Canada FIN 357 2016 free printable template

Show details

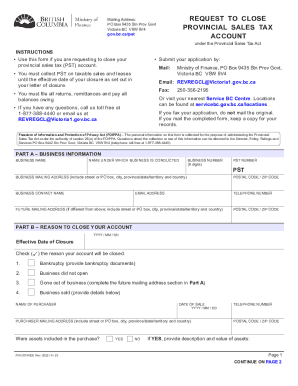

Mailing Address: PO Box 9435 STN Prov Govt Victoria BC V8W 9V3 gov.bc.ca/pst REQUEST TO CLOSE PROVINCIAL SALES TAX ACCOUNT under the Provincial Sales Tax Act INSTRUCTIONS Use this form if you are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada FIN 357

Edit your Canada FIN 357 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FIN 357 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada FIN 357 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada FIN 357. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 357 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FIN 357

How to fill out Canada FIN 357

01

Begin by gathering all necessary information and documents related to the transaction.

02

Fill out the top section with your name, address, and contact information.

03

Provide details about the organization or individual receiving the funds.

04

Complete the section detailing the purpose of the funds and how they will be used.

05

Ensure that all monetary amounts are clearly stated in Canadian dollars.

06

Review the form for accuracy and sign where required.

07

Submit the completed form to the appropriate financial institution or regulatory body.

Who needs Canada FIN 357?

01

Individuals or organizations making a financial transaction that involves a large sum of money.

02

Businesses that are required to report certain financial activities.

03

Financial institutions processing transactions that exceed reporting thresholds.

Fill

form

: Try Risk Free

People Also Ask about

What is exempt from PST in BC?

These include exemptions for: Health and medical products, and equipment for persons with disabilities (PDF, 383KB) Adult-sized clothing and footwear for kids under 15 years of age (PDF, 279KB) School supplies for students (PDF, 292KB)

How do I apply for a PST number in Manitoba?

In Manitoba, you are required fill out an RST Application for Registration form, which can be accomplished online through the Manitoba Finance website or by filling out a paper application form that you can get at any Manitoba Tax Division office. Registration as a provincial sales tax vendor is free.

How do I register for PST in Manitoba?

You can register online at manitoba.ca/TAXcess or submit a paper application form, which is available on the website and at Taxation Division offices listed at the end of this bulletin. There is no charge to apply. The Taxation Division will review the information provided on the application and issue an RST number.

How do I close my BC PST account?

To close your PST account, submit a closure request: Online using eTaxBC, or. By submitting a Request to Close Provincial Sales Tax Account (FIN 357) (PDF, 301KB)

How does PST work in Manitoba?

Often called the PST, Manitoba 7% Retail Sales Tax is applied to the retail sale or rental of most goods and services. The tax is calculated on the selling price, before the GST is applied. Small firms with annual taxable tales under $10,000 are not required to register and collect PST.

Who has to pay PST in BC?

Yes, you must charge PST on all taxable goods and services you sell in B.C., unless a specific exemption applies. There are no general exemptions that apply if you sell goods or services in B.C. to customers that live outside B.C. (e.g. tourists).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada FIN 357 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including Canada FIN 357, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in Canada FIN 357 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your Canada FIN 357, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete Canada FIN 357 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your Canada FIN 357. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Canada FIN 357?

Canada FIN 357 is a financial report that must be filed by certain entities in Canada to disclose their financial activities, particularly those related to foreign financial accounts.

Who is required to file Canada FIN 357?

Individuals and businesses that hold foreign financial accounts or have foreign income exceeding a certain threshold are required to file Canada FIN 357.

How to fill out Canada FIN 357?

To fill out Canada FIN 357, gather the necessary information regarding foreign accounts and income, follow the provided guidelines, and complete each section accurately before submitting it to the relevant tax authority.

What is the purpose of Canada FIN 357?

The purpose of Canada FIN 357 is to ensure compliance with tax regulations and to provide the government with information regarding foreign income and financial assets held by Canadian residents.

What information must be reported on Canada FIN 357?

Canada FIN 357 requires reporting of details such as the account number, financial institution, account balance, and any foreign income received during the reporting period.

Fill out your Canada FIN 357 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FIN 357 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.