GA DoR IT-RD 2008 free printable template

Show details

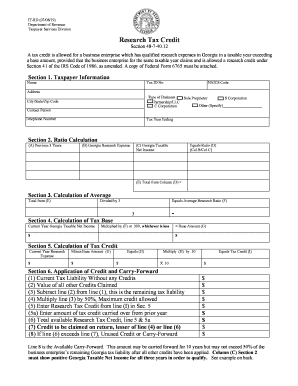

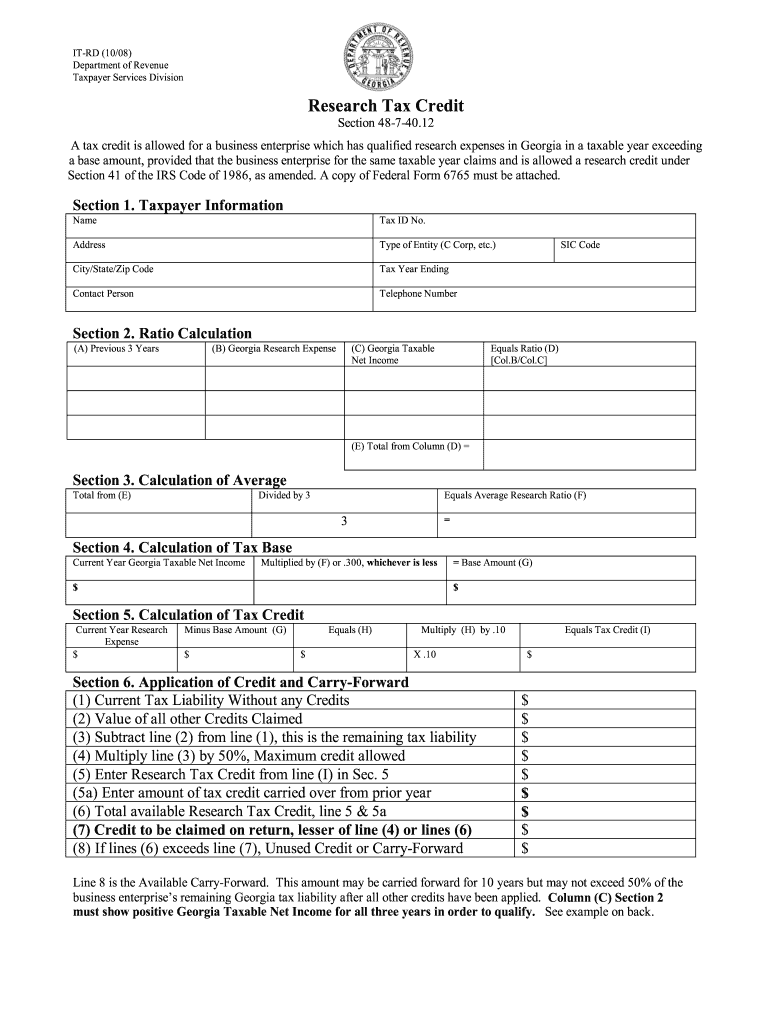

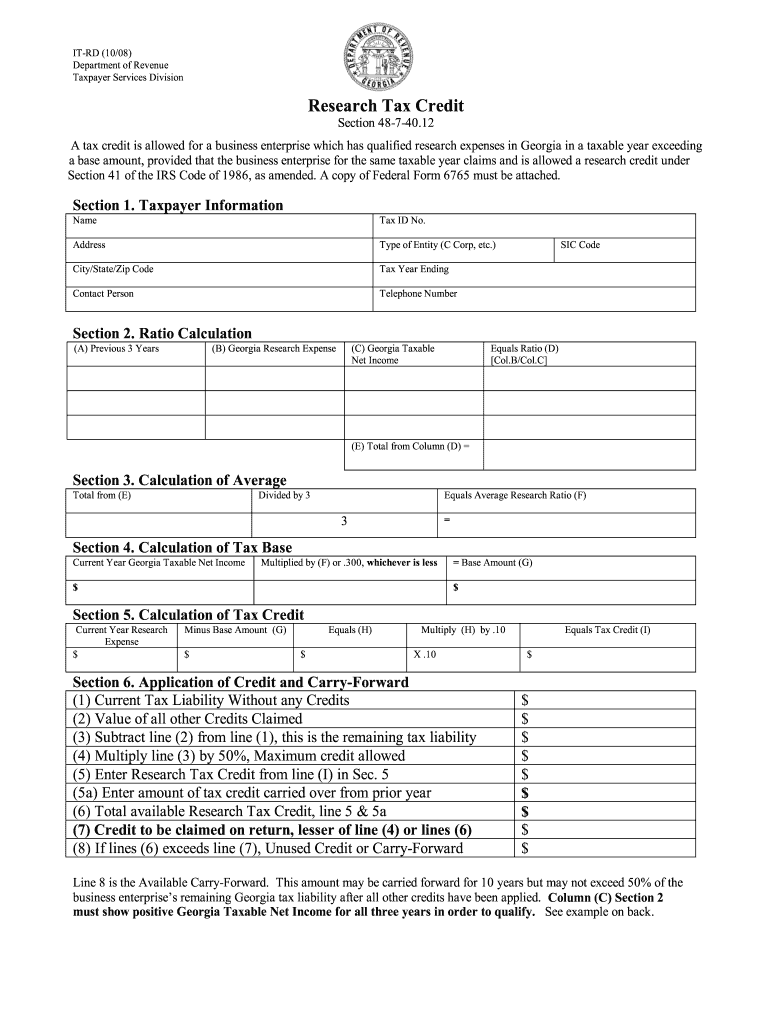

IT-RD (10/08) Department of Revenue Taxpayer Services Division Research Tax Credit Section 48-7-40.12 A tax credit is allowed for a business enterprise which has qualified research expenses in Georgia

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign research tax credit form

Edit your research tax credit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your research tax credit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing research tax credit form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit research tax credit form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR IT-RD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out research tax credit form

How to fill out GA DoR IT-RD

01

Gather all required information and documentation related to the project.

