Get the free 5498_CopyC. Instructions for Form 5498-ESA, Coverdell ESA Contribution Information

Show details

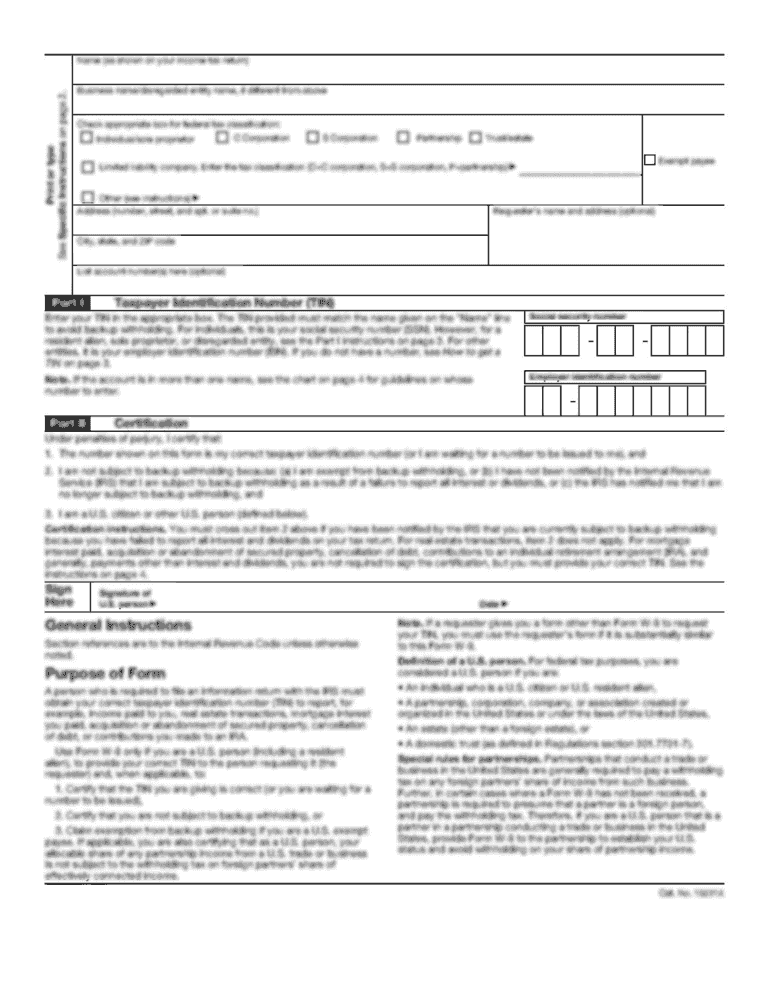

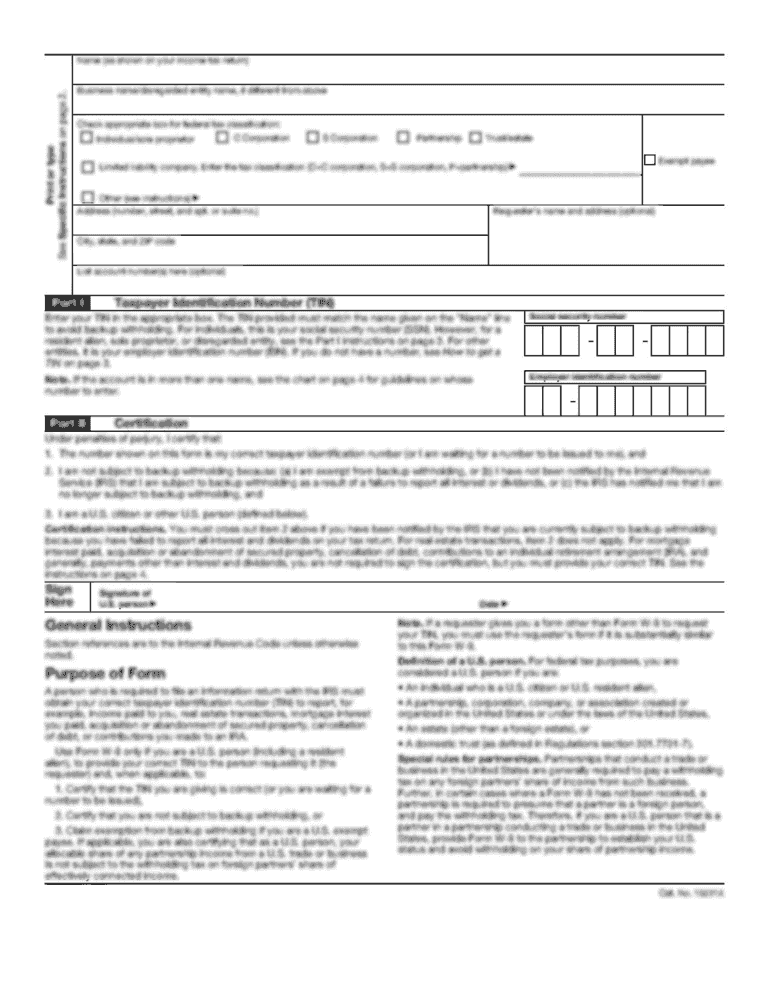

VOID CORRECTED TRUSTEE? S or ISSUER? S name, street address, city, state, and ZIP code 1 IRA contributions (other than amounts in boxes 2?4 and 8?10) OMB No. 1545-$07472007 2 Rollover contributions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 5498_copyc instructions for form

Edit your 5498_copyc instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5498_copyc instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 5498_copyc instructions for form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 5498_copyc instructions for form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 5498_copyc instructions for form

How to Fill out 5498_copyc Instructions for Form:

01

Obtain the form: The first step in filling out the 5498_copyc form is to obtain the form itself. You can typically access this form from the Internal Revenue Service (IRS) website or obtain a physical copy from a local IRS office.

02

Review the instructions: Before starting to fill out the form, it's crucial to carefully read and understand the instructions provided. The instructions will guide you through the process and help ensure that you provide accurate and complete information.

03

Gather necessary information: Collect all the information required to fill out the form. This includes details such as your name, address, Social Security number, employer information, and any other relevant financial details that the form requires.

04

Follow the form sections: The 5498_copyc form is typically divided into various sections. Each section may require different information or may relate to a specific aspect of your financial situation. Make sure you understand what each section is asking for and provide the necessary information accordingly.

05

Complete the form accurately: Take your time to fill out the form accurately. Double-check your entries and ensure that the information you provide is correct. Mistakes or inaccuracies may result in delays or potential issues with your taxes.

06

Seek professional assistance if needed: If you find the form instructions confusing or if you have complex financial circumstances, seeking assistance from a tax professional can be beneficial. They can help ensure that you complete the form correctly and comply with any additional requirements or regulations.

Who Needs 5498_copyc Instructions for Form?

01

Individual taxpayers: If you are an individual taxpayer who received an IRA (Individual Retirement Account) contribution, distribution, or conversion during the tax year, you may need to refer to the 5498_copyc instructions. These instructions provide guidance on reporting these transactions accurately on your tax return.

02

