Canada FIN 542S 2015 free printable template

Show details

Logging TAX RETURN OF income Mailing Address: PO Box 9444 STN Prov Govt Victoria BC V8W 9W8 gov.bc.ca×logging tax General Inquiries: 250 9533082 Toll free: 1 877 3873332 Email: ITBTaxQuestions gov.bc.ca

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada FIN 542S

Edit your Canada FIN 542S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FIN 542S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada FIN 542S online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada FIN 542S. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 542S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FIN 542S

How to fill out Canada FIN 542S

01

Obtain a copy of the Canada FIN 542S form from the official website or financial institution.

02

Read the instructions carefully to understand the requirements for the form.

03

Fill out your personal information, including name, address, and contact details, in the designated fields.

04

Provide accurate details of your financial transactions as required by the form.

05

Attach any necessary supporting documents that validate your financial information.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate authority as directed in the instructions.

Who needs Canada FIN 542S?

01

Individuals or entities involved in specific financial transactions that require reporting.

02

Individuals who are subject to Canadian tax regulations that necessitate the use of FIN 542S.

03

Financial institutions that must report client transactions to comply with Canadian laws.

Fill

form

: Try Risk Free

People Also Ask about

Who can claim BC logging tax credit?

Individuals and corporations in British Columbia that pay logging tax can claim the BC logging tax credit.

Who is eligible for BC tax credit?

BC Sales Tax Credit Eligibility Residents of British Columbia may be eligible for the refundable sales tax credit if they are: 19 years old or over, have a spouse or common-law partner, or are a parent.

Which spouse should claim the BC tax credit?

If you are eligible for the BC Sales Tax Credit, it does not matter which spouse claims it on their tax return. It will simply increase the refund of whose return it is claimed on, (or reduce the amount owing).

What is the logging tax in Ontario?

6.6667% of your net logging income for the year in the province.

Who pays BC logging tax?

Logging tax applies to individuals or corporations that have income from logging operations on private or Crown land in B.C.

What is Canada logging tax?

What is the logging tax? The logging tax is a 10 per cent tax that applies to individuals and corporations in BC that receive income related to log- ging operations from private and Crown land.

What is the logging tax return of income in BC?

The logging tax is equal to the lesser of: 10% of income derived from logging operations in B.C., or. 150% of the federal logging tax credit that would be allowable before any deductions for federal investment tax credits or political contribution credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada FIN 542S to be eSigned by others?

When you're ready to share your Canada FIN 542S, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute Canada FIN 542S online?

Filling out and eSigning Canada FIN 542S is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out Canada FIN 542S on an Android device?

On Android, use the pdfFiller mobile app to finish your Canada FIN 542S. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

