Get the free SHARE PLEDGE AGREEMENT

Show details

This document outlines the agreement between a Shareholder and a Lender regarding the pledge of shares as security for the repayment of a loan.

We are not affiliated with any brand or entity on this form

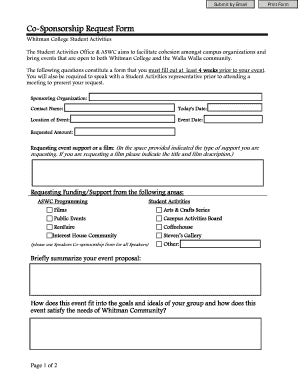

Get, Create, Make and Sign share pledge agreement

Edit your share pledge agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your share pledge agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing share pledge agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit share pledge agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out share pledge agreement

How to fill out SHARE PLEDGE AGREEMENT

01

Begin with the title 'SHARE PLEDGE AGREEMENT'.

02

Identify the parties involved in the agreement (Pledgee and Pledgor).

03

Clearly describe the shares being pledged, including quantity and type.

04

Include the terms of the pledge, outlining the rights and obligations of both parties.

05

Specify any conditions that must be met for the pledge to be enforced.

06

Add a clause detailing the consequences of default.

07

Ensure that the agreement is signed and dated by both parties.

08

Consider having the document witnessed or notarized for legal validity.

Who needs SHARE PLEDGE AGREEMENT?

01

Individuals or entities looking to secure a loan using shares as collateral.

02

Businesses that require financing and want to pledge shares to lenders.

03

Investors wanting to demonstrate commitment to a financial obligation.

04

Parties entering into agreements where collateralization of shares is necessary.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I pledge my shares?

Pledging of shares is when you use the shares that you own as collateral to secure a loan. You can, as a promoter or shareholder pledge your shareholdings with banks or financial institutions to access funds. You can use the borrowed amount for business expansion, repaying debt, and other immediate financial needs.

What are the disadvantages of pledging shares?

Key risks include forced sale by lenders, loss of promoter control, stock price volatility, and negative investor sentiment. Retail shareholders may suffer sharp mark-to-market losses if large pledges are invoked.

What is a share pledge agreement?

Pledging of shares is an arrangement in which the promoters of a company use their shares as collateral to fulfil their financial requirements. While pledging shares, promoters still hold ownership in the company. However, the value of the collateral changes with fluctuations in the market value of the pledged shares.

How to write a pledge agreement?

Know what is required in a pledge agreement: A pledge agreement must include the names of the parties involved, the amount of the loan or security, the terms of repayment, the description and value of the asset that is being pledged, and the date and place of the agreement.

What is a good pledged percentage?

Analysis of Pledge in Indian Stock Market If 15-20% of the promoter shares of a company are pledged, it is important to assess cash flows of the company. If operating cash flows of a company are increasing, it reflects positive sign and the stock is worth investing.

Which is better, MTF or pledge?

Key Takeaways. Margin pledge allows you to use any securities in your demat account as collateral. MTF pledge is only for shares bought using the MTF facility. MTF pledge allows you to keep a lower margin and hold your shares for a longer time.

What is a share pledge agreement in English law?

Under English law a share pledge involves a registered owner of the pledged shares (the Pledgor) delivering possession of the pledged shares to its creditors by way of security.

Is pledging of shares good or bad?

Higher % of pledged shares is considered bad for the company because it raises doubts of promoters interest in the company and hence may not run it efficiently to provide good value. In the event of payment default, lenders have right to sell these shares and recover their money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SHARE PLEDGE AGREEMENT?

A SHARE PLEDGE AGREEMENT is a legal document in which a borrower pledges shares of a company as collateral for a loan, allowing the lender to claim the collateral in case of default.

Who is required to file SHARE PLEDGE AGREEMENT?

Generally, the borrower who is pledging the shares as collateral is required to file the SHARE PLEDGE AGREEMENT, and lending institutions may also need to report it to ensure their security interest.

How to fill out SHARE PLEDGE AGREEMENT?

To fill out a SHARE PLEDGE AGREEMENT, include details such as the names of the pledgor and pledgee, a description of the shares being pledged, the terms of the loan, and signatures from both parties.

What is the purpose of SHARE PLEDGE AGREEMENT?

The purpose of a SHARE PLEDGE AGREEMENT is to secure a loan by using company shares as collateral, thereby protecting the lender's interests in case the borrower fails to repay the loan.

What information must be reported on SHARE PLEDGE AGREEMENT?

The SHARE PLEDGE AGREEMENT must report information such as the names and addresses of the parties involved, details of the shares being pledged (e.g., number and class), loan terms, and conditions under which the lender can enforce their rights.

Fill out your share pledge agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Share Pledge Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.