Get the free W-10

Show details

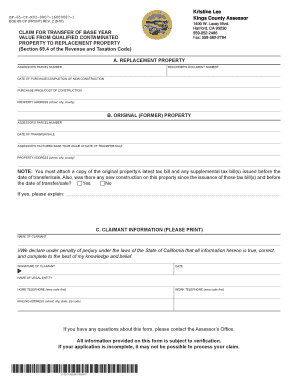

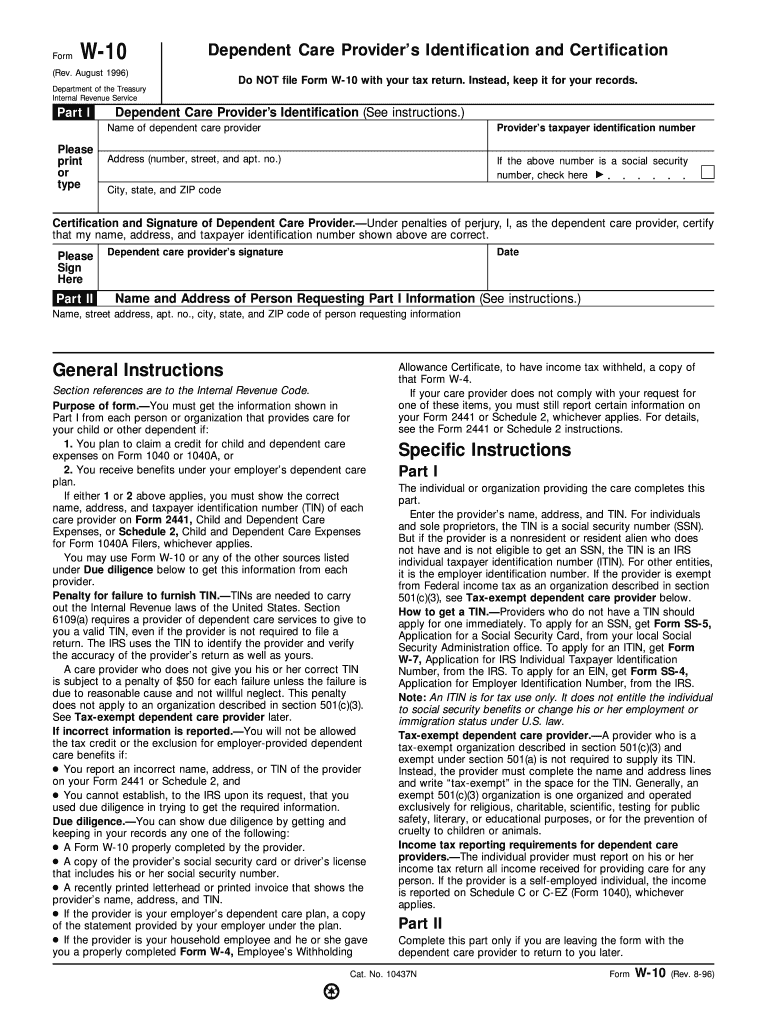

This form is used to collect and certify the identification information of a dependent care provider for tax purposes, including their name, address, and taxpayer identification number.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-10

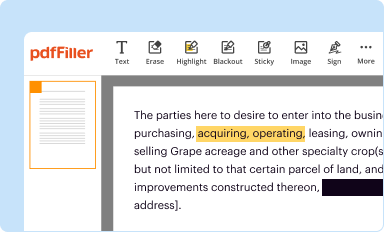

Edit your w-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

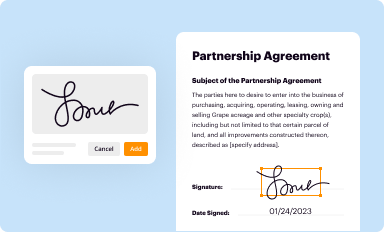

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

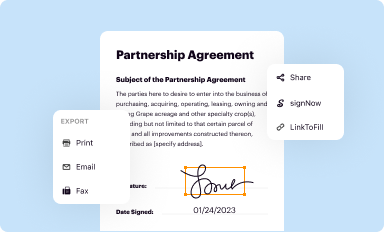

Share your form instantly

Email, fax, or share your w-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

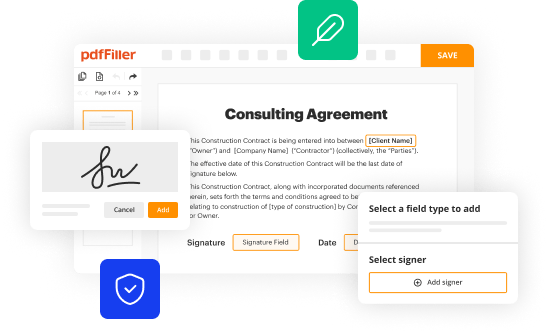

Editing w-10 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w-10. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

