Get the free Goldman Sachs Mutual Fund

Show details

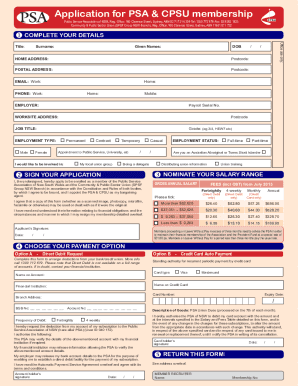

This document provides essential information for prospective investors regarding the Goldman Sachs CNX 500 Fund, including investment objectives, risk factors, asset allocation, and guidelines for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign goldman sachs mutual fund

Edit your goldman sachs mutual fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goldman sachs mutual fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit goldman sachs mutual fund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit goldman sachs mutual fund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out goldman sachs mutual fund

How to fill out Goldman Sachs Mutual Fund

01

Gather necessary documents: Collect your identification, social security number, and financial information.

02

Visit the Goldman Sachs Mutual Fund website: Navigate to the specific fund you are interested in.

03

Review the fund's prospectus: Understand the investment objectives, risks, and fees associated with the fund.

04

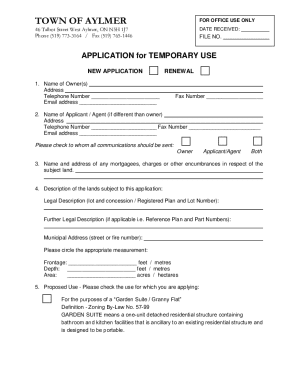

Complete the application form: Fill out the required personal information and investment details.

05

Choose your investment amount: Decide how much money you want to invest in the mutual fund.

06

Select payment method: Choose how you will fund your investment (e.g., bank transfer, check).

07

Submit your application: Review all details for accuracy and submit the application online or by mail.

08

Monitor your investment: Regularly check your account and investment performance.

Who needs Goldman Sachs Mutual Fund?

01

Individuals looking for a diversified investment option.

02

Investors seeking professional management of their investment portfolios.

03

Retirement savers wanting to grow their assets over time.

04

People who prefer a hands-off investment strategy.

Fill

form

: Try Risk Free

People Also Ask about

What are the top 5 performing mutual funds?

Top 10 Best-Performing Mutual Funds: 10-Year Analysis SymbolName10 Year Total NAV Returns (As of: January 31, 2025) VITAX Vanguard Information Technology Index Fund Admiral 577.8% CSGZX Columbia Seligman Global Technology Fund I 554.1% PGTYX Putnam Global Technology Fund Y 563.0% WWNPX Kinetics Paradigm Fund No Load 484.1%6 more rows • May 21, 2025

Is 12% return possible?

Of course! The highest average 30-year geometric return was 13.7%, so it's definitely possible. At the same time, though, the lowest average 30-year geometric return has been 8.5%, so it's been lower as well.

How can I get 12% interest?

Nothing in life is without risks, but if you want to earn a 12% return in the US, your best option is the stock market or a peer-to-peer lending site. If you go the stock market route, your risk and returns will depend on the investments you choose and how well you diversify your portfolio.

Can I get 20% return in mutual funds?

Based on historical analysis, mutual funds have provided solid returns, often around 9 – 12% annually. However, these returns can be higher depending on market conditions. For example, in India, mutual funds have given an average 20% return over ten years and have shown strong market growth.

Does Goldman Sachs have a mutual fund?

View all of Goldman Sachs's mutual funds and start searching for your next investment. Below are pre-screened investment lists to kickstart the process.

Which mutual fund gives 12% return?

Other schemes which gave more than 12 percent return include Canara Robeco Bluechip Equity Fund, SBI Bluechip Fund and HDFC Large Cap Fund. However, it is important to note that the past returns of a scheme should be seen as indicative since they do not guarantee future returns.

How much money do you need to invest at Goldman Sachs?

Cons of Goldman Sachs: Clients must have at least USD$10 million to invest in order to qualify for the firm's services. Advisors may receive compensation for the sale of securities and other investments, which may create the risk of conflicts of interest.

Which mutual fund has 12 percent return?

Value funds Value funds10-year-returns HDFC Large Cap Fund 12.00 ICICI Prudential Bluechip Fund 13.21 Mirae Asset Large Cap Fund 12.58 Nippon India Large Cap Fund 13.232 more rows • Feb 10, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Goldman Sachs Mutual Fund?

Goldman Sachs Mutual Fund is a type of investment vehicle managed by Goldman Sachs Asset Management that pools money from many investors to invest in various securities, such as stocks, bonds, and other assets. The goal is to offer investors diversified exposure to different asset classes.

Who is required to file Goldman Sachs Mutual Fund?

Investors who hold shares in Goldman Sachs Mutual Funds may be required to file specific forms for tax purposes, such as the IRS Form 1099-DIV for dividend income. Financial advisors, fund managers, and other financial professionals involved with the fund's management may also be required to file with regulatory bodies.

How to fill out Goldman Sachs Mutual Fund?

To fill out a Goldman Sachs Mutual Fund application, investors typically need to provide personal information such as their name, address, Social Security number, and financial information. It's important to follow the instructions provided on the application form and consult a financial advisor if needed.

What is the purpose of Goldman Sachs Mutual Fund?

The primary purpose of Goldman Sachs Mutual Fund is to provide investors with a way to invest in a diversified portfolio of securities, managed by experienced professionals, with the aim of achieving capital appreciation and income generation based on the fund's investment strategy.

What information must be reported on Goldman Sachs Mutual Fund?

Investors must report information such as capital gains, dividends received, and any unrealized gains or losses on their tax returns. Financial advisors and fund managers also need to report performance metrics and disclosures relevant to regulatory agencies.

Fill out your goldman sachs mutual fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Goldman Sachs Mutual Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.