Canada FIN 542S 2018-2025 free printable template

Show details

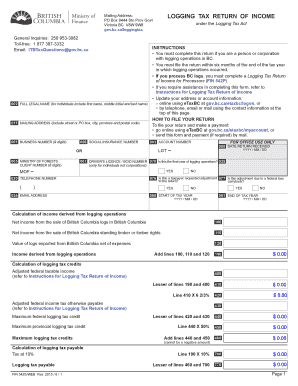

HOW TO FILE YOUR RETURN To file your return and make a payment send this form and payment if required by mail. 003 ACCOUNT NUMBER LGT OR 005 MINISTRY OF FORESTS under the Logging Tax Act YYYY / MM / DD 007 DRIVER S LICENCE / BCID NUMBER 078 Is this the final year of logging operations 025 only for individuals not corporations MOF 020 TELEPHONE NUMBER FOR OFFICE USE ONLY 000 DATE RETURN RECEIVED YES 024 EMAIL ADDRESS NO 076 Is this a taxpayer requested adjustment 077 Is this adjustment due...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fin 542 form

Edit your fin542s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax form 542 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit logging tax return online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit logging tax return online form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN 542S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fin 542s form

How to fill out Canada FIN 542S

01

Obtain a copy of Form FIN 542S from the Canada Revenue Agency (CRA) website.

02

Review the instructions provided with the form carefully before starting.

03

Fill in your personal information at the top of the form, including your name, address, and contact details.

04

Indicate your tax year for which you are filing the form.

05

Complete the income section by accurately reporting all sources of income as required.

06

Fill in the deductions and credits sections, ensuring you have supporting documents where necessary.

07

Review all entries for accuracy and completeness before signing the form.

08

Submit the completed form to the designated CRA address.

Who needs Canada FIN 542S?

01

Individuals or entities that have Canadian income or are required to report foreign income.

02

Taxpayers who need to declare their income and pay taxes accordingly in Canada.

03

Residents and non-residents who receive income from Canadian sources.

Fill

fin 542s form

: Try Risk Free

People Also Ask about 542s form search

Who can claim BC logging tax credit?

Individuals and corporations in British Columbia that pay logging tax can claim the BC logging tax credit.

What form do I need to file NY state tax return?

Form IT-201, Resident Income Tax Return.

Who pays BC logging tax?

Logging tax applies to individuals or corporations that have income from logging operations on private or Crown land in B.C.

Do I have to file 1120S if no income?

Therefore, when an S corp doesn't file, the IRS makes assumptions about taxes owed and sends a bill for that amount. The IRS does not assume that the business has no income. Even though an S corp does not pay income taxes, it still must file the Form 1120S to create a record of profits and losses.

What is the difference between it-201 and 1040?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Do you need to attach federal return with New York State return?

State Only Return Requirements – New York returns can be transmitted with the Federal return or as a State Only return unlinked from the Federal return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send canada logging tax return bc get for eSignature?

When you're ready to share your fin income ministry bc, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find form fin 542s 2018-2025?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the form fin 542s 2018-2025 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the form fin 542s 2018-2025 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form fin 542s 2018-2025 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is Canada FIN 542S?

Canada FIN 542S is a form used by the Canada Revenue Agency (CRA) for reporting certain non-resident income tax information.

Who is required to file Canada FIN 542S?

Non-residents of Canada who receive Canadian-source income, such as dividends, interest, or rents, may be required to file Canada FIN 542S.

How to fill out Canada FIN 542S?

To fill out Canada FIN 542S, taxpayers must provide accurate information regarding their income, residency status, and any tax withholding summaries as required in the instructions provided by the CRA.

What is the purpose of Canada FIN 542S?

The purpose of Canada FIN 542S is to ensure that non-residents accurately report their income from Canadian sources and comply with Canadian tax obligations.

What information must be reported on Canada FIN 542S?

Information reported on Canada FIN 542S includes the amount and type of Canadian-source income received, details of any taxes withheld, and identification of the filer.

Fill out your form fin 542s 2018-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Fin 542s 2018-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.