MI 5076 2023 free printable template

Show details

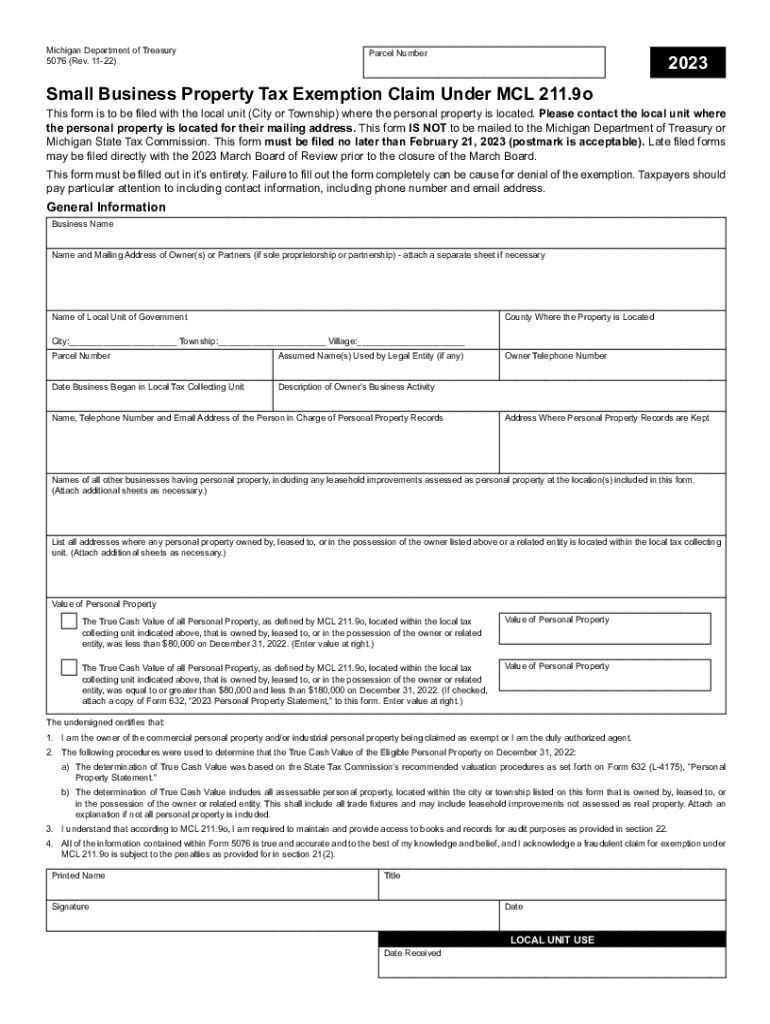

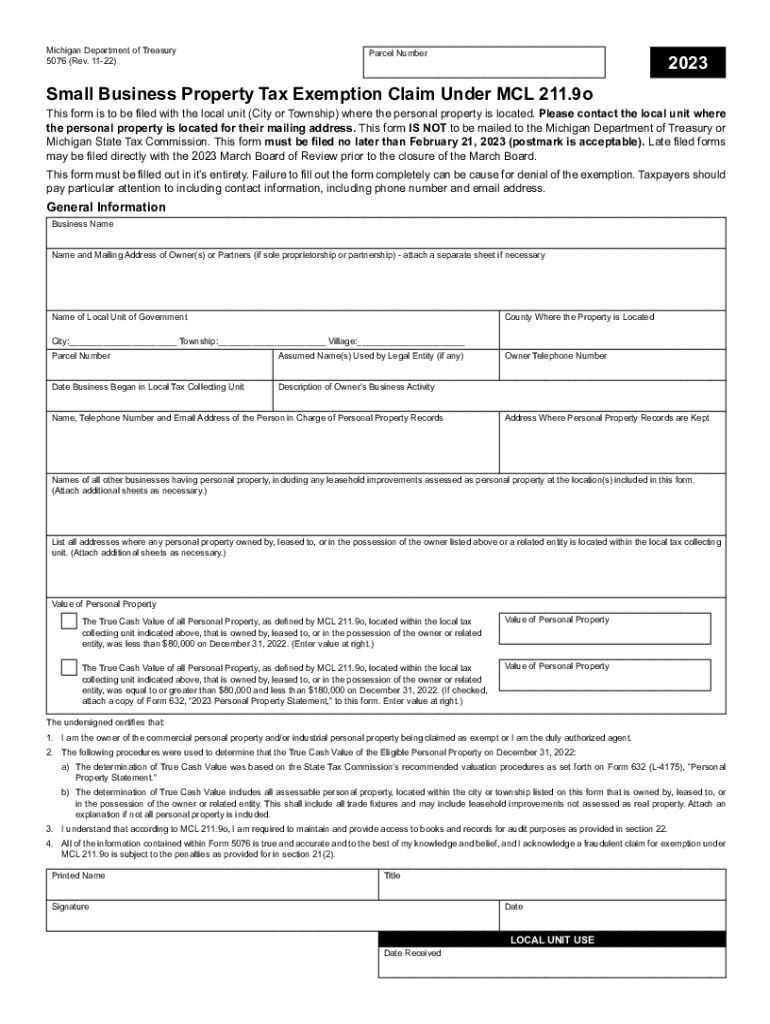

Reset Form Michigan Department of Treasury 5076 (Rev. 0721)Parcel Number2022Small Business Property Tax Exemption Claim Under MCL 211.9o This form is to be filed with the local unit (City or Township)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 5076

Edit your MI 5076 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 5076 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI 5076 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI 5076. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 5076 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 5076

How to fill out MI 5076

01

Obtain the MI 5076 form from the appropriate government website or office.

02

Enter your personal information in the designated fields, including your name, address, and contact details.

03

Fill out the sections relevant to your specific situation, carefully following the instructions provided.

04

Review your entries to ensure accuracy and completeness before submitting.

05

Sign and date the form as required.

06

Submit the form either online or by mailing it to the designated office.

Who needs MI 5076?

01

Individuals who are applying for specific government assistance programs or benefits.

02

Those who need to report changes in their circumstances related to a government program.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for principal residence exemption in Michigan?

Complete the Michigan Form 2368 The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit. The affidavit has to be filed with our office on or before June 1st to be applied to the current tax year.

How do I get property tax exemption in Michigan?

Principal Residence Exemption - If you own and occupy your principal residence, it may be exempt from a portion of your local school operating taxes. To claim an exemption, complete the Homeowner's Principal Residence Exemption Affidavit (Form 2368) and file it with your township or city assessor.

What are Michigan special exemptions?

Exemption allowances and the tax rate: $5,000 for personal and dependent exemptions. $2,900 for special exemptions. $400 for qualified disabled veterans.

