Get the free tata mutual fund pan updation form

Show details

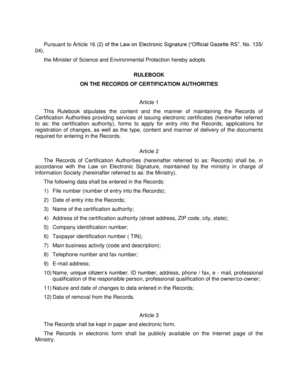

EMAIL Update FORM Investor Manager: Tata Asset Management Ltd. Trustee : Tata Trustee Company Pvt. Ltd. Investor Services at : Mull House, Gr. Floor, M. G. Road, Fort, Mumbai 400 001. Tel.: 1800-209-0101

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tata mutual fund pan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tata mutual fund pan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tata mutual fund pan updation form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tata mf pan updation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out tata mutual fund pan

How to fill out tata mutual fund pan:

01

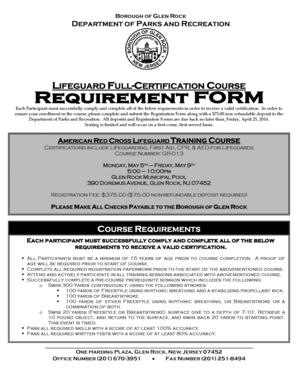

Obtain the Pan card application form from the nearest Tata Mutual Fund branch or download it from their official website.

02

Fill in all the required personal details such as name, date of birth, address, and contact information accurately.

03

Provide your Aadhaar or other acceptable identity and address proof documents along with the application form.

04

Attach a recent passport size photograph with the application form.

05

Verify all the information provided and sign the form along with the date.

06

Submit the filled application form along with the necessary documents at the Tata Mutual Fund branch or send it through post/courier to the designated address.

Who needs tata mutual fund pan:

01

Individuals who are interested in investing in Tata Mutual Fund schemes and want to gain potential returns on their investments.

02

Anyone above the age of 18 who is an Indian resident or NRIs/OCBs who fulfill the necessary requirements can apply for a Tata Mutual Fund PAN.

03

Investors who want to avail tax benefits under various sections of the Income Tax Act by investing in mutual funds through the PAN card.

04

Individuals looking for a diversified investment option to achieve their financial goals in the long term can consider Tata Mutual Fund schemes.

Fill tata mutual fund email id updation online : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tata mutual fund pan?

Tata Mutual Fund PAN is AAATT1607G.

Who is required to file tata mutual fund pan?

Individuals are required to file Tata Mutual Fund PAN if they want to invest in Tata Mutual Fund.

What is the purpose of tata mutual fund pan?

The purpose of the Tata Mutual Fund PAN is to provide an identification number to mutual fund investors so that the investments and transactions they make can be tracked and monitored by the mutual fund company and the government.

How to fill out tata mutual fund pan?

1. Go to the official website of Tata Mutual Fund.

2. Click on ‘Register’ on the top right corner of the page.

3. Select the option ‘New Investor’.

4. Enter the required details such as Name, Date of Birth, Email, Mobile Number, PAN Number.

5. Select your KYC status.

6. Enter the Aadhar Card number and other relevant details as asked.

7. Upload the PAN card and other documents as asked.

8. Submit the form and you will receive an OTP on your registered mobile number.

9. Enter the OTP and click on ‘Submit’.

Your PAN will be successfully registered with Tata Mutual Fund.

What information must be reported on tata mutual fund pan?

The following information must be reported on a Tata Mutual Fund PAN (Permanent Account Number) form:

1. Personal details of the investor: This includes the name, date of birth, gender, address, phone number, email address, and occupation.

2. PAN details: The PAN number of the investor needs to be mentioned in the form.

3. Bank account details: The investor should provide the bank account number, type of account (savings/current), bank branch name and address, and IFSC code.

4. Investment details: The form will require the investment details like the scheme name, scheme type, purchase amount, and investment mode (lump sum or SIP).

5. Nominee details: The investor will have to provide the name, date of birth, relationship with the nominee, and address of the nominee.

6. FATCA/CRS details: The form will contain a section for reporting Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) information, which includes details about the investor's foreign tax residency status.

7. Financial transaction details: Any financial transaction details like total investment amount, mode of payment, and any existing folio details may also need to be reported.

It is important to note that the specific details required on a Tata Mutual Fund PAN form may vary based on the requirements of the fund house and regulatory guidelines.

What is the penalty for the late filing of tata mutual fund pan?

There is no specific penalty mentioned for the late filing of Tata Mutual Fund PAN. However, it is important to note that PAN (Permanent Account Number) is required for investing in mutual funds in India. Failure to provide a valid PAN may result in rejection of the investment application or non-allocation of units.

Additionally, late filing of income tax returns (ITR) can lead to penalties and consequences as per the Income Tax Act, 1961. It is advisable to file the necessary documents, including PAN, within the given deadlines to avoid any potential penalties.

How can I edit tata mutual fund pan updation form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tata mf pan updation form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get tata mutual fund data updation form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tata mutual fund pan updation online in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit tata mutual fund email id updation form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tata mf contact details updation form.

Fill out your tata mutual fund pan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tata Mutual Fund Data Updation Form is not the form you're looking for?Search for another form here.

Keywords relevant to tata mutual fund pan kyc updation form

Related to tata mutual fund contact details updation form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.