Get the free OFFERING MEMORANDUM

Show details

This document serves as an Offering Memorandum for a Private Placement, detailing the terms and conditions of the Class 'A' Units being offered for investment in a limited partnership, including risk

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offering memorandum

Edit your offering memorandum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offering memorandum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

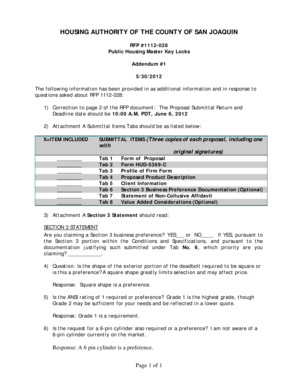

Editing offering memorandum online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit offering memorandum. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offering memorandum

How to fill out OFFERING MEMORANDUM

01

Title Page: Include the title 'Offering Memorandum' and relevant identification information.

02

Executive Summary: Provide a brief overview of the investment opportunity.

03

Investment Highlights: Summarize the key points that make the investment appealing.

04

Company Overview: Describe the company, its mission, and its history.

05

Financial Information: Include past financial performance and projections.

06

Market Analysis: Provide an analysis of the market conditions and competition.

07

Offer Details: Detail the terms of the offering, including pricing and structure.

08

Risk Factors: Identify any potential risks associated with the investment.

09

Legal Information: Include any legal disclaimers and compliance information.

10

Appendices: Attach additional documents or data supporting the memorandum.

Who needs OFFERING MEMORANDUM?

01

Real estate investors seeking opportunities in property investments.

02

Private equity firms looking for investment opportunities in businesses.

03

Investment banks preparing to raise capital for clients.

04

Business owners seeking to attract investors for their company.

05

Financial advisors presenting investment options to clients.

Fill

form

: Try Risk Free

People Also Ask about

What is another name for an offering memorandum?

Offering Memorandum Vs Investor Prospectus These names give the impression of different documents, but in truth, there is no difference between a Private Placement Memorandum (PPM), Offering Memorandum (OM), or an Information Memorandum (IM). All are simply synonyms for the same document.

How to create an om?

Here are 6 indispensable strategies for crafting a winning OM that captivates attention and positions you for success. Hire a professional to design it. Invest in photography. Be clear and concise. Accentuate area amenities. Optimize PDF file size. Include a clear call-to-action.

How do you write an offering memorandum?

An Offering Memorandum should include the following sections: Executive Summary. Company Overview. Business Model and Strategy. Market Analysis. Financial Information. Risk Factors. Management Team. Legal and Regulatory Considerations.

Is an offering memorandum legally binding?

Importance of Issuing an Offering Memorandum The document is legally binding, and its importance goes beyond being a necessary document in the process of investment for both sellers and investors.

What is the difference between offering memorandum and ppm?

Offering Memorandum (OM) Also known as a private placement memorandum (PPM). A document typically used in a private placement offering of securities that provides investors with certain information about the issuer of the securities, its business and the securities being offered.

Who prepares the offering memorandum?

Offering memorandums are usually put together by an investment banker on behalf of the business owners. The banker uses the memorandum to conduct an auction among the specific group of investors to generate interest from qualified buyers.

What is an offering memorandum in M&A?

An Offering Memorandum (“OM”) or Confidential Information Memorandum (“CIM”) is a document that informs interested parties about the details of an investment opportunity, like a private placement of securities or a sale of a company.

How do you write a simple memorandum?

Tips for writing your memo Your memos should be succinct, formal, clear, interesting and easy to read. It should be logically organised, accurate, well-researched and informative. Avoid using technical jargon and abbreviations that the recipient may not understand. Avoid the use of slang, colloquialisms and contractions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OFFERING MEMORANDUM?

An Offering Memorandum (OM) is a legal document that provides details about an investment offering, commonly used in private placements to inform potential investors about the investment opportunity, risks, and terms.

Who is required to file OFFERING MEMORANDUM?

Entities that are raising funds through private placements or offerings that are not registered with the Securities and Exchange Commission (SEC) are typically required to file an Offering Memorandum.

How to fill out OFFERING MEMORANDUM?

To fill out an Offering Memorandum, provide comprehensive information about the investment, including financial statements, business descriptions, management backgrounds, risk factors, and terms of the offering.

What is the purpose of OFFERING MEMORANDUM?

The purpose of an Offering Memorandum is to disclose all pertinent information about an investment opportunity to potential investors, ensuring they make informed decisions while complying with legal requirements.

What information must be reported on OFFERING MEMORANDUM?

The Offering Memorandum must report information such as the business model, use of proceeds, risk factors, financial projections, management qualifications, and any legal disclosures relevant to the offering.

Fill out your offering memorandum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offering Memorandum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.