MI 5076 2015 free printable template

Show details

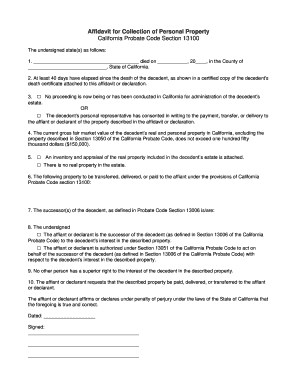

Reset Form Michigan Department of Treasury 5076 (Rev. 10-14) Parcel Number 2014 Affidavit of Owner of Eligible Personal Property Claiming Exemption from Collection of Taxes (As of 12-31-2014) Notice:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 5076

Edit your MI 5076 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 5076 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 5076 online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI 5076. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 5076 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 5076

How to fill out MI 5076

01

Start by gathering your personal identification information, including your name, address, and social security number.

02

Review the instructions provided with the MI 5076 form to understand the requirements.

03

Fill out your demographic information in the designated sections.

04

Provide details regarding the reason for submitting the form, including any relevant case numbers or account details.

05

Complete any necessary declarations or certifications as per the form's instructions.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

Who needs MI 5076?

01

Individuals applying for certain state benefits, such as food assistance or medical services.

02

Residents seeking financial assistance or support from the Michigan Department of Health and Human Services.

03

Anyone required to provide verification of eligibility for specific services.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file a Michigan property transfer affidavit?

Transfer Affidavit (Form 4260) It must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

What is Michigan personal exemption for 2023?

The personal exemption amount for 2023 is $5,400.

Who qualifies for homestead property tax credit in Michigan?

You were a resident of Michigan for at least six months during the year. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied. If you own your home, your taxable value is $143,000 or less. Your total household resources are $63,000 or less.

What is the personal property tax exemption for 2023 in Michigan?

Personal Property Exemption CHANGES FOR 2023 - You may NOW qualify! Taxpayers with less than $80,000 of Personal Property are no longer required to annually file Form 5076 in order to claim the exemption.

What is Michigan Form 5076?

Complete the Michigan Form 5076 The form you use to apply for this exemption is a State of Michigan form called the Small Business Property Tax Exemption Claim Under MCL 211.9o.

What is the personal exemption amount in Michigan?

Exemption allowances and the tax rate: $5,000 for personal and dependent exemptions. $2,900 for special exemptions. $400 for qualified disabled veterans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MI 5076 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing MI 5076 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the MI 5076 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your MI 5076 in seconds.

How do I complete MI 5076 on an Android device?

Use the pdfFiller Android app to finish your MI 5076 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MI 5076?

MI 5076 is a form used in the state of Michigan for reporting and documenting the transfer of ownership of certain vehicles.

Who is required to file MI 5076?

Individuals or businesses that are transferring ownership of a vehicle in Michigan are required to file MI 5076.

How to fill out MI 5076?

To fill out MI 5076, provide the required information about the vehicle, including the VIN, make, model, year, and the details of the buyer and seller. Follow the instructions on the form carefully.

What is the purpose of MI 5076?

The purpose of MI 5076 is to facilitate the proper transfer of vehicle ownership and ensure that the state's records are updated accordingly.

What information must be reported on MI 5076?

The information that must be reported on MI 5076 includes the vehicle's VIN, make, model, year, odometer reading, and the names and addresses of both the buyer and seller.

Fill out your MI 5076 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 5076 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.