Get the free CUSTOMER CREDIT APPLICATION - btrinityb-busabbnetb - trinity-usa

Show details

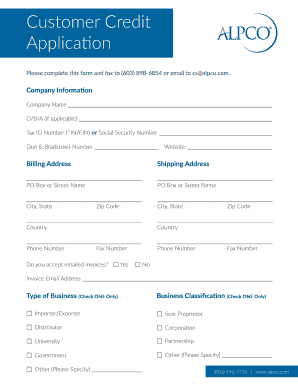

CUSTOMER CREDIT APPLICATION Date Credit Fax: 8008598149 Credit email: credit apps bsnsports.com ACCOUNT BILLING INFORMATION: PERSON TO CONTACT FOR QUESTIONS REGARDING THIS INFORMATION ACCOUNT NAME:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer credit application

Edit your customer credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer credit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customer credit application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer credit application

Who needs customer credit application?

01

Any business or organization that extends credit to its customers may need a customer credit application. This can include retailers, financial institutions, service providers, and wholesalers.

02

Customer credit applications are commonly used in industries such as retail, automotive, banking, and telecommunications.

03

It is important for businesses to have a customer credit application process in place to assess the creditworthiness of potential customers, protect against fraud, and manage risk.

How to fill out a customer credit application:

01

Start by obtaining a copy of the customer credit application form from the business or organization extending credit. This form is usually available in physical or digital format.

02

Provide accurate and complete personal information such as your full name, contact details, and address. It is important to ensure that the information provided matches your legal identification documents.

03

Fill out the employment and income section, providing details about your current job or business. This may include your job title, employer's details, salary, and length of employment.

04

Provide information about your financial history, including any outstanding debts, loans, mortgages, or credit cards. Be truthful and transparent about your financial obligations.

05

Some credit applications may require you to provide references. These references can be individuals who can vouch for your character, financial responsibility, or previous credit history.

06

Review the terms and conditions carefully before signing the customer credit application. Ensure that you understand the credit terms, interest rates, and any fees associated with the credit facility you are applying for.

07

Attach any supporting documentation that may be required, such as proof of identification, income statements, bank statements, or tax returns. Make sure to include only copies and keep the original documents for your records.

08

Once you have completed the customer credit application form and attached any supporting documents, submit it to the business or organization as instructed. This can be done in person, by mail, or through an online application portal.

09

After submitting the credit application, it is common practice for the business or organization to conduct a credit check or verification process. This may include reviewing your credit history, income verification, and contacting your references.

10

Finally, wait for the business or organization to evaluate your credit application and provide a response. This can take anywhere from a few days to a couple of weeks, depending on the complexity of the application and the internal processes of the company.

Remember, it is essential to provide accurate and truthful information on the customer credit application. Any misrepresentation of facts or failure to disclose relevant information may result in the denial of credit or potential legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the customer credit application in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your customer credit application directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit customer credit application straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing customer credit application.

How do I fill out customer credit application using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign customer credit application and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is customer credit application?

Customer credit application is a form filled out by individuals or businesses seeking to apply for credit from a company.

Who is required to file customer credit application?

Any individual or business seeking to apply for credit from a company is required to file a customer credit application.

How to fill out customer credit application?

To fill out a customer credit application, individuals or businesses must provide personal and financial information, such as name, address, income, and employment information.

What is the purpose of customer credit application?

The purpose of a customer credit application is for companies to assess the creditworthiness of individuals or businesses seeking credit.

What information must be reported on customer credit application?

Information such as personal details, financial information, employment history, and references must be reported on a customer credit application.

Fill out your customer credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.