Get the free Property Tax Reassessment Moratorium Application - Jeffersontown

Show details

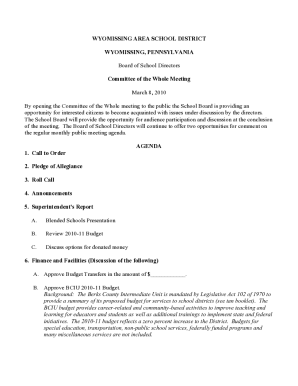

City of Jeffersontown Department of Building Inspection and Code Enforcement 10416 Patterson Trail, Louisville, KY 402993950 Telephone: (502× 2678333 Fax: (502× 2670547 Explanation of Assessment×Reassessment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax reassessment moratorium

Edit your property tax reassessment moratorium form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax reassessment moratorium form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax reassessment moratorium online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax reassessment moratorium. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax reassessment moratorium

How to fill out property tax reassessment moratorium:

01

Obtain the necessary forms: Begin by contacting your local tax assessor's office or visiting their website to obtain the required forms for applying for a property tax reassessment moratorium. These forms are typically available online or can be obtained in person.

02

Gather supporting documents: Before filling out the forms, gather any supporting documents that may be required. This could include property ownership documents, proof of income, recent property tax assessments, and any other relevant documentation.

03

Complete the forms accurately: Take your time to carefully fill out the forms, ensuring all information is accurate and up-to-date. Review the instructions provided with the forms to make sure you have filled them out correctly.

04

Attach supporting documents: Once you have completed the forms, be sure to attach any necessary supporting documents as required. These could include copies of property ownership documents, recent tax assessments, or any other relevant paperwork requested in the application.

05

Submit the application: Once you have completed the forms and attached all the necessary documents, submit your application to the designated tax assessor's office. Follow any specific submission instructions provided, such as mailing the application or submitting it in person.

Who needs property tax reassessment moratorium?

01

Property owners facing financial hardship: Individuals or families who are experiencing financial hardship and are struggling to pay their property taxes may consider applying for a property tax reassessment moratorium. This can provide temporary relief by freezing or reducing the property tax burden during a designated period.

02

Homeowners with significant changes in property value: Property tax assessments are usually based on the estimated value of the property. If there have been significant changes in the value of the property, such as a decrease due to declining market conditions or an increase due to substantial improvements, homeowners may choose to apply for a reassessment moratorium to adjust their property taxes accordingly.

03

Those affected by natural disasters or emergencies: In some cases, natural disasters or emergencies can cause significant damage to properties, leading to a decrease in their value. Homeowners affected by such events may be eligible for a reassessment moratorium to temporarily reduce their property taxes until the property is repaired or the value is restored.

It is essential to consult with your local tax assessor's office or seek professional advice to better understand the specific requirements and eligibility criteria for a property tax reassessment moratorium in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit property tax reassessment moratorium online?

The editing procedure is simple with pdfFiller. Open your property tax reassessment moratorium in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the property tax reassessment moratorium electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your property tax reassessment moratorium in minutes.

Can I create an eSignature for the property tax reassessment moratorium in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your property tax reassessment moratorium right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is property tax reassessment moratorium?

Property tax reassessment moratorium is a temporary suspension of the reassessment of property taxes.

Who is required to file property tax reassessment moratorium?

Property owners who meet certain qualifications may be required to file property tax reassessment moratorium.

How to fill out property tax reassessment moratorium?

To fill out the property tax reassessment moratorium, property owners must submit the required forms to the appropriate tax authority.

What is the purpose of property tax reassessment moratorium?

The purpose of property tax reassessment moratorium is to provide temporary relief to property owners facing increases in property taxes.

What information must be reported on property tax reassessment moratorium?

Property owners must report specific details about their property, income, and other relevant information on the property tax reassessment moratorium form.

Fill out your property tax reassessment moratorium online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Reassessment Moratorium is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.