Get the free Small Business Payroll Services LLC - bddstaffingbbcomb

Show details

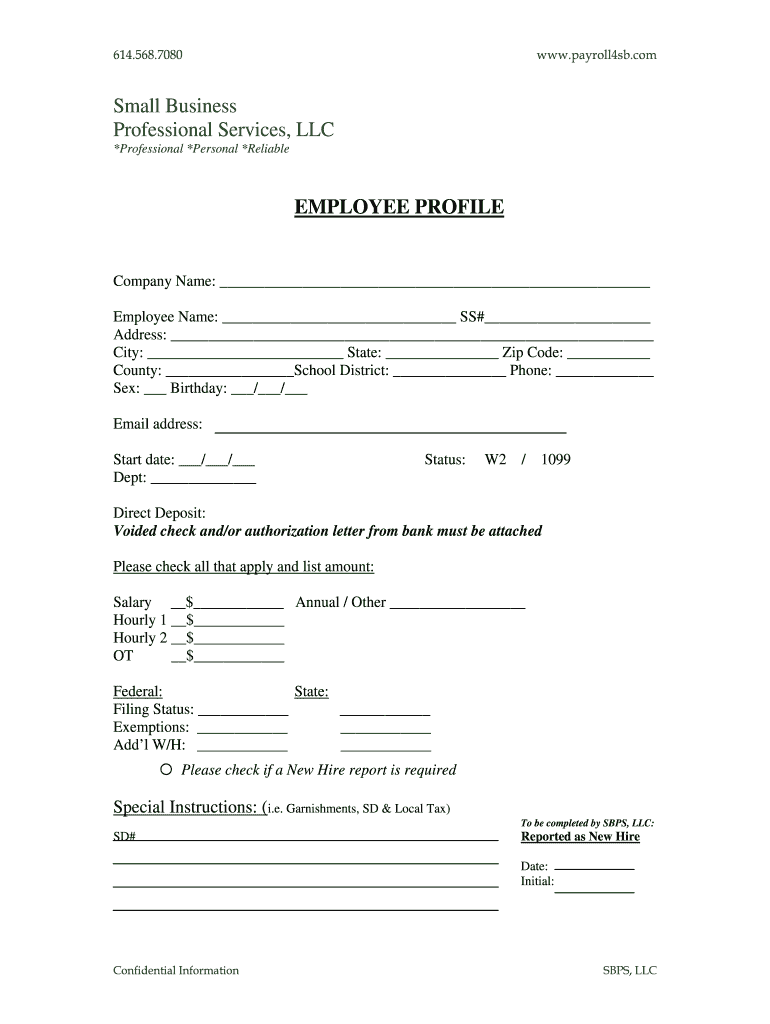

614.568.7080 www.payroll4sb.com Small Business Professional Services, LLC *Professional *Personal *Reliable EMPLOYEE PROFILE Company Name: Employee Name: SS# Address: City: State: Zip Code: County:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business payroll services

Edit your small business payroll services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business payroll services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business payroll services online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small business payroll services. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business payroll services

How to fill out small business payroll services:

01

Collect employee information: Start by gathering the necessary details from your employees, such as their legal names, social security numbers, addresses, tax filing status, and any other relevant information for payroll calculations.

02

Determine pay rates: Set up pay rates for your employees based on their job roles, experience, and any applicable wage laws or employment contracts. This includes regular pay rates, overtime rates, and any commission or bonus structures.

03

Track work hours: Implement a system to track and record the hours worked by your employees. This can be done through a time clock, timesheets, or an online tracking tool. Accurate timekeeping is crucial for calculating payroll accurately.

04

Calculate gross wages: Use the work hours recorded to calculate the gross wages for each employee. Multiply the number of hours worked by their respective pay rates, including any overtime or additional pay.

05

Deduct taxes and withholdings: Determine the required federal, state, and local taxes to withhold from each employee's paycheck. This includes income tax, Social Security and Medicare taxes, and any other applicable deductions like health insurance or retirement contributions.

06

Consider other payroll deductions: Take into account any other voluntary or mandatory deductions, such as garnishments, child support payments, or employee benefits. Ensure that these deductions are properly accounted for when calculating net pay.

07

Calculate net pay: Subtract the applicable tax withholdings and deductions from the gross wages to arrive at the net pay for each employee. This is the amount that will be paid to the employee after all deductions have been taken into account.

08

Issue paychecks or set up direct deposit: Decide on the method of payment for your employees. You can choose to issue physical paychecks or set up direct deposit into their bank accounts. Ensure that you comply with all banking and payment laws when distributing wages.

Who needs small business payroll services?

Small business payroll services are essential for:

01

Business owners with employees: If you have hired employees to help run your small business, payroll services are crucial to ensure accurate and timely payment of wages, as well as proper tax and withholding compliance.

02

Businesses with complex payroll requirements: If your business has unique payroll needs, such as handling multiple pay rates, commissions, or overtime calculations, outsourcing your payroll services can help simplify the process and minimize errors.

03

Businesses looking to save time and reduce administrative burden: Payroll processing can be time-consuming and complex, especially as your business grows. Outsourcing this function to a payroll service provider can free up valuable time and resources, allowing you to focus on other core aspects of your business.

04

Businesses aiming for compliance and avoiding penalties: Payroll regulations and tax laws can be complex and subject to frequent changes. Employing the services of a payroll provider ensures that your payroll processes are compliant with legal requirements, reducing the risk of penalties and fines.

In conclusion, small business payroll services are essential for accurate and efficient payroll processing, compliance with tax and withholding regulations, and minimizing administrative burden for business owners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my small business payroll services in Gmail?

small business payroll services and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my small business payroll services in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your small business payroll services and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out small business payroll services on an Android device?

On Android, use the pdfFiller mobile app to finish your small business payroll services. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is small business payroll services?

Small business payroll services are services provided to help small businesses manage and process their employee payrolls, including calculating wages, deducting taxes, and issuing paychecks or direct deposits.

Who is required to file small business payroll services?

Small businesses with employees are required to file small business payroll services in order to ensure proper payment of wages and compliance with tax laws.

How to fill out small business payroll services?

Small business owners can fill out payroll services by accurately recording employee hours, calculating and deducting taxes, and issuing paychecks or direct deposits to employees.

What is the purpose of small business payroll services?

The purpose of small business payroll services is to ensure accurate and timely payment of wages to employees, as well as compliance with tax laws and regulations.

What information must be reported on small business payroll services?

Information that must be reported on small business payroll services includes employee wages, hours worked, tax deductions, and any additional withholdings or benefits.

Fill out your small business payroll services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Payroll Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.