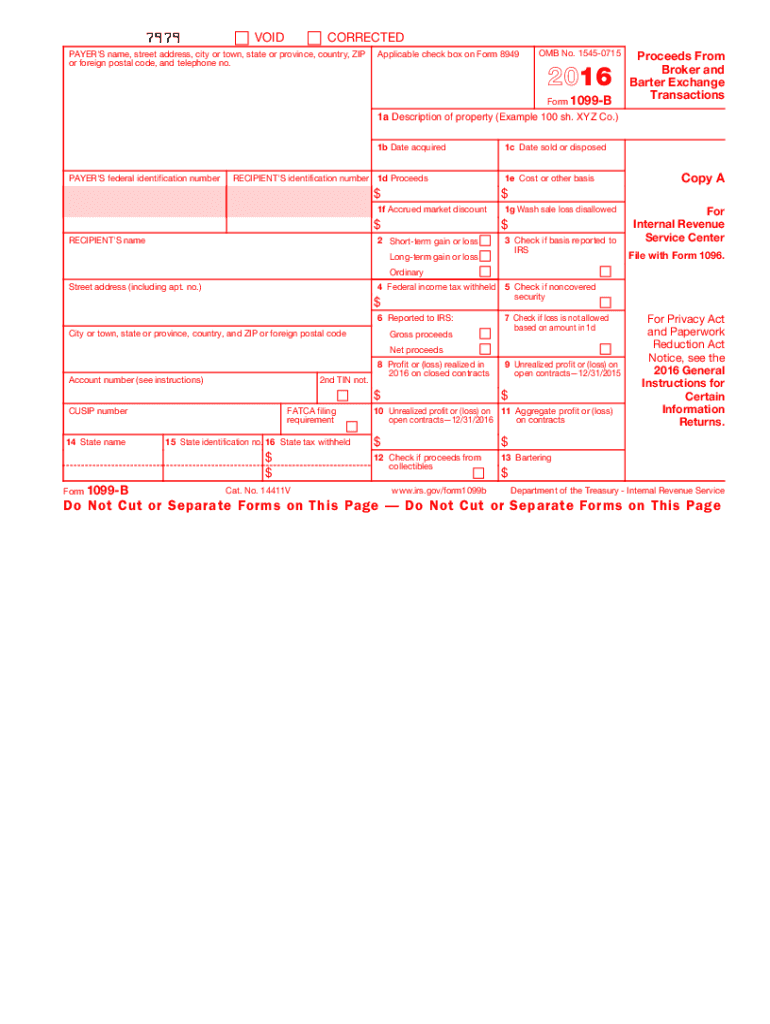

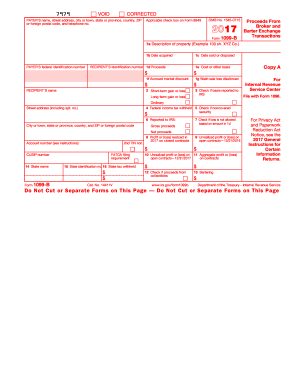

What is form 1099-B?

Form 1099 B, Proceeds from Broker and Barter Exchange Transactions, is an IRS form that brokers and barter exchanges must file for every person:

- To whom they sold assets for cash

- Who earned money, stocks, or equivalent property from a corporation that has had its stock acquired in an acquisition of control or had a substantial change in capital structure

- Who exchanged assets or services through a barter exchange.

Who should file 1099-B?

Brokers and barter exchanges file the form to report profits from transactions to the IRS and you (for tax filing purposes). It is filed for each transaction separately (except for regulated futures, foreign currency, or Section 1256 option contracts filed on an aggregate basis). Individuals must take into account 1099-B when filing their tax returns.

How do I report 1099 B on my taxes?

Report the capital gains or losses from form 1099-B on Schedule D and/or form 8949. Both forms have a section to provide totals of all short-term transactions reported on the 1099 B form. You must report the total amount of the proceeds, as well as your basis (what was paid for securities plus brokerage fees or other transaction costs). You must specify the total gain or loss in your tax return.

Is form 1099-B accompanied by other forms?

Form 1099 B consists of several similar copies. Here are instructions for each copy that must be filed:

- Submit Copy A with form 1096;

- File Copy B with the recipient’s state income tax return.

As for the rest of the form’s pages, there is no need to accompany them with other documents.

When is form 1099-B due?

Similar to the required attachments, the due dates of all copies vary depending on their recipients. Here are some guidelines as to when each document should be filed:

Hard Copy A must be directed to the IRS before February 28. If the payer files taxes electronically, then the deadline for Copy A submission is March 31.

Copy B of IRS form 1099 B must be sent to the recipient before February 15.

Other copies must be submitted as required.

Where do I send form 1099-B?

The recipient of each copy of the Proceeds From Broker and Barter Exchange Transactions form is indicated on each form’s page in the box on the right.