Tax Form 1099-r

What is tax form 1099-r?

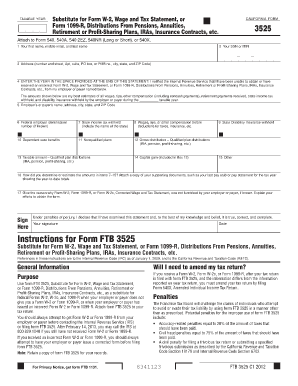

Tax form 1099-R is a document issued by the Internal Revenue Service (IRS) to report distributions from pensions, annuities, retirement plans, and other similar sources. It is used to report the income received and the related taxes withheld from these distributions.

What are the types of tax form 1099-r?

There are different types of tax form 1099-R depending on the nature of the distribution. Some common types include:

Traditional IRA distributions

Roth IRA distributions

Pension distributions

Annuity distributions

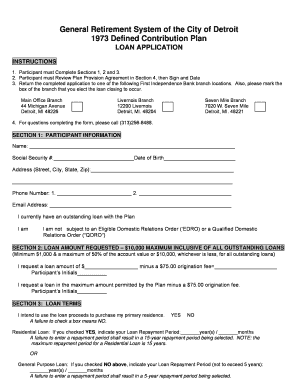

How to complete tax form 1099-r

To complete tax form 1099-R, follow these steps:

01

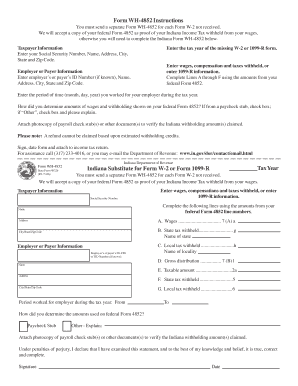

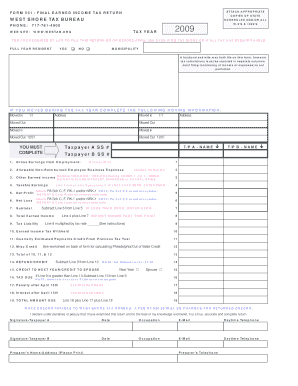

Gather the necessary information, including the recipient's name, address, and Social Security number

02

Enter the payer's information, including name, address, and TIN

03

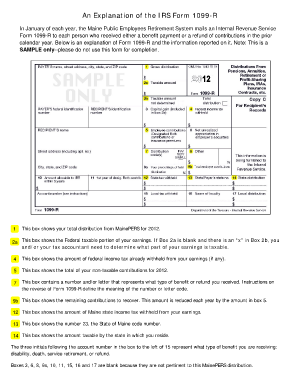

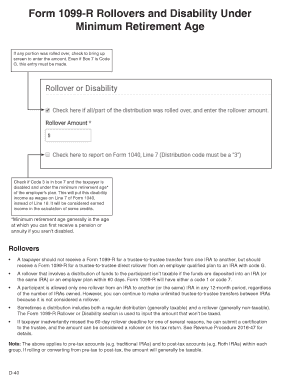

Provide details about the distributions, including the distribution code, taxable amount, and federal income tax withheld

04

Attach Copy B of the form to the recipient's tax return

05

Keep Copy C for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out tax form 1099-r

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I report a 1099-R on my taxes?

You'll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you'll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy – Copy B—to your tax return.

How much tax do I owe on 1099-R?

Funds distributed directly to the taxpayer are generally subject to a 20% federal income tax withholding. This means that the taxpayer must contribute additional funds in order to make up for the 20% that was withheld and sent to the IRS so that the rollover amount is equal to the total distribution.

Do you need a 1099-R to file taxes?

As long as you have the correct information, you can put it on your tax form without having the statement in hand. The one exception is the 1099-R, which tracks distributions from retirement plans and insurance contracts. You'll need to send that in with your tax return if income tax was withheld.

Does a 1099-R count as earned income?

Since income on Form 1099-R is unearned income, it does not count as earned income for the purposes of figuring the amount of the EIC. However, if the income on Form 1099-R is taxable, it may increase a taxpayer's adjusted gross income, which could reduce the amount of EIC he is eligible to receive.

Related templates