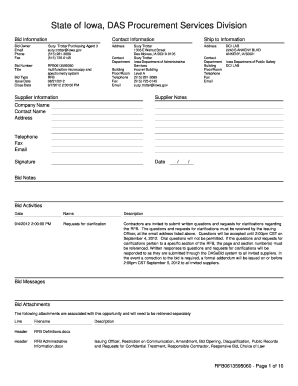

Get the free RENEWABLE ENERGY TAX CREDIT, - legis iowa

Show details

1 RENEWABLE ENERGY TAX CREDIT, ?476C.6 476C.6 Transferability and use of tax credit certificates ? Registration. 1. a. Renewable energy tax credit certificates issued under this chapter may be transferred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign renewable energy tax credit

Edit your renewable energy tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your renewable energy tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing renewable energy tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit renewable energy tax credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out renewable energy tax credit

How to fill out renewable energy tax credit:

01

Gather the necessary documentation: Before filling out the renewable energy tax credit, you will need to gather relevant documents such as receipts, invoices, and forms that prove your investment in renewable energy sources.

02

Determine your eligibility: Make sure you are eligible for the tax credit by reviewing the requirements set by the government or tax authorities. You may need to meet specific criteria related to the type of renewable energy system you have installed or the amount of energy generated.

03

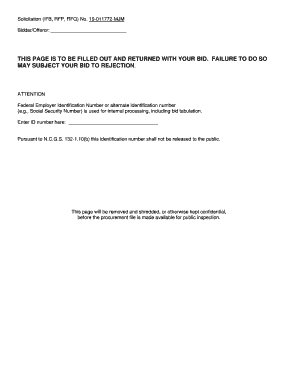

Obtain the appropriate form: Check the official website of the tax authority in your country to find the specific form required for claiming the renewable energy tax credit. Download or request a physical copy of the form.

04

Fill out the form accurately: Carefully fill out all the sections of the form with accurate and updated information. Double-check your entries for any errors or missing details that could delay or invalidate your claim.

05

Include all necessary supporting documents: Attach all the relevant supporting documents, such as receipts, invoices, and proof of purchase, to your completed form. Make sure to organize them in a clear and logical order.

06

Review and submit your application: Before submitting your application, review it one more time to ensure that all the information provided is complete and accurate. Consider making copies of your application and supporting documents for your records.

07

File your claim: Submit your completed application, along with the supporting documents, to the designated tax authority. Follow the instructions provided on where and how to file your claim to ensure it is processed in a timely manner.

08

Keep a record: Maintain a copy of your filed application, along with all the supporting documents, for future reference or in case of any inquiries or audits from the tax authority.

09

Await confirmation and payment: After submitting your claim, await confirmation from the tax authority regarding the acceptance and processing of your application. Once approved, you may be eligible for a tax credit or refund related to your renewable energy investment.

Who needs renewable energy tax credit:

01

Homeowners: Homeowners who have invested in renewable energy systems, such as solar panels or wind turbines, may be eligible for the renewable energy tax credit.

02

Businesses: Businesses that have integrated renewable energy sources into their operations, such as commercial solar installations or geothermal heating and cooling systems, may qualify for the tax credit.

03

Investors: Individuals or organizations that have financed the development of renewable energy projects, such as solar or wind farms, may also be eligible for the tax credit.

04

Developers and contractors: Professionals involved in the design, installation, or maintenance of renewable energy systems may benefit from the tax credit as a way to incentivize and promote the adoption of clean energy technologies.

05

Individuals and organizations seeking energy efficiency: In some cases, energy-efficient improvements or upgrades, such as energy-efficient windows or insulation, may also qualify for a tax credit if they contribute to overall renewable energy goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

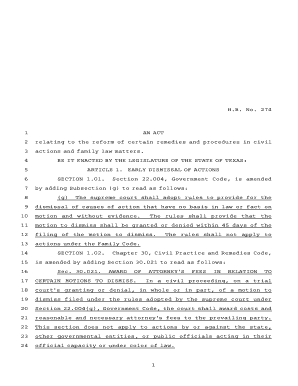

What is renewable energy tax credit?

Renewable energy tax credit is a federal tax credit provided to individuals or businesses that invest in renewable energy sources such as solar, wind, geothermal, or biomass. The credit helps offset the costs of installing and using renewable energy systems.

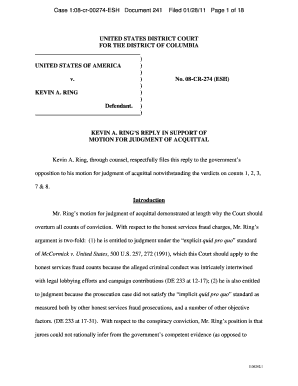

Who is required to file renewable energy tax credit?

Any individual or business that has made qualified expenditures for renewable energy systems and meets other eligibility criteria specified by the government is required to file for the renewable energy tax credit.

How to fill out renewable energy tax credit?

To fill out renewable energy tax credit, individuals or businesses need to complete Form 5695 and attach it to their tax return. They must provide information about the qualified expenditures made for renewable energy systems.

What is the purpose of renewable energy tax credit?

The purpose of renewable energy tax credit is to incentivize individuals and businesses to invest in renewable energy sources and promote the use of clean and sustainable energy.

What information must be reported on renewable energy tax credit?

On the renewable energy tax credit form, individuals or businesses must report the qualified expenditures made for renewable energy systems, including the type and cost of the system, date of installation, and any other relevant information specified by the government.

How can I modify renewable energy tax credit without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your renewable energy tax credit into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send renewable energy tax credit to be eSigned by others?

When you're ready to share your renewable energy tax credit, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit renewable energy tax credit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share renewable energy tax credit from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your renewable energy tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renewable Energy Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.