What is the personal property tax exemption for 2023 in Michigan?

Personal Property Exemption CHANGES FOR 2023 - You may NOW qualify! Taxpayers with less than $80,000 of Personal Property are no longer required to annually file Form 5076 in order to claim the exemption.

What are exemptions to Michigan use tax?

Michigan provides an exemption from sales or use tax on tangible personal property used in tilling, planting, caring for or harvesting things of the soil, in the breeding, raising or caring of livestock poultry or horticultural products for further growth.

How many exemptions should I claim on my Michigan W4?

MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE (Form MI-W4) Your employer is required to notify the Michigan Department of Treasury if you have claimed 10 or more personal or dependency exemptions or claimed that you are exempt from withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI 5076 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing MI 5076 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit MI 5076 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit MI 5076.

How do I complete MI 5076 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MI 5076. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MI 5076?

MI 5076 is a form used in Michigan for reporting certain information related to taxes.

Who is required to file MI 5076?

Individuals and businesses that need to report certain tax information as specified by the Michigan Department of Treasury are required to file MI 5076.

How to fill out MI 5076?

To fill out MI 5076, you need to provide the required tax details, personal information, and any other relevant information as indicated on the form.

What is the purpose of MI 5076?

The purpose of MI 5076 is to facilitate the reporting of specific tax-related information to ensure compliance with Michigan tax laws.

What information must be reported on MI 5076?

Information that must be reported on MI 5076 includes taxpayer identification details, income figures, and any applicable deductions or credits.

Fill out your MI 5076 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 5076 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.