IRS 8959 2013 free printable template

Show details

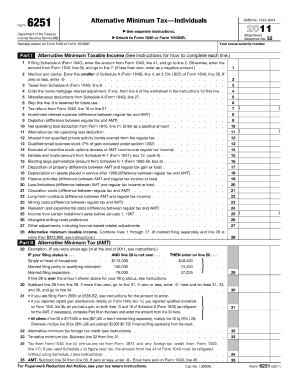

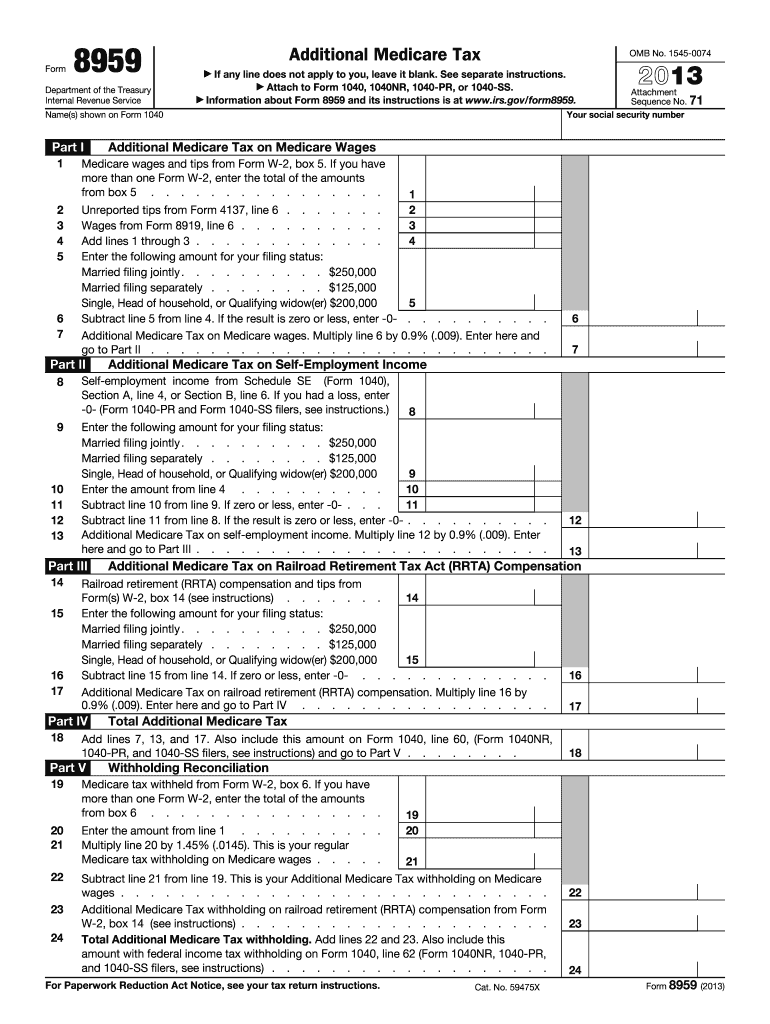

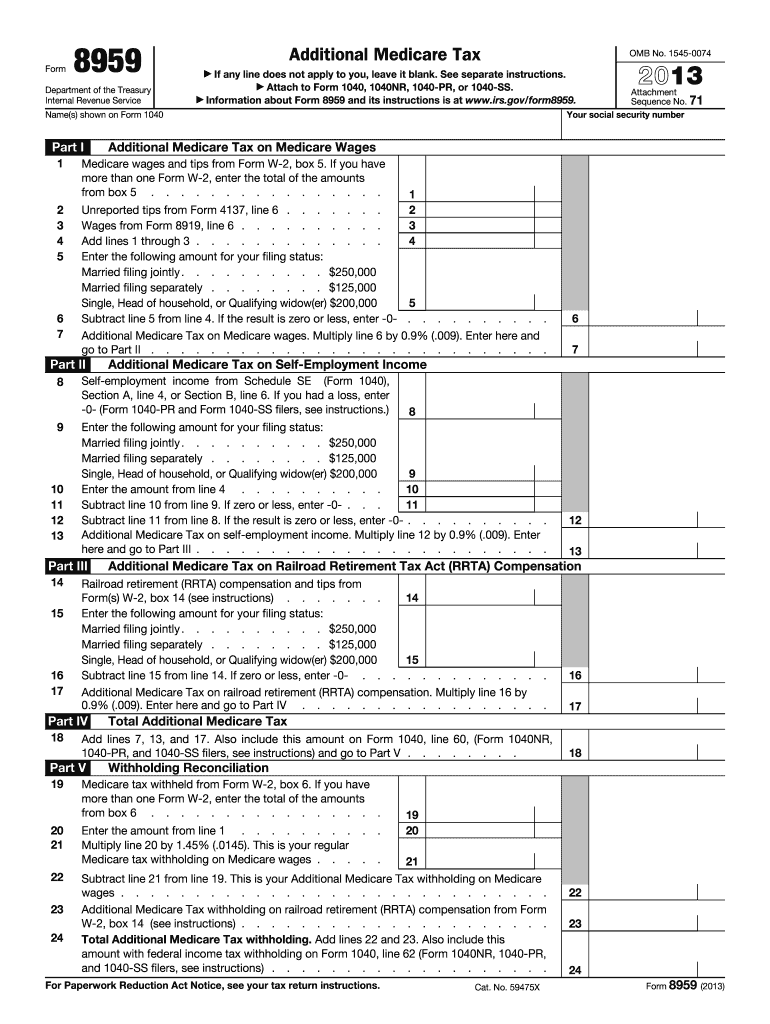

Form 8959 Department of the Treasury Internal Revenue Service Additional Medicare Tax OMB No. 1545-0074 If any line does not apply to you, leave it blank. See separate instructions. ? Attach to Form

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8959

Edit your IRS 8959 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8959 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8959 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 8959. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8959 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8959

How to fill out IRS 8959

01

Obtain IRS Form 8959 from the IRS website or your tax software.

02

Fill in your name and Social Security number at the top of the form.

03

Review your income sources to determine if you are required to pay Additional Medicare Tax.

04

Input your wages, compensation, and self-employment income on line 1.

05

Calculate the total based on the thresholds (over $200,000 for single filers, $250,000 for married filing jointly) and input it on line 2.

06

Calculate the Additional Medicare Tax by applying the 0.9% rate on the excess amount over the threshold on line 3.

07

Total the Additional Medicare Tax on line 4 and ensure your calculations are correct.

08

Attach Form 8959 to your tax return when filing.

Who needs IRS 8959?

01

Individuals with wages or self-employment income exceeding the threshold amounts.

02

High-income earners who are subject to the Additional Medicare Tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the filing requirement for Form 8959?

You should file form 8959 if one or more conditions are met as follows: Medicare wages and tips are greater than $200,000. Retirement income (RRTA) compensation is greater than $200,000. Medicare wages, tips, and self-employment income are greater than threshold amount for your filing status (see table below).

What is the additional Medicare tax 2013?

As of 2013, the IRS requires higher-earning taxpayers to pay more into Medicare. The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages.

Who needs to file form 8959?

The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-2 income, the tax will most likely be withheld from your wages. Either way, anyone subject to the tax is required to file Form 8959 with their annual income tax filing.

What is a 8959 form used for?

