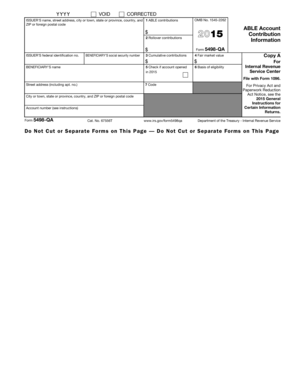

Form 5498 Rollover

What is form 5498 rollover?

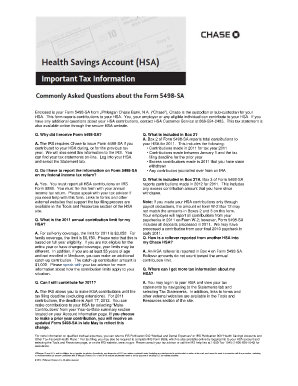

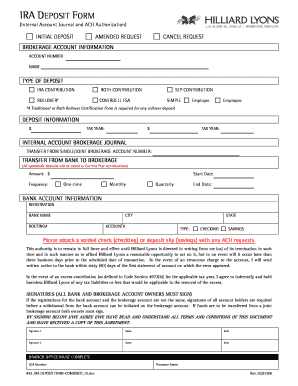

Form 5498 rollover is a tax form used by individuals who have made contributions to an individual retirement account (IRA) or other eligible retirement plan. This form is issued by the financial institution that holds the account and reports the amount of rollovers made from one retirement account to another.

What are the types of form 5498 rollover?

There are two types of form 5498 rollover: direct rollover and indirect rollover. In a direct rollover, the funds are transferred directly from one retirement account to another, typically without any tax withholding. An indirect rollover involves the account holder receiving a distribution from their retirement account and then depositing it, within 60 days, into another eligible retirement account. It's important to note that with an indirect rollover, there is a 20% mandatory tax withholding unless the distribution is rolled over within the specified time frame.

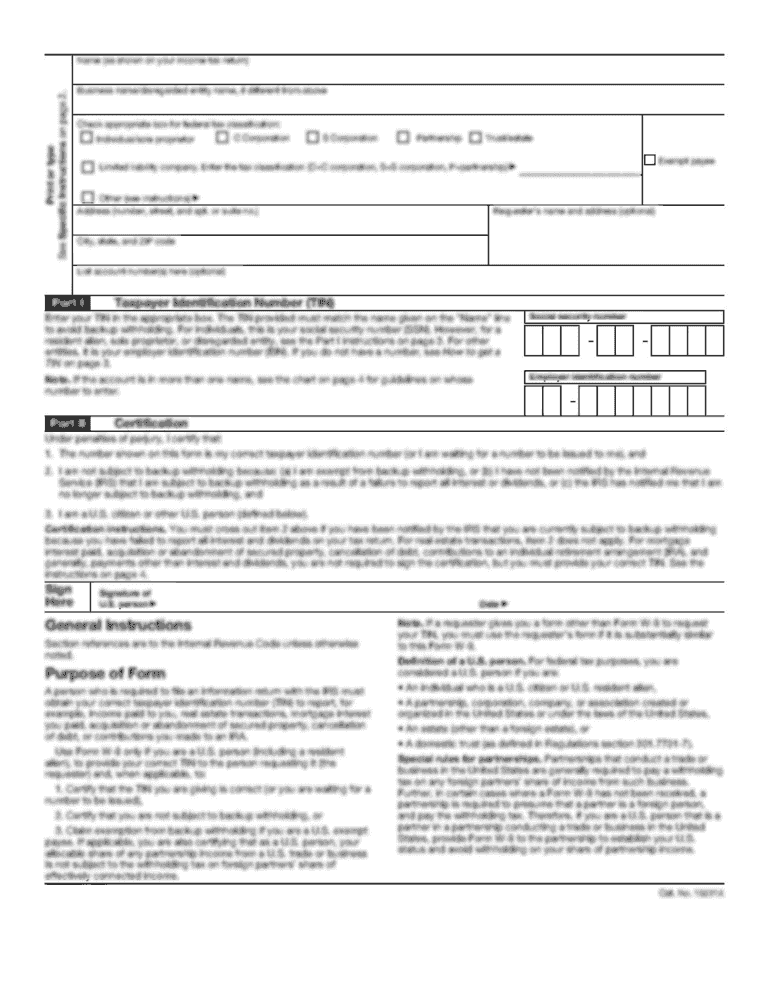

How to complete form 5498 rollover

Completing form 5498 rollover is a relatively straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.