Get the free Monthly Money Management Worksheet

Show details

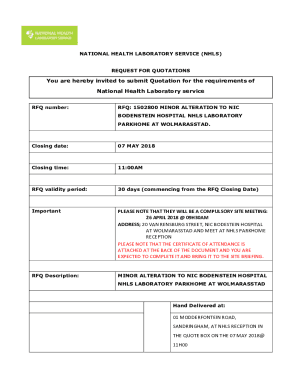

PROB 48J (Rev. 07×13) MONTHLY MONEY MANAGEMENT WORKSHEET CASH INFLOWS Your Wages (Pay Dates) Spouses Wages (Pay Dates) Other Cash Inflows Other Cash Inflows (1) TOTAL CASH INFLOWS CASH OUTFLOWS FIXED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monthly money management worksheet

Edit your monthly money management worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monthly money management worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit monthly money management worksheet online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit monthly money management worksheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monthly money management worksheet

01

Start by gathering all of your financial documents, such as bank statements, credit card statements, and bills.

02

Create categories for your income and expenses on the worksheet. Common categories include income, housing expenses, transportation expenses, food expenses, debt payments, and miscellaneous expenses.

03

Begin by entering your income for the month in the appropriate section. This can include your salary, any side hustle income, or any other sources of income.

04

Next, list all of your monthly expenses in their respective categories. This can include rent or mortgage payments, utility bills, transportation costs, groceries, dining out expenses, entertainment expenses, and any other regular payments.

05

Make sure to include both fixed expenses, such as rent or insurance payments, as well as variable expenses, such as utility bills or discretionary spending.

06

If you have any debts, make sure to also include the minimum payment amounts in the debt payments category.

07

Once you have listed all of your income and expenses, calculate the total for each category and the overall total. This will give you a comprehensive view of your monthly cash flow.

08

Analyze your financial situation by comparing your income to your expenses. Are you spending more than you earn? Do you have any areas where you can cut back on expenses? This analysis will help you identify any problem areas and make adjustments to your budget.

09

Make a plan for any surplus or deficit in your budget. If you have extra money left over, consider saving it or investing it for the future. If you have a deficit, brainstorm ways to reduce expenses or increase income.

10

Regularly update your monthly money management worksheet to reflect any changes in your income or expenses. This will help you stay on top of your finances and make informed decisions about your financial goals.

Who needs a monthly money management worksheet?

01

Individuals or households looking to track their income and expenses in a systematic manner.

02

People with variable income who want to have a clear understanding of their monthly cash flow.

03

Individuals or families who want to create a budget and track their progress towards financial goals.

04

Those seeking to identify areas where they can cut back on expenses and save more money.

05

People with debt who need to track their debt payments and make a plan for paying off their debts.

06

Individuals preparing for major life events, such as buying a house, starting a family, or retiring, who need to assess their financial readiness.

07

Those who want to have a better understanding of their spending habits and make more informed financial decisions.

Remember, a monthly money management worksheet can be a valuable tool in helping you gain control over your finances and work towards your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my monthly money management worksheet directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your monthly money management worksheet and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit monthly money management worksheet on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing monthly money management worksheet right away.

How can I fill out monthly money management worksheet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your monthly money management worksheet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is monthly money management worksheet?

The monthly money management worksheet is a tool used to track and monitor your income, expenses, and savings on a monthly basis.

Who is required to file monthly money management worksheet?

Individuals who want to track their finances and manage their money more effectively are encouraged to use a monthly money management worksheet.

How to fill out monthly money management worksheet?

To fill out the monthly money management worksheet, you will need to record all sources of income, track expenses, and calculate your savings for the month.

What is the purpose of monthly money management worksheet?

The purpose of the monthly money management worksheet is to help individuals gain insight into their financial situation, make informed decisions, and work towards financial goals.

What information must be reported on monthly money management worksheet?

The monthly money management worksheet typically includes sections for income sources, fixed expenses, variable expenses, savings contributions, and financial goals.

Fill out your monthly money management worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monthly Money Management Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.