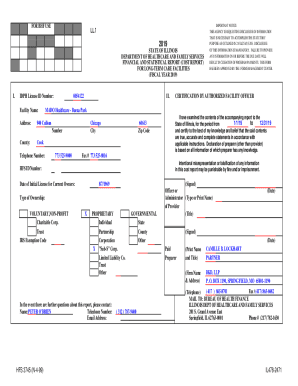

Get the free CD Early Withdrawal

Show details

This form allows members to request an early withdrawal from their Certificate of Deposit (CD) account while acknowledging the associated penalty.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cd early withdrawal

Edit your cd early withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cd early withdrawal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cd early withdrawal online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cd early withdrawal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cd early withdrawal

How to fill out CD Early Withdrawal

01

Obtain the CD Early Withdrawal form from your bank or financial institution.

02

Fill out your personal information, including full name, address, and account number.

03

Specify the amount you wish to withdraw early from the certificate of deposit.

04

Indicate the reason for the early withdrawal, if required by the bank.

05

Review the terms and penalties associated with the early withdrawal.

06

Sign and date the form to authorize the transaction.

07

Submit the completed form to your bank either in person or through their online platform, if available.

Who needs CD Early Withdrawal?

01

Individuals who require immediate access to funds invested in a certificate of deposit.

02

Account holders facing unexpected financial emergencies, such as medical expenses or repair bills.

03

Those who may need to take advantage of a time-sensitive investment opportunity.

04

People who have changed their financial situation and need to reallocate their funds.

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid early withdrawal penalty on CD?

Choose the Right CD Term for Your Needs One way to avoid penalties is by choosing a CD with a term that fits your financial situation. If you think you might need access to your money soon, don't lock it up in a long-term CD. Instead, choose a short-term CD or a more flexible savings option.

What happens if you withdraw from a CD early?

How early withdrawal penalties affect your taxes. If you withdraw money from a CD before it matures, you'll typically pay an early withdrawal penalty. The silver lining is that this penalty can reduce your tax bill. Early withdrawal penalties are tax deductible, even if the penalty exceeds the interest you earned.

What is the penalty for early withdrawal of CDs at Dollar bank?

The penalty for early withdrawal from each certificate will equal the years remaining until maturity (including partial years) multiplied by the principal being withdrawn, multiplied by the difference between the contract rate of the certificate being withdrawn and the rate currently offered on certificates with terms

What happens if I pull my CD early?

The major drawback of withdrawing early from a CD is a penalty imposed by the bank or credit union. The exact CD early withdrawal penalty varies based on the CD's terms. This typically involves forfeiting some or all of the interest earned, and sometimes even a portion of the principal.

What happens if you pull out of a CD?

If you cash out before the CD matures, you'll likely pay an early withdrawal penalty. Early withdrawal penalties are typically calculated in a number of days or months of lost interest gains. Federal law sets a minimum penalty for taking your cash out early.

How much will $10,000 make in a 6 month CD?

Choose the Right CD Term for Your Needs One way to avoid penalties is by choosing a CD with a term that fits your financial situation. If you think you might need access to your money soon, don't lock it up in a long-term CD. Instead, choose a short-term CD or a more flexible savings option.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CD Early Withdrawal?

CD Early Withdrawal refers to the act of taking funds out of a Certificate of Deposit (CD) before the maturity date, typically resulting in penalties or loss of interest.

Who is required to file CD Early Withdrawal?

Individuals who withdraw funds from a CD before its maturity date are required to file CD Early Withdrawal, particularly if there are penalties incurred.

How to fill out CD Early Withdrawal?

To fill out a CD Early Withdrawal, individuals must complete a form provided by their financial institution, detailing their account information, withdrawal amount, and acknowledgment of any penalties.

What is the purpose of CD Early Withdrawal?

The purpose of CD Early Withdrawal is to allow account holders access to their funds in case of emergencies or unexpected expenses, despite certain penalties.

What information must be reported on CD Early Withdrawal?

The information that must be reported includes the account holder's name, account number, amount being withdrawn, reason for the withdrawal, and any penalties being incurred.

Fill out your cd early withdrawal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cd Early Withdrawal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.