What Do I Do With Irs Form 5498

What is what do I do with IRS Form 5498?

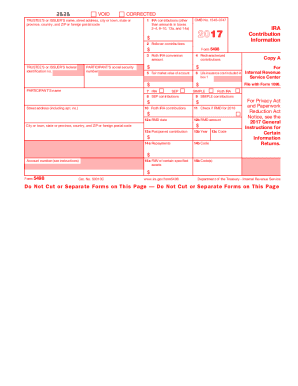

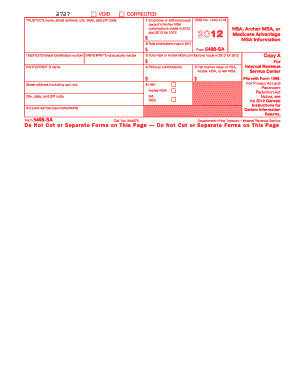

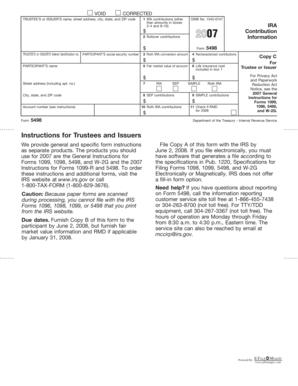

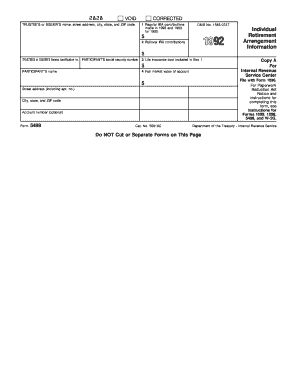

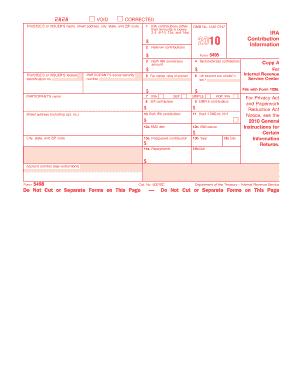

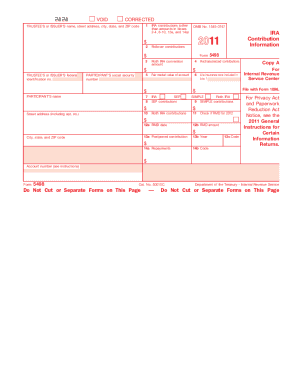

When it comes to IRS Form 5498, it's important to understand its purpose and what you need to do with it. This form is used to report contributions made to individual retirement arrangements (IRAs) and can provide valuable information for tax purposes. You will receive this form if you have made contributions to your IRA, received certain IRA distributions, or engaged in other IRA-related transactions. It's crucial to review and understand the information provided on Form 5498 to ensure accurate reporting on your tax return.

What are the types of what do I do with IRS Form 5498?

There are three types of information reported on IRS Form 5498: contributions, rollovers, and recharacterizations. 1. Contributions: This section includes the total amount of contributions made to your IRA during the tax year. It's essential to verify the accuracy of these contributions, as they can impact your tax deductions. 2. Rollovers: If you rolled over funds from one IRA to another, this section will provide details on the rollover amounts. It's crucial to report these rollovers correctly to avoid any penalties or tax implications. 3. Recharacterizations: This section relates to any changes made to your IRA contributions after they were initially made. It's important to understand the recharacterization rules and accurately report any recharacterized amounts on your tax return.

How to complete what do I do with IRS Form 5498

Completing IRS Form 5498 may seem overwhelming, but with the right guidance, it can be a straightforward process. Here are the steps to follow: 1. Gather the necessary information: Collect all the relevant documents, such as your IRA statements and records of contributions, rollovers, and recharacterizations. 2. Fill in the basic details: Provide your name, address, and social security number as requested on the form. 3. Report contributions: Enter the total amount of contributions made to your IRA during the tax year in the designated section. 4. Record rollovers: If you completed any rollovers during the year, accurately report the rollover amounts in the respective section of the form. 5. Include recharacterizations: If you recharacterized any IRA contributions, ensure that you accurately report these amounts in the provided section. 6. Review and verify: Double-check all the information you entered on Form 5498 to ensure accuracy and completeness. 7. Submit the form: Mail the completed form to the IRS address provided on the form instructions or use electronic filing options if available in your circumstances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.