02

Open the GA DoR IT-RD form in the designated format.

03

Fill out the project title and brief description in the respective fields.

04

Provide details on the project's objective, including the expected outcomes.

05

List all stakeholders involved in the project and their roles.

06

Include the timeline for the project, specifying start and end dates.

07

Outline the budget and resources required for the project.

08

Review the filled information for accuracy and completeness.

09

Submit the form according to the organization's guidelines.

Who needs GA DoR IT-RD?

01

Project managers who are initiating new IT-related projects.

02

Team members responsible for documenting project requirements.

03

Stakeholders needing a formal record of project details and objectives.

04

Regulatory bodies or governance teams reviewing project compliance.

Fill

form

: Try Risk Free

People Also Ask about

How is COVID infection rate calculated?

To calculate the daily rate of new infections, we look at the average number of newly confirmed cases in the last 7 days per 100,000 residents. Using the population size in the calculation helps us more easily compare larger and smaller counties.

Can you learn R in one day?

R's basic data types are character, numeric, integer, complex, and logical. R's basic data structures include the vector, list, matrix, data frame, and factors.

Is the R&D tax credit still available?

You can still qualify for the Payroll Tax Credit. Companies with less than $5 million in gross receipts can use the R&D tax credit to offset payroll taxes up to $250,000 per year.

Is R easy to learn?

R also has two native data formats—Rdata (sometimes shortened to Rda) and Rds. These formats are used when R objects are saved for later use. Rdata is used to save multiple R objects, while Rds is used to save a single R object. See below for instructions on how to read and load data into R from both file extensions.

What is Python?

R Programming. Python is a general-purpose language that is used for the deployment and development of various projects. Python has all the tools required to bring a project into the production environment. R is a statistical language used for the analysis and visual representation of data.

Is R written in C++?

So in conclusion: while R itself is mostly written in C (with hefty chunks in R and Fortran), R packages are mostly written in R (with hefty chunks written in C/C++).

How much does an R-1 visa cost?

Applying for an R1 Visa will be $180. Paying this fee will ensure that you can proceed with the rest of the application, but there might be other fees involved. It all depends on what country you're coming from. There could also be a filing fee of $460.

What is used for?

R offers a wide variety of statistics-related libraries and provides a favorable environment for statistical computing and design. In addition, the R programming language gets used by many quantitative analysts as a programming tool since it's useful for data importing and cleaning.

How long does it take to get a religious worker green card?

The R-1 visa provides a convenient way for people to gain that two years of experience in the United States. A simple route to the green card for a religious worker, therefore, is to obtain the R-1 visa, work for two years, and then have the same or another employer start the green card process.

What is the R0 value?

R0, or the basic reproduction number/rate, refers to the contagiousness and transmissibility of infectious pathogens. R0 varies depending on a variety of factors and is critical in public health management to ensure infectious epidemics (or global pandemics) are controlled.

Is R&D taxable?

Is R&D tax credit taxable income? The R&D credit reduces federal taxable income, meaning that businesses receive a dollar-for-dollar tax credit and still get to deduct expenses related to research and development.

What is the RD tax incentive in Australia?

The Research and Development Tax Incentive (R&D Tax Incentive or R&DTI) helps companies innovate and grow by offsetting some of the costs of eligible research and development (R&D). the broader Australian economy. to grow and succeed. Companies take pride in their R&D.

How is transmission rate calculated?

The transmission rate is calculated by dividing incidence for a given time period by a disease prevalence for the same time interval. Most infectious disease data are collected in form of incidence and/or prevalence.

Who is eligible for the R&D tax credit?

Startups may use R&D credits against up to $250,000 of their payroll taxes in five separate taxable years—a total of $1,250,000—if they have: Gross receipts less than $5 million in the taxable credit year; and. No gross receipts for any of the four preceding taxable years.

What is R&D tax?

Companies that spend money developing new products, processes or services; or enhancing existing ones, are eligible for R&D tax relief. If you're spending money on your innovation, you can make an R&D tax credit claim to receive either a cash payment and/or Corporation Tax reduction.

What is RD tax?

Money spent by a company on research and development activities may qualify for the R&D Tax Credit. The credit is calculated at 25% of qualifying expenditure and is used to reduce a company's Corporation Tax (CT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send research tax credit form to be eSigned by others?

When you're ready to share your research tax credit form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the research tax credit form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your research tax credit form in minutes.

How do I edit research tax credit form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing research tax credit form right away.

What is GA DoR IT-RD?

GA DoR IT-RD stands for Georgia Department of Revenue Individual Tax Return - Reporting Document. It is a form used for reporting income and taxes related to individuals.

Who is required to file GA DoR IT-RD?

Individuals who have earned income in Georgia and are subject to state income tax are required to file GA DoR IT-RD.

How to fill out GA DoR IT-RD?

To fill out GA DoR IT-RD, individuals must provide personal information, income details, deductions, and tax credits applicable to their financial situation.

What is the purpose of GA DoR IT-RD?

The purpose of GA DoR IT-RD is to report an individual's income, calculate taxes owed, and ensure compliance with state tax laws in Georgia.

What information must be reported on GA DoR IT-RD?

The information that must be reported on GA DoR IT-RD includes personal identification details, total income, adjustments to income, deductions, tax credits, and final tax liability.

Fill out your research tax credit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Research Tax Credit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.