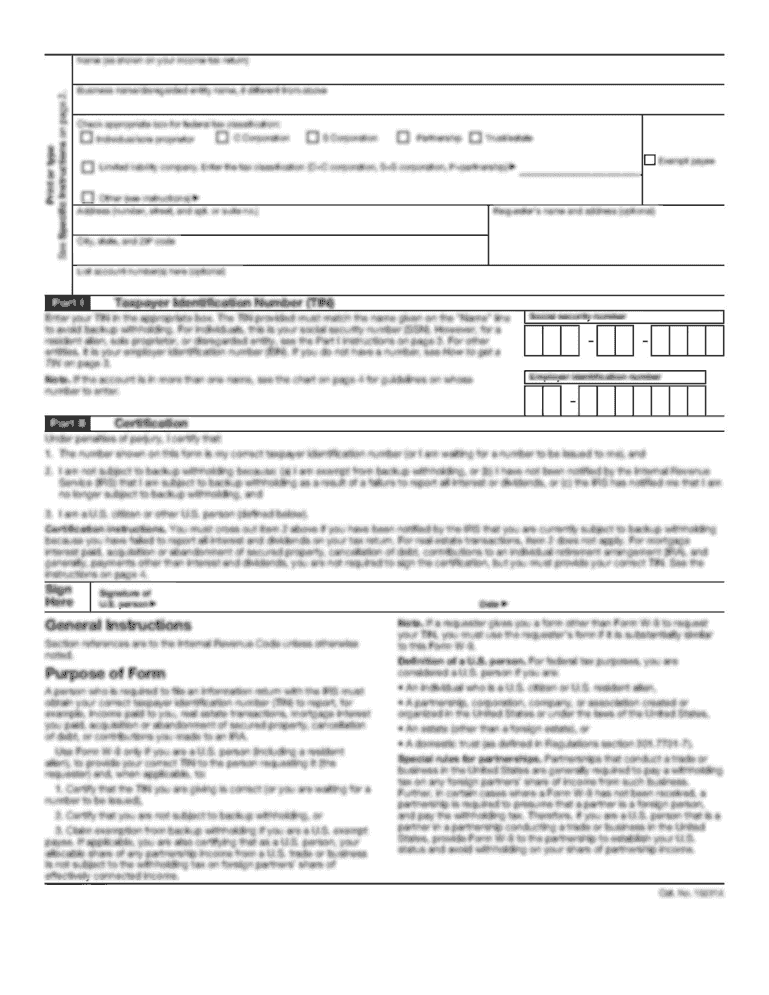

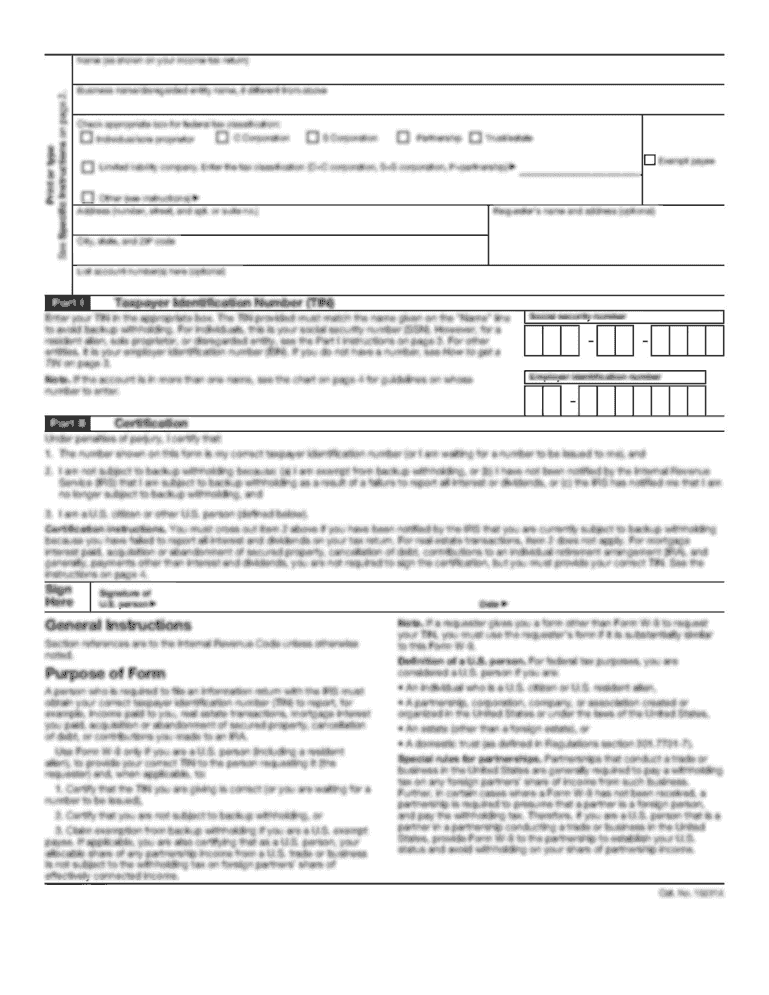

What is Canada FIN 542S?

Canada FIN 542S is a tax form used by Canadian residents and businesses to report their foreign income and financial assets to the Canada Revenue Agency (CRA).

Who is required to file Canada FIN 542S?

Taxpayers who have foreign income or foreign assets exceeding specified limits are required to file Canada FIN 542S.

How to fill out Canada FIN 542S?

To fill out Canada FIN 542S, taxpayers must provide their personal information, details of foreign income, and a summary of foreign assets following the instructions provided by the CRA.

What is the purpose of Canada FIN 542S?

The purpose of Canada FIN 542S is to ensure that Canadians report their foreign income and assets accurately, promoting tax compliance and transparency.

What information must be reported on Canada FIN 542S?

Information that must be reported on Canada FIN 542S includes foreign bank account details, foreign investment properties, foreign employment income, and other relevant foreign financial information.

Fill out your Canada FIN 542S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FIN 542s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.