Financial institutions: Financial institutions such as banks, mutual fund companies, and other entities that administer IRA accounts may also need to refer to the 5498_copyc instructions. These instructions help them accurately report IRA-related information to the IRS and provide accurate statements to their clients.

03

Tax professionals: Tax professionals, including accountants and tax preparers, may also utilize the 5498_copyc instructions to ensure they understand the reporting requirements for IRA-related transactions. This enables them to accurately prepare their clients' tax returns and avoid any potential penalties or issues with the IRS.

Overall, the 5498_copyc instructions are essential resources for individuals, financial institutions, and tax professionals to ensure accurate reporting and compliance with IRA-related transactions during the tax year.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 5498_copyc instructions for form for eSignature?

Once you are ready to share your 5498_copyc instructions for form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the 5498_copyc instructions for form in Gmail?

Create your eSignature using pdfFiller and then eSign your 5498_copyc instructions for form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit 5498_copyc instructions for form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 5498_copyc instructions for form.

What is 5498_copyc instructions for form?

The 5498_copyc instructions for form provide guidance on how to complete and submit Form 5498_copyc, which is used to report contributions made to an individual retirement arrangement (IRA) for a specific tax year.

Who is required to file 5498_copyc instructions for form?

Financial institutions, including banks, mutual fund companies, and other IRA trustees or custodians, are required to file Form 5498_copyc and follow the associated instructions.

How to fill out 5498_copyc instructions for form?

To fill out the 5498_copyc form, follow the instructions provided by the IRS. The instructions will guide you through the required information such as the account holder's name, social security number, contribution amounts, and any rollovers or conversions.

What is the purpose of 5498_copyc instructions for form?

The purpose of the 5498_copyc instructions for form is to ensure accurate reporting of contributions made to IRAs and to assist financial institutions in complying with IRS regulations.

What information must be reported on 5498_copyc instructions for form?

The 5498_copyc instructions specify the information that must be reported on Form 5498_copyc, which includes the account holder's name, social security number, contribution amounts, rollovers, conversions, and any other relevant details regarding the IRA.

Fill out your 5498_copyc instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5498_Copyc Instructions For Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.