Purpose of Form Use Form 8959 to figure the amount of Additional Medicare Tax you owe and the amount of Additional Medicare Tax withheld by your employer, if any. You will carry the amounts to one of the following returns.

Why do I have additional Medicare tax form 8959?

Therefore, even if your employer withheld the 0.9% Additional Medicare Tax from your wages or compensation above the $200,000 withholding threshold, you must file Form 8959, Additional Medicare Tax, to ensure that you are reporting and paying the correct amount.

What is the additional Medicare tax threshold for 2013?

Beginning in 2013, the employee portion of the Medicare tax is increased from 1.45% to 2.35% on wages received in a calendar year in excess of $200,000 ($250,000 for married couples filing jointly; $125,000 for married filing separately) (Sec.

Why would I have to pay additional Medicare tax?

Wages, RRTA Compensation, and Self-Employment Income An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8959 for eSignature?

Once you are ready to share your IRS 8959, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit IRS 8959 online?

The editing procedure is simple with pdfFiller. Open your IRS 8959 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete IRS 8959 on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 8959. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 8959?

IRS Form 8959 is used to report Additional Medicare Tax for individuals with wages, compensation, or self-employment income over a certain threshold.

Who is required to file IRS 8959?

Individuals with wages, compensation, or self-employment income exceeding the threshold for Additional Medicare Tax, which is $200,000 for single filers and $250,000 for married couples filing jointly, are required to file IRS Form 8959.

How to fill out IRS 8959?

To fill out IRS Form 8959, you need to report your total wages and self-employment income and calculate the Additional Medicare Tax owed based on the income exceeding the threshold. The form must then be submitted along with your income tax return.

What is the purpose of IRS 8959?

The purpose of IRS Form 8959 is to calculate and report the Additional Medicare Tax imposed on higher-income individuals, ensuring that the appropriate amount is collected for Medicare.

What information must be reported on IRS 8959?

IRS Form 8959 requires reporting total wages, compensation, self-employment income, and the amount of Additional Medicare Tax due based on income over the established thresholds.

Fill out your IRS 8959 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8959 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.