MI 5076 2024 free printable template

Get, Create, Make and Sign mi tax exemption form

Editing mi exemption online

Uncompromising security for your PDF editing and eSignature needs

MI 5076 Form Versions

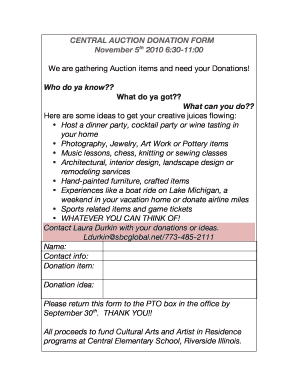

How to fill out michigan small business tax exemption form

How to fill out MI 5076

Who needs MI 5076?

Video instructions and help with filling out and completing mi exemption

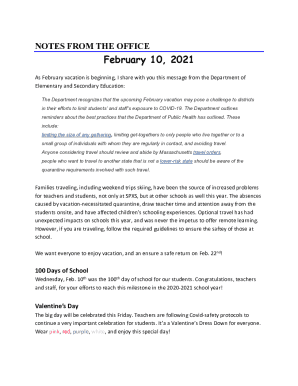

Instructions and Help about mi form tax exemption

How×39’s it's going everybodTibetanatherehe bush today IN×39’goinTonyna show you how to fill out your w-4 form properly so that you do not owe the government any money and that you do not get an excessive tax return at the end of the year this is anywhere that is more than a thousand dollars it's generally not a good idea because you×39’re essentiallgivinghgovernmentnt a loan of $1,000 or so forth whole year now if you stick this in the bank instead well you×39

People Also Ask about small business tax exemption claim

What is the form for principal residence exemption in Michigan?

How do I get property tax exemption in Michigan?

What are Michigan special exemptions?

What is the personal property tax exemption for 2023 in Michigan?

What are exemptions to Michigan use tax?

How many exemptions should I claim on my Michigan W4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 5076 for online?

How can I edit form 5076 on a smartphone?

How do I edit form 5076 mcl 211 online on an iOS device?

What is MI 5076?

Who is required to file MI 5076?

How to fill out MI 5076?

What is the purpose of MI 5076?

What information must be reported on MI 5076?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.