given time period by a disease prevalence for the same time interval. Most infectious disease data are collected in form of incidence and/or prevalence.

Who is eligible for the R&D tax credit?

Startups may use R&D credits against up to $250,000 of their payroll taxes in five separate taxable years—a total of $1,250,000—if they have: Gross receipts less than $5 million in the taxable credit year; and. No gross receipts for any of the four preceding taxable years.

What is R&D tax?

Companies that spend money developing new products, processes or services; or enhancing existing ones, are eligible for R&D tax relief. If you're spending money on your innovation, you can make an R&D tax credit claim to receive either a cash payment and/or Corporation Tax reduction.

What is RD tax?

Money spent by a company on research and development activities may qualify for the R&D Tax Credit. The credit is calculated at 25% of qualifying expenditure and is used to reduce a company's Corporation Tax (CT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send it rd 2009 for eSignature?

To distribute your it rd 2009, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute it rd 2009 online?

pdfFiller makes it easy to finish and sign it rd 2009 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the it rd 2009 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your it rd 2009 in seconds.

What is GA DoR IT-RD?

GA DoR IT-RD stands for Georgia Department of Revenue Information Technology Reporting Device. It is a form used to report certain information related to IT transactions and activities within the state of Georgia.

Who is required to file GA DoR IT-RD?

Any individual or entity engaged in IT transactions in Georgia, particularly those who meet specific reporting thresholds set by the Georgia Department of Revenue, are required to file GA DoR IT-RD.

How to fill out GA DoR IT-RD?

To fill out GA DoR IT-RD, follow the instructions provided by the Georgia Department of Revenue, ensuring to complete all required sections accurately and provide relevant information pertaining to IT transactions.

What is the purpose of GA DoR IT-RD?

The purpose of GA DoR IT-RD is to provide the Georgia Department of Revenue with detailed information regarding IT-related transactions as part of compliance and regulatory requirements.

What information must be reported on GA DoR IT-RD?

Information required on GA DoR IT-RD includes details of the IT transactions, the parties involved, the nature of the services or products exchanged, and any relevant financial data.

Fill out your it rd 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It Rd 2009 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.