Get the free Repurchase of shares

Show details

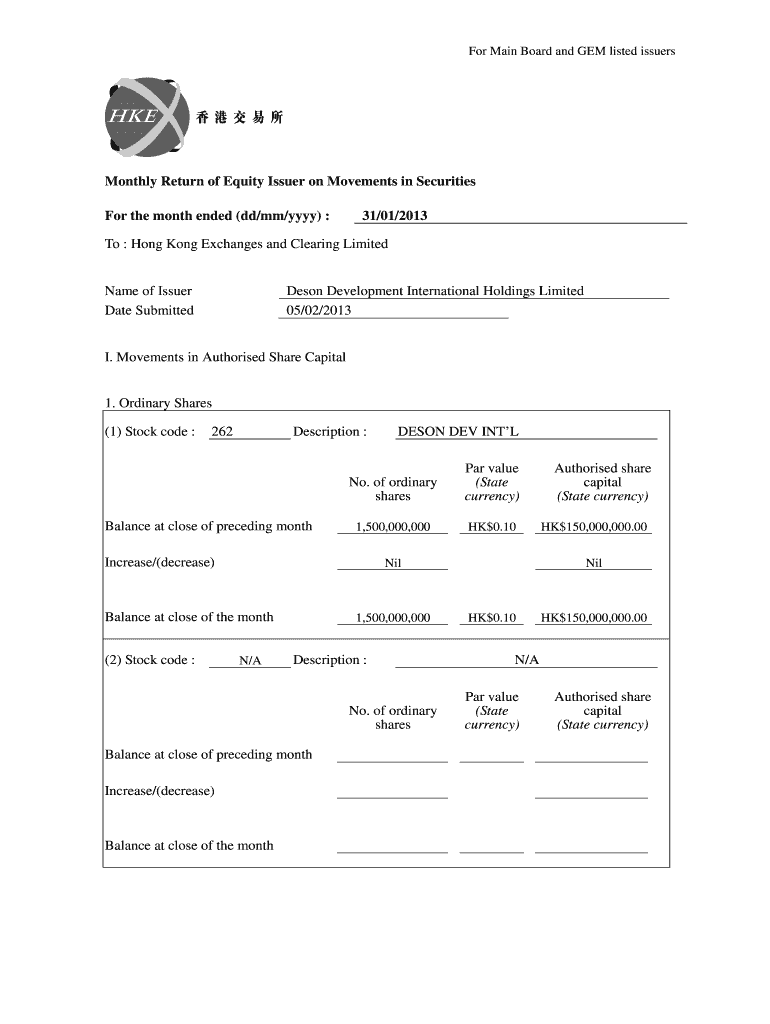

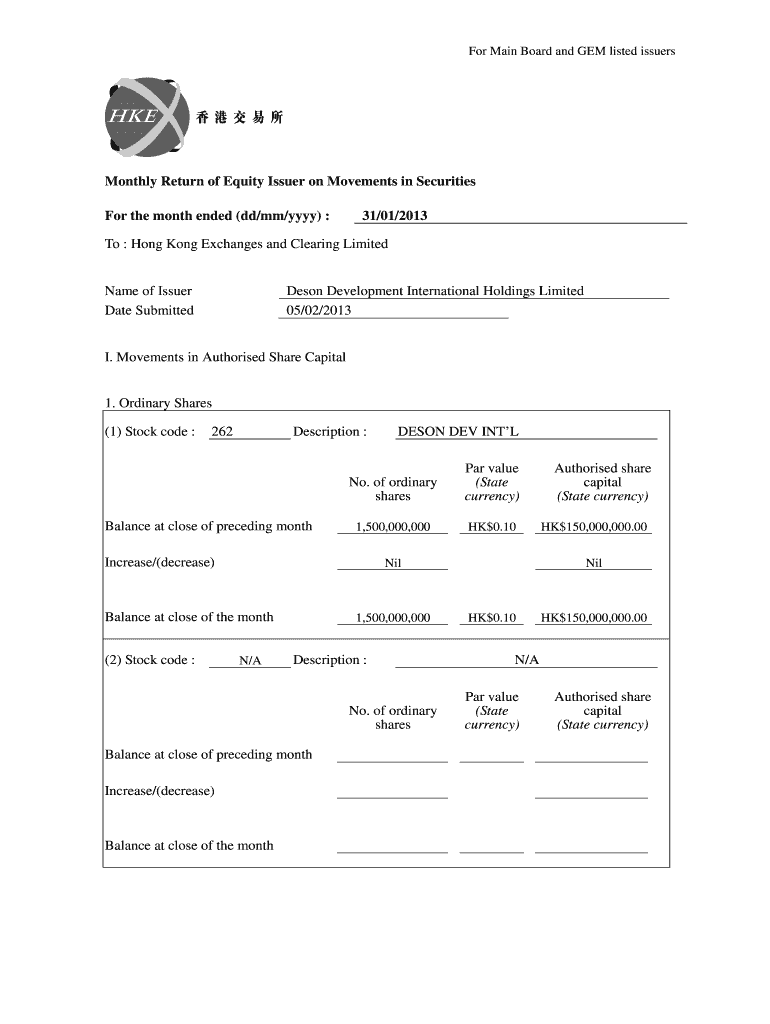

For Main Board and GEM listed issuers Monthly Return of Equity Issuer on Movements in Securities For the month ended (dd×mm/YYY) : 31×01/2013 To : Hong Kong Exchanges and Clearing Limited Name of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign repurchase of shares

Edit your repurchase of shares form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your repurchase of shares form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit repurchase of shares online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit repurchase of shares. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out repurchase of shares

Question:

Write point by point how to fill out repurchase of shares. Who needs repurchase of shares?

01

Understand the Purpose: Repurchase of shares, also known as stock buyback, is a process in which a company buys back its own shares from existing shareholders. Before filling out the necessary paperwork, it is important to understand the reasons behind the repurchase decision and the intended outcome.

02

Review Applicable Laws and Regulations: Familiarize yourself with the applicable laws and regulations governing repurchase of shares in your country or jurisdiction. Different regions may have specific requirements that need to be followed.

03

Consult with Legal and Financial Advisors: It is highly recommended to consult with legal and financial advisors who specialize in securities and corporate law. They can guide you through the legal aspects and ensure compliance with regulations.

04

Prepare the Repurchase Agreement: The repurchase agreement is a legally binding contract that outlines the terms and conditions of the stock buyback. It typically includes details such as the number of shares to be repurchased, the purchase price, the method of payment, and any limitations or restrictions.

05

Obtain Board Approval: In most cases, repurchases of shares require approval from the company's board of directors. Present the proposed repurchase plan to the board and seek their formal approval before proceeding.

06

Communicate with Shareholders: It is essential to inform shareholders about the intention to repurchase shares. Shareholders have the right to know the reasoning behind the repurchase and how it may affect their ownership in the company.

07

Execute the Repurchase: Once all necessary approvals and documentation are in place, proceed with executing the repurchase agreement. This may involve transferring funds to the selling shareholders in exchange for their shares.

08

Update Corporate Records: After the completion of the repurchase, it is important to update the company's corporate records. This includes updating the shareholder registry, adjusting the total number of outstanding shares, and ensuring compliance with reporting requirements.

Who needs repurchase of shares?

01