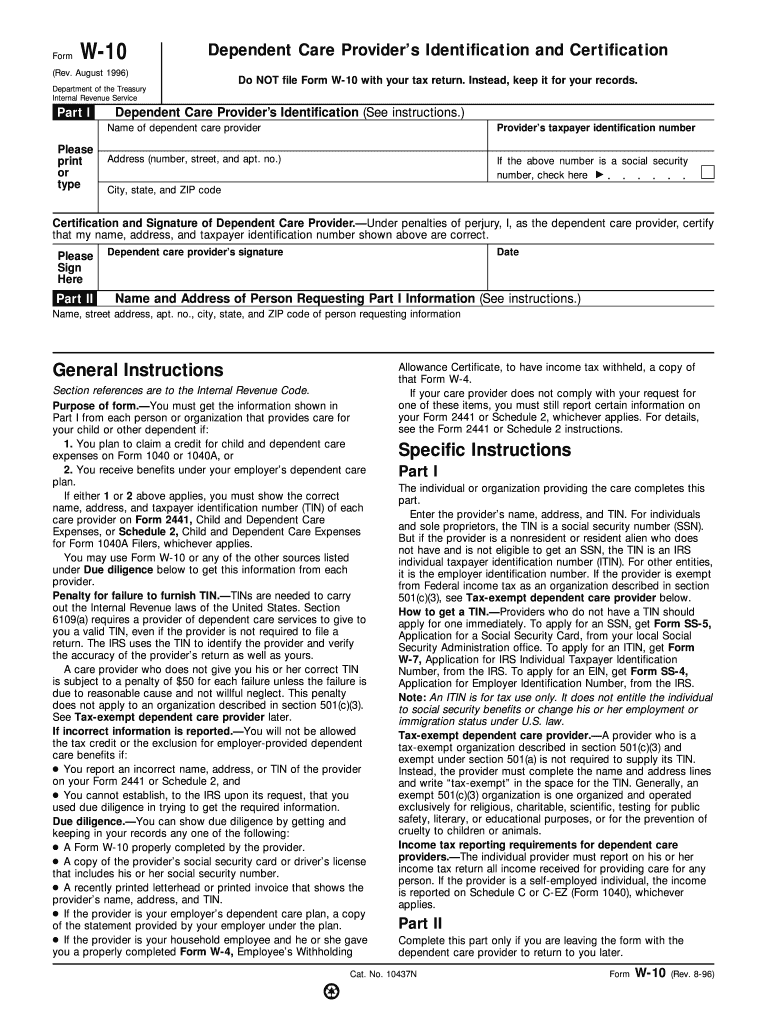

How to fill out w-10

How to fill out W-10

01

Obtain the W-10 form from the IRS website or your tax professional.

02

Fill in your personal information at the top of the form, including your name, address, and TIN (Taxpayer Identification Number).

03

Indicate the type of income for which you are claiming the exemption on the form.

04

Confirm that you meet the eligibility criteria for the exemption.

05

Provide your signature and the date at the bottom of the form.

06

Submit the completed W-10 form to the requester who asked for it.

Who needs W-10?

01

Taxpayers who receive certain types of income that are exempt from withholding tax.

02

Individuals claiming a reduced rate of withholding under a tax treaty.

03

Foreign entities claiming benefits under a tax treaty.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies for dependent care expenses?

A qualifying individual for the child and dependent care credit is: Your dependent qualifying child who was under age 13 when the care was provided, Your spouse who was physically or mentally incapable of self-care and lived with you for more than half of the year, or.

Do you file W-10?

Do NOT file Form W-10 with your tax return. Instead, keep it for your records. Section references are to the Internal Revenue Code.

What is the purpose of form 10?

The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession.

What is a daycare provider statement?

Daycare centers are required to provide parents with an annual daycare tax statement. This statement shows the total amount parents spent on child care costs during the past year. These annual receipts should cover January 1st through December 31st of the previous year.

What tax form should my daycare give me?

Form W-10 information helps you complete Form 2441, the IRS Form you need to complete to claim the Child and Dependent Care Credit. You may be eligible for this credit if you paid for child or dependent care so that you could work, look for work, or attend school full time.

What is a W-10 form for?

You may use this form to get the correct name, address and taxpayer identification number (TIN) from each person or organization that provides care for your child or other dependent if: You plan to claim a credit for child and dependent care expenses on Form 1040 or 1040-SR, or.

What is a 10 W 9 form?

The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income. The information taken from a W-9 form is often used to generate a 1099 tax form, which is required for income tax filing purposes.

Who fills out a W10 form?

If you're the taxpayer, you're generally not going to fill out much information on this tax form. Instead, the dependent care provider will fill in the required information in Part I.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is W-10?

Form W-10 is a document used by payors to request the Taxpayer Identification Number (TIN) of the payee in order to meet IRS requirements.

Who is required to file W-10?

Payors who are required to obtain TINs from payees for certain payments must file the W-10.

How to fill out W-10?

To fill out W-10, the payor needs to enter information such as their name, address, and the type of payment, along with the payee's name and TIN.

What is the purpose of W-10?

The purpose of W-10 is to collect TINs from payees to ensure that the correct tax information is reported to the IRS.

What information must be reported on W-10?

Information that must be reported on W-10 includes the payor's name, address, the payee's name, and the payee's TIN.

Fill out your w-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.