Get the free Foreclosure Mitigation Analysis for Financial Institutions

Show details

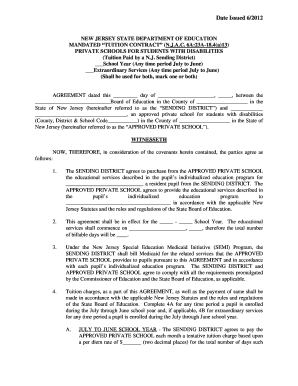

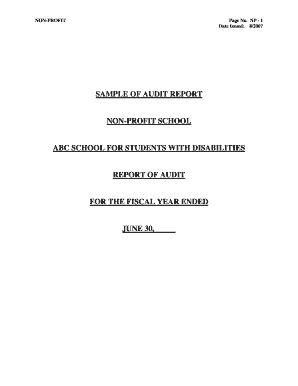

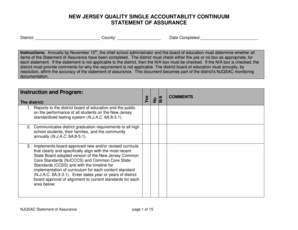

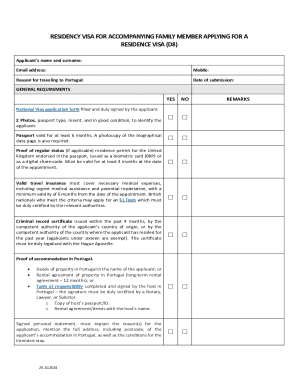

Foreclosure Mitigation Analysis for Financial Institutions Fundamental bottom up analysis at the loan level based on income and geographic location. System oriented digital solution to process bulk

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreclosure mitigation analysis for

Edit your foreclosure mitigation analysis for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreclosure mitigation analysis for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreclosure mitigation analysis for online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit foreclosure mitigation analysis for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreclosure mitigation analysis for

How to fill out foreclosure mitigation analysis:

01

Start by gathering all the necessary documents and information related to the foreclosure process. This may include loan documents, financial statements, income records, and any communication from the lender.

02

Review the eligibility criteria and guidelines for the foreclosure mitigation analysis. This could vary depending on the organization or agency conducting the analysis. Make sure you meet the requirements before proceeding.

03

Identify the specific sections and questions within the foreclosure mitigation analysis form. It may cover topics such as financial hardship, income and expense details, past and future payment plans, and any proposed solutions or alternatives to foreclosure.

04

Carefully read each question and provide accurate and complete answers. Take your time to ensure that you understand the information being asked and fill it out honestly. Incomplete or false information may negatively impact the outcome of the analysis.

05

If you are uncertain about any question or require clarification, don't hesitate to seek assistance from a foreclosure counselor, attorney, or the organization responsible for the analysis. It's crucial to understand the implications of your answers and to provide the most accurate information possible.

06

Attach any requested supporting documentation, such as proof of income, bank statements, tax returns, or medical bills. These documents will help validate the information provided in the analysis and strengthen your case.

Who needs foreclosure mitigation analysis:

01

Homeowners who are at risk of foreclosure due to financial hardship. This could be caused by job loss, medical expenses, divorce, or other unforeseen circumstances that make it difficult to make mortgage payments.

02

Banks and mortgage lenders may also require homeowners to fill out a foreclosure mitigation analysis. This can help them assess the borrower's financial situation and determine the appropriate course of action to avoid foreclosure.

03

Non-profit organizations, government agencies, or foreclosure prevention programs may use foreclosure mitigation analysis to provide assistance and guidance to homeowners facing foreclosure. The analysis helps them understand the borrower's needs and develop appropriate solutions or interventions.

In summary, filling out a foreclosure mitigation analysis involves carefully reviewing and answering the form's questions, providing accurate information, and attaching supporting documents. It is essential for homeowners at risk of foreclosure and may also be required by lenders, organizations, or programs offering foreclosure assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is foreclosure mitigation analysis for?

Foreclosure mitigation analysis is used to assess options for homeowners facing foreclosure and determine the best course of action to help them avoid losing their home.

Who is required to file foreclosure mitigation analysis for?

Financial institutions and loan servicers are typically required to file foreclosure mitigation analysis for homeowners in the foreclosure process.

How to fill out foreclosure mitigation analysis for?

Foreclosure mitigation analysis can be filled out by gathering information on the homeowner's financial situation, loan details, and potential options for avoiding foreclosure.

What is the purpose of foreclosure mitigation analysis for?

The purpose of foreclosure mitigation analysis is to help homeowners explore all options available to them to prevent foreclosure and find a solution that works best for their financial situation.

What information must be reported on foreclosure mitigation analysis for?

Information such as the homeowner's income, expenses, loan details, and potential foreclosure prevention options must be reported on foreclosure mitigation analysis.

How do I modify my foreclosure mitigation analysis for in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your foreclosure mitigation analysis for and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out foreclosure mitigation analysis for using my mobile device?

Use the pdfFiller mobile app to fill out and sign foreclosure mitigation analysis for. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete foreclosure mitigation analysis for on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your foreclosure mitigation analysis for. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your foreclosure mitigation analysis for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreclosure Mitigation Analysis For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.