Companies looking to consolidate ownership: Repurchasing shares is often pursued by companies aiming to reduce the number of shareholders and consolidate ownership. By buying back shares, companies can effectively increase the ownership percentage held by the remaining shareholders.

02

Companies seeking to control stock dilution: If a company has issued stock options or grants as part of an employee compensation plan, repurchasing shares can help to offset the potential dilution effects. By reducing the overall outstanding shares, the company can maintain the value of existing shareholders' ownership.

03

Investors planning to exit: In some cases, existing shareholders may express their desire to sell their shares and exit the company. Repurchasing shares can provide these investors with an opportunity to liquidate their holdings, providing an exit strategy while maintaining control of the company's ownership structure.

04

Companies with excess cash reserves: Repurchasing shares can be a strategic use of excess cash reserves. Instead of retaining these funds or distributing them as dividends, companies can invest in their own stock when they believe it is undervalued. This can potentially increase the value for remaining shareholders.

Remember, it is always advised to consult with legal and financial professionals to ensure that the repurchase of shares is done in compliance with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my repurchase of shares directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your repurchase of shares as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in repurchase of shares?

The editing procedure is simple with pdfFiller. Open your repurchase of shares in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my repurchase of shares in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your repurchase of shares and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is repurchase of shares?

Repurchase of shares is when a company buys back its own shares from the shareholders.

Who is required to file repurchase of shares?

Companies that engage in repurchasing their own shares are required to file repurchase of shares.

How to fill out repurchase of shares?

To fill out repurchase of shares, companies need to provide information such as the number of shares repurchased, the price paid per share, and the total cost of the repurchase.

What is the purpose of repurchase of shares?

The purpose of repurchase of shares can vary, but it is often done to return cash to shareholders, boost the company's stock price, or reduce the number of shares outstanding.

What information must be reported on repurchase of shares?

Companies must report information such as the number of shares repurchased, the price paid per share, and the total cost of the repurchase.

Fill out your repurchase of shares online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Repurchase Of Shares is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.