Canada FIN 357 2015 free printable template

Show details

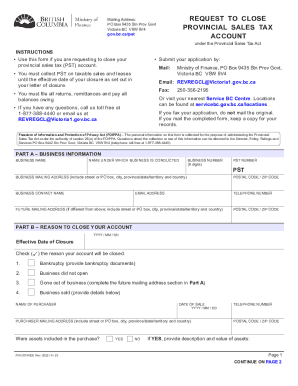

REQUEST TO CLOSE PROVINCIAL SALES TAX ACCOUNT Mailing Address: PO Box 9442 STN Prov Govt Victoria BC V8W 9V4 gov.bc.ca×PST under the Provincial Sales Tax Act INSTRUCTIONS Use this form if you are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada FIN 357

Edit your Canada FIN 357 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FIN 357 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada FIN 357 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada FIN 357. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 357 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FIN 357

How to fill out Canada FIN 357

01

Obtain a copy of the Canada FIN 357 form from the official website or relevant authority.

02

Read the instructions provided at the top of the form carefully.

03

Fill out your personal information, including your full name, address, and contact details in the designated fields.

04

Provide accurate information about your financial situation as requested in the form.

05

Include any necessary supporting documents as specified in the instructions.

06

Review all entries for accuracy and completeness before submission.

07

Sign and date the form where required.

08

Submit the completed form to the designated authority either online or by mail.

Who needs Canada FIN 357?

01

Individuals or businesses who are applying for certain financial exemptions or benefits in Canada.

02

Those who need to report specific financial transactions to the government.

03

Anyone who has been instructed by a regulatory body or agency to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

Is BC PST recoverable?

If you paid PST on exempt goods or services, or if you were required to pay PST because you didn't provide the required information or document to obtain an exemption at the time of the sale, you can get a refund or credit from the seller of the PST you paid within 180 days of the date PST was paid.

How do I close my BC company?

Thank you for your request on how to dissolve a company under section 316 (see attached Appendix A) of the Business Corporations Act. STEP 1: COMPLETE AN AFFIDAVIT. STEP 2: FILE ANY OUTSTANDING ANNUAL. STEP 3: FILE A DISSOLUTION REQUEST. STEP 4: RECEIVE CONFIRMATION.

How do I close my BC PST account?

To close your PST account, submit a closure request: Online using eTaxBC, or. By submitting a Request to Close Provincial Sales Tax Account (FIN 357) (PDF, 301KB)

How do I close my payroll account revenue Canada?

To close your payroll program account, you can use the "Request to close payroll account" service in My Business Account. An authorized representative can use this service through Represent a Client. You can also complete Form RC145, Request to Close Business Number Program Accounts.

How do I claim my PST refund in BC?

To apply for a general refund from us, complete an Application for Refund – General (FIN 355) and provide the supporting documentation listed in the instructions to the form. If you paid PST and were not required to pay it, you are eligible for a refund of the PST paid.

Does Canada have a sales tax exemption form?

Canadian resellers and manufacturers must complete and sign the Canada Uniform Sale & Use Tax Certification - Multi-Province form (see below) (PEC). You must give TBG a Purchase Exemption Certificate (PEC) at the Time of Sale.

How do I contact BC PST tax?

If you can't get the information you need by reviewing the available bulletins and brochures on the BC Small Business and Revenue Provincial Sales Tax web site, you can telephone the Taxpayer Services information line at 1-877-388-4440.

What is the provincial sales tax in British Columbia?

Generally, the rate of PST is 7% on the purchase or lease price of goods and services, with some exceptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada FIN 357?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada FIN 357 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit Canada FIN 357 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing Canada FIN 357.

How do I fill out Canada FIN 357 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada FIN 357 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Canada FIN 357?

Canada FIN 357 is a financial reporting form used by certain entities to disclose their foreign investments and financial interests outside of Canada.

Who is required to file Canada FIN 357?

Entities with foreign investments exceeding a certain threshold, as defined by Canadian tax regulations, are required to file Canada FIN 357.

How to fill out Canada FIN 357?

To fill out Canada FIN 357, entities must provide detailed information about their foreign investments, including financial details, ownership percentages, and geographical locations.

What is the purpose of Canada FIN 357?

The purpose of Canada FIN 357 is to collect data on Canadian entities' foreign investments for statistical and taxation purposes, ensuring compliance with Canadian regulations.

What information must be reported on Canada FIN 357?

Canada FIN 357 requires reporting information such as the nature of the foreign investment, value of the investment, earnings derived from the investment, and the jurisdiction of the investment.

Fill out your Canada FIN 357 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FIN 357 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.