Strayer University Sample Section 127 Plan free printable template

Show details

SAMPLE SECTION 127 PLAN DOCUMENT

The following document is intended to be a sample Section 127 Plan for assistance to FCA Dealers and

their attorneys in establishing a valid written plan under Section

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign determine the eligibility criteria for participating in the section 127 plan undefined form

Edit your section 127 plan template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your top software for section 127 administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit top digital tools for section 127 plans online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 127. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

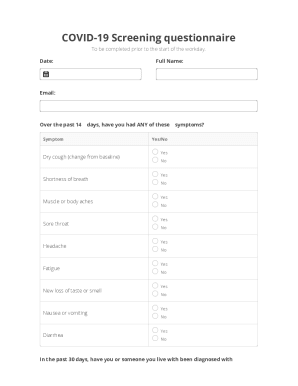

How to fill out section 127 educational assistance program form

How to fill out Strayer University Sample Section 127 Plan Document

01

Begin by gathering all necessary employee information, including names and positions.

02

Determine the eligibility criteria for participating in the Section 127 Plan.

03

Describe the benefits provided under the Section 127 Plan, including educational assistance details.

04

Specify the maximum benefit amount per employee per year.

05

Include any tax implications or compliance information related to the Section 127 Plan.

06

Outline the process for employees to apply for and receive benefits.

07

Ensure you have a method for tracking and reporting on the plan’s usage and effectiveness.

08

Finalize the document for review by relevant stakeholders.

Who needs Strayer University Sample Section 127 Plan Document?

01

Businesses looking to provide educational assistance benefits to their employees.

02

HR departments managing employee benefits and compliance.

03

Organizations aiming to attract and retain talent through educational support.

04

Employees who wish to access tuition reimbursement or other educational benefits.

Fill

how to create a section 127 program

: Try Risk Free

People Also Ask about

Are Section 127 plans subject to Erisa?

Like a §127 program, educational assistance benefits provided under §132 are not employee welfare benefits for the purposes of ERISA. Neither §127 nor §132 provides an exclusion from gross income for educational assistance benefits paid to anyone other than the employee.

Should a company pay for its employees education?

Reimbursing or paying for employees' expenses for work-related education is a great way to add to your employees' skills and knowledge, which they can then apply to help make your business a success. And for employers, the amount paid or reimbursed for an employee's education expenses is a deductible business expense.

How does a Section 127 Plan Work?

Under Section 127 of the Internal Revenue Code (IRC), employers are allowed to provide tax-free payments of up to $5,250 per year to eligible employees for qualified educational expenses. To be considered qualified, payments must be made in ance with an employer's written educational assistance plan.

What is the difference between tuition assistance and tuition reimbursement?

Tuition reimbursement programs are similar to tuition assistance programs in that they allow companies to provide financial support to qualifying employees who choose to go back to school. The primary difference, however, is that tuition reimbursement requires that professionals pay the cost of their tuition initially.

Is paying for employee education tax deductible?

You can deduct the costs of qualifying work-related education as business expenses. This is education that meets at least one of the following two tests: The education is required by your employer or the law to keep your present salary, status or job.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Strayer University Sample Section 127 Plan for eSignature?

Strayer University Sample Section 127 Plan is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out the Strayer University Sample Section 127 Plan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Strayer University Sample Section 127 Plan on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out Strayer University Sample Section 127 Plan on an Android device?

Use the pdfFiller Android app to finish your Strayer University Sample Section 127 Plan and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Strayer University Sample Section 127 Plan Document?

The Strayer University Sample Section 127 Plan Document is a template that outlines the structure and provisions of an employee benefit plan under Section 127 of the Internal Revenue Code, which allows for tax-free educational assistance benefits for employees.

Who is required to file Strayer University Sample Section 127 Plan Document?

Employers who provide educational assistance benefits to their employees and wish to qualify for the tax exclusions under Section 127 are required to file the Strayer University Sample Section 127 Plan Document.

How to fill out Strayer University Sample Section 127 Plan Document?

To fill out the Strayer University Sample Section 127 Plan Document, employers should provide details such as the plan's eligibility requirements, the types of educational assistance offered, the maximum benefit amount, and the procedures for submitting claims.

What is the purpose of Strayer University Sample Section 127 Plan Document?

The purpose of the Strayer University Sample Section 127 Plan Document is to provide a formalized framework for educational assistance benefits, ensuring compliance with tax regulations while promoting employee development and retention.

What information must be reported on Strayer University Sample Section 127 Plan Document?

The information reported on the Strayer University Sample Section 127 Plan Document must include plan details such as eligibility criteria, types of educational assistance, maximum benefit amounts, plan administration procedures, and any applicable disclaimers.

Fill out your Strayer University Sample Section 127 Plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Strayer University Sample Section 127 Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.