Get the free borrowers form

Show details

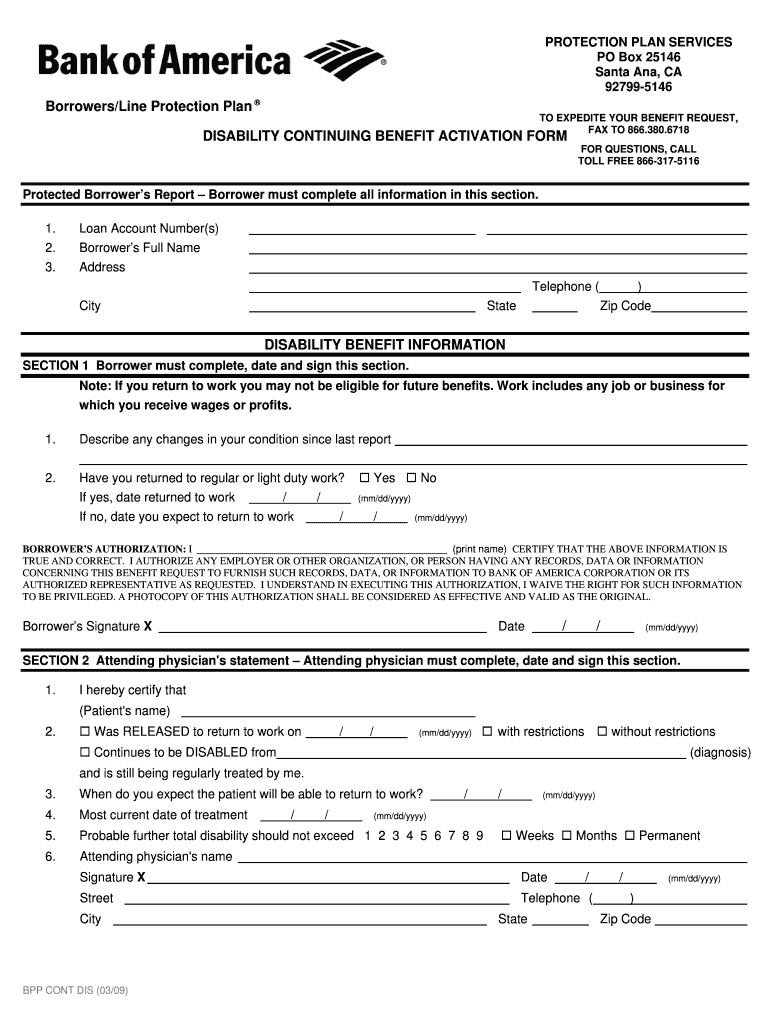

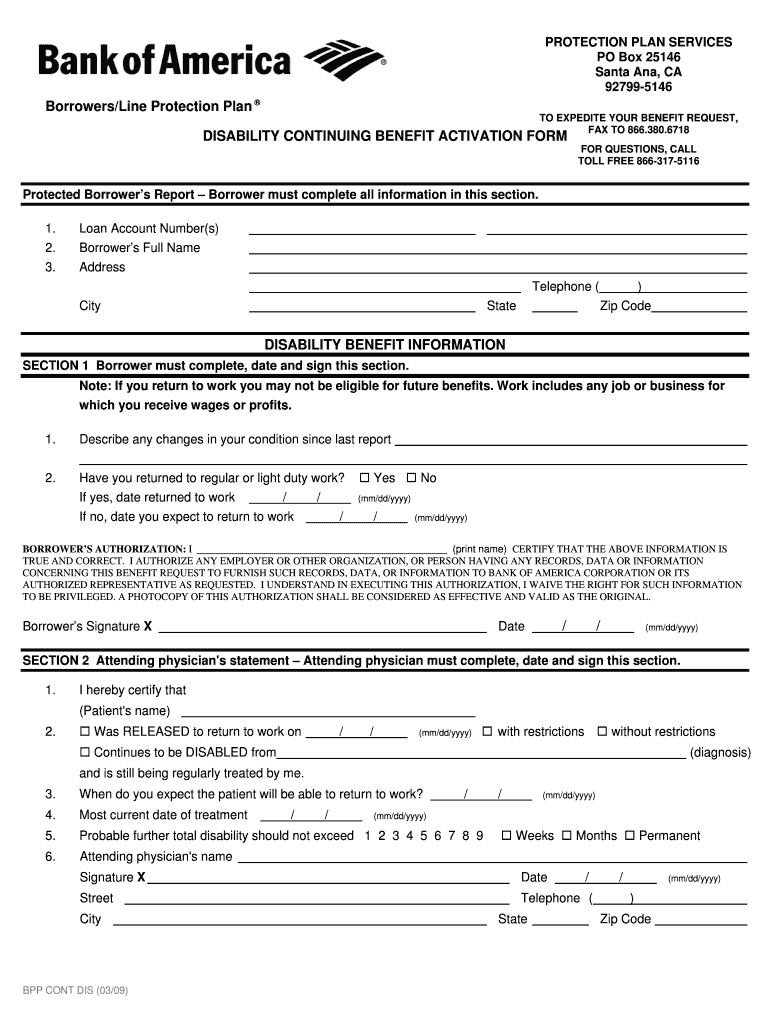

PROTECTION PLAN SERVICES PO Box 25146 Santa Ana, CA 92799-5146 Borrowers/Line Protection Plan DISABILITY CONTINUING BENEFIT ACTIVATION FORM TO EXPEDITE YOUR BENEFIT REQUEST, FAX TO 866.380.6718 FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign borrowers form

Edit your borrowers form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrowers form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit borrowers form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit borrowers form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrowers form

To fill out the description of borrowers form, follow these steps:

01

Start by providing accurate and detailed information about the borrower, including their full name, contact details, and any relevant identification numbers.

02

Describe the purpose of the loan or borrowing, specifying the amount, duration, and any specific terms or conditions. Include any supporting documents or evidence that may be required.

03

Include information about the borrower's current financial situation, such as their income, employment status, and any existing debts or liabilities. Provide documentation or proof to support these details if necessary.

04

Outline the borrower's credit history, including any previous loans, defaults, or bankruptcies. Mention any positive factors that may strengthen the borrower's credibility, such as a good repayment track record.

05

Clearly state the borrower's intentions and plans for utilizing the borrowed funds. Be specific and concise in explaining how the money will be used and how it will benefit the borrower's financial situation.

06

Lastly, provide any additional relevant information or documentation that may be required by the lender or institution processing the form. This could include references, collateral details, or any other supporting evidence.

Who needs description of borrowers form?

01

Individuals or businesses seeking to obtain a loan or credit facility from a financial institution or lender.

02

Loan officers, credit analysts, or underwriters who evaluate loan applications and assess the creditworthiness of borrowers.

03

Regulatory authorities or auditors who review loan files to ensure compliance with legal and regulatory requirements.

