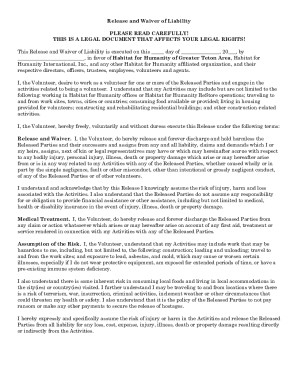

This form is used by an individual contractor in response to a request for a list in writing of all persons who have furnished labor or material, or both, in connection with the building, repair, or alteration of a building.

Get the free Contractor's List--Individual

Show details

A document listing all individuals who have provided labor or materials for a construction project, detailing their names, addresses, and descriptions of services or materials provided, as required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contractors list--individual

Edit your contractors list--individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractors list--individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contractors list--individual

How to fill out Contractor's List--Individual

01

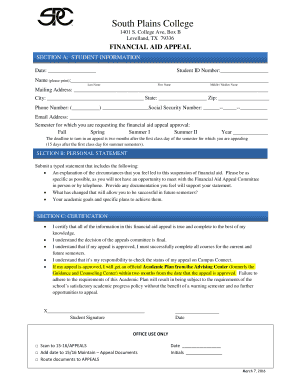

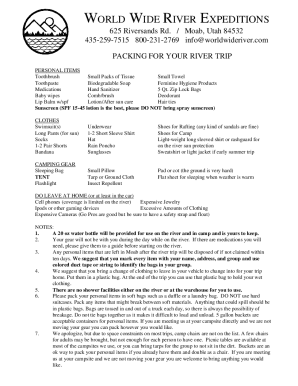

Begin by downloading or obtaining the Contractor's List--Individual form.

02

Fill in your personal details such as your name, address, and contact information at the top of the form.

03

Provide details about your business, including the name, type of services offered, and any relevant licenses or certifications.

04

List the projects you have completed in the past, including the client names, project descriptions, and completion dates.

05

Include references or testimonials from past clients if required or applicable.

06

Review all information for accuracy and completeness.

07

Submit the form as instructed, either online or via postal mail.

Who needs Contractor's List--Individual?

01

Individuals seeking to work as independent contractors in various industries.

02

Contractors who need to register or verify their qualifications for specific projects or jobs.

03

Businesses looking to hire independent contractors and need a list of available candidates.

Fill

form

: Try Risk Free

People Also Ask about

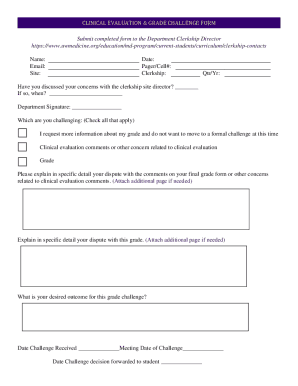

What is the 2 year contractor rule?

The 2 year contractor rule is a provision that limits the amount of time a contractor can work for a company as an independent contractor without being considered an employee. It typically states contractor works company 2 years, may deemed employee legal tax purposes.

How do I write an independent contractor agreement?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

Who writes the independent contractor agreement?

It's important to work with your legal counsel to draft a contractor agreement template that can be easily utilized across your contractor workforce and customized to protect your business from liability when engaging with independent contractors.

Can you write your own contract agreement?

If you're asking whether you need a lawyer to draft a contract, legally, the answer is no. Anyone can draft a contract on their own and as long as the elements above are included and both parties are legally competent and consent to the agreement, it is generally lawful.

What should be included in a contract with a contractor?

The contract should describe, in detail, the products to be used and how the work will be performed, i.e., size, color, who will be doing what work, amounts of materials provided, manufacturer model number, etc. There must be a detailed, written payment schedule in the contract.

How do you structure an independent contractor agreement?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

How do I write a contract for a 1099 employee?

How to draft an effective independent contractor agreement? General information about the parties. Scope of work and deliverables. Compensation and payment terms. Reimbursement policies. Employment benefits and liability exclusion. Termination clause. Indemnification clause. Dispute resolution.

What is independent contractor in English?

The general rule is that an individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

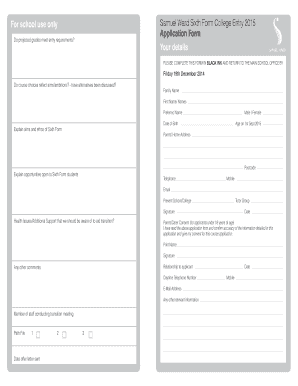

What is Contractor's List--Individual?

The Contractor's List--Individual is a document that lists individuals who are providing services or performing work as contractors for a business or organization.

Who is required to file Contractor's List--Individual?

Businesses or organizations that hire independent contractors or individuals to perform services or work are required to file the Contractor's List--Individual.

How to fill out Contractor's List--Individual?

To fill out the Contractor's List--Individual, provide the names, addresses, and services performed by each contractor. Ensure all required information fields are completed accurately.

What is the purpose of Contractor's List--Individual?

The purpose of the Contractor's List--Individual is to maintain records of contractors for tax compliance and reporting purposes, ensuring that all services provided are accounted for.

What information must be reported on Contractor's List--Individual?

The information that must be reported includes the contractor's name, address, Tax Identification Number (TIN), and a description of the services provided.

Fill out your contractors list--individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contractors List--Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.