04

Third-party entities involved in credit scoring or risk assessment processes, such as credit bureaus or credit rating agencies.

05

Any other stakeholders who require a thorough understanding of the borrower's financial situation and borrowing needs, such as investors or business partners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my borrowers form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your borrowers form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send borrowers form to be eSigned by others?

To distribute your borrowers form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get borrowers form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the borrowers form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is borrowers form?

The borrowers form is a document used to collect specific information from individuals or entities seeking to borrow funds. It typically includes details about the borrower's financial status, credit history, and the purpose of the loan.

Who is required to file borrowers form?

Individuals or entities applying for a loan or credit from financial institutions are required to file the borrowers form as part of the loan application process.

How to fill out borrowers form?

To fill out the borrowers form, applicants need to provide accurate and complete information regarding their personal details, financial history, and the specifics of the loan they are requesting. It is important to read all instructions carefully and ensure that all required fields are filled.

What is the purpose of borrowers form?

The purpose of the borrowers form is to assess the creditworthiness of the applicant, determine the risks involved in lending, and ensure that the lender has all the necessary information to make an informed decision about the loan.

What information must be reported on borrowers form?

The information that must be reported on the borrowers form typically includes personal identification information, employment details, income sources, existing debts, credit history, and details regarding the asset being financed or the purpose of the loan.

Fill out your borrowers form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Borrowers Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.