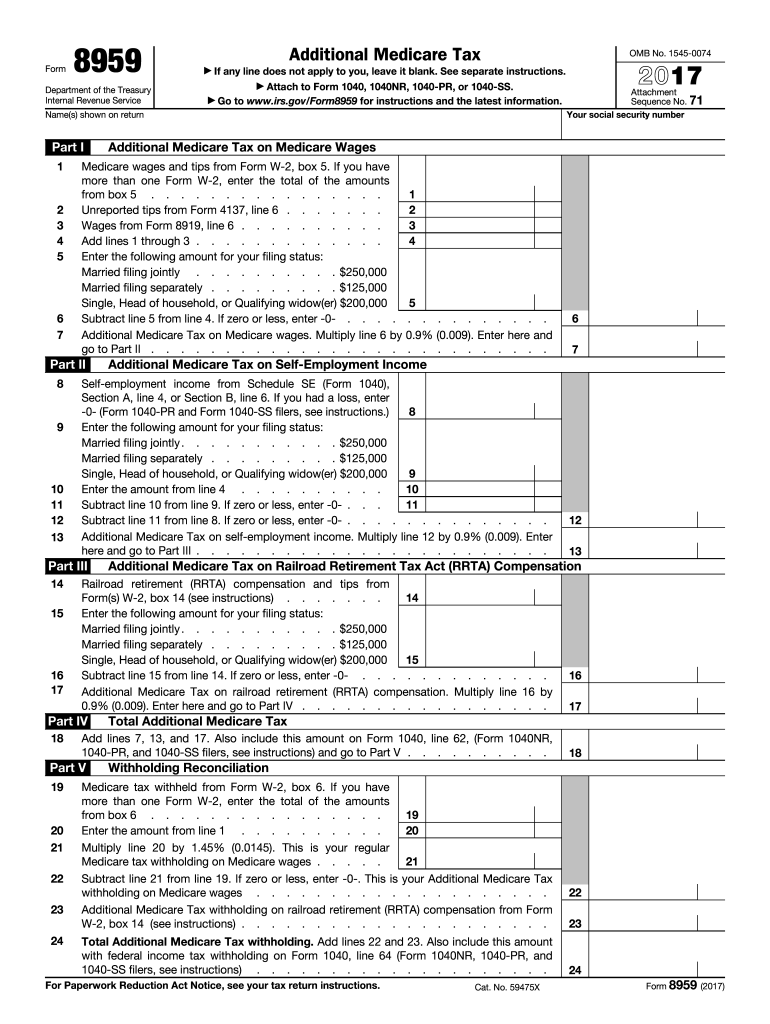

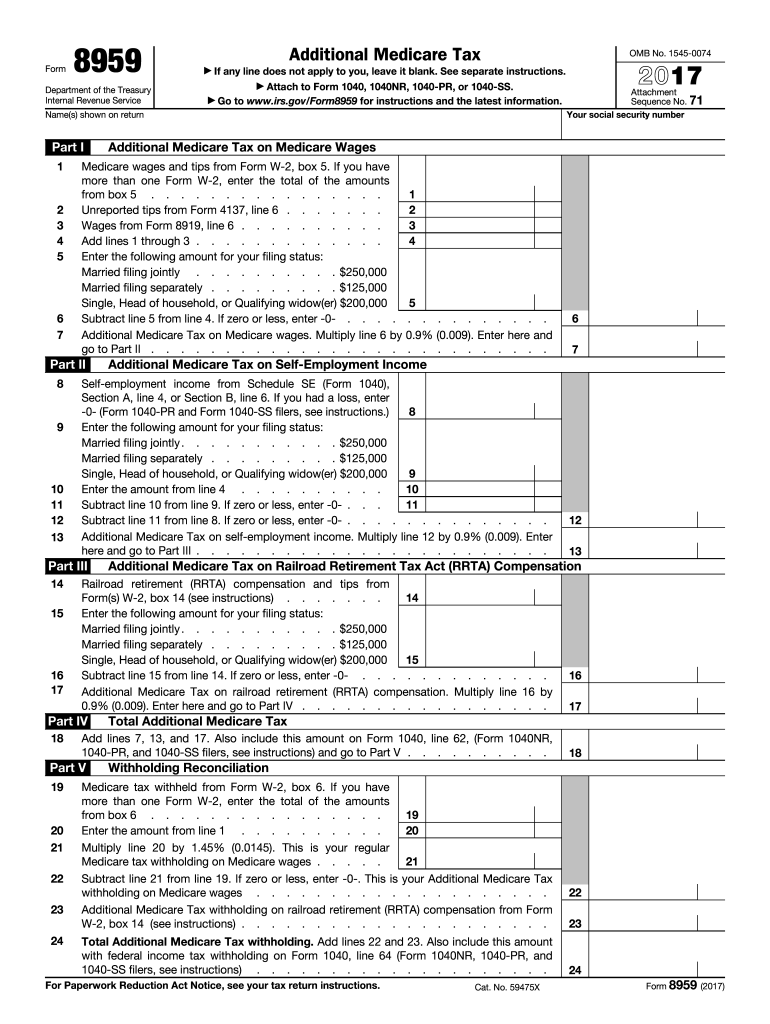

IRS 8959 2017 free printable template

Get, Create, Make and Sign 8959 tax 2017 form

Editing 8959 tax 2017 form online

Uncompromising security for your PDF editing and eSignature needs

IRS 8959 Form Versions

How to fill out 8959 tax 2017 form

How to fill out IRS 8959

Who needs IRS 8959?

Instructions and Help about 8959 tax 2017 form

Welcome to our discussion of the brandnew forms the IRS has released toimplement the new additional taxes thatour clients are going to face this yearon the Medicare taxes meaning theadditional 0.9 percent withholding onwages and self-employment income as wellas a section 14 11 net investment incometax in August the IRS released drafts ofthe new form 89 59 on which we'llcompute the additional withholding taxand the new form 8960 where the section14 11 net investment income tax will bereported the form 1040 released back inJuly the draft version showed a new lineentry for line 60 where we're going toput the result of these two forms aswill also discuss we're going to modifya reporting of federal withholding taxon the form 1040 we're going to modifythat because they're going to have tocompute how much additional withholdingwe're going to pick up due to theadditional Medicare tax withholding theform 89 59 is shown on your screen nowprobably not a very readable form foryou but we're gonna break it down andlook at it's five parts part one dealswith standard w-2 wages these are wagesnot from the railroad not covered byrailroad retirement Act and obviouslynot self-employment probably for thelargest number of taxpayers these sevenlines are going to be the key you pickup Medicare wages on this form as wellas any additional Medicare wages thatwould come from the 440 137 or 89 19 ifyou have some items that were paid toyou and not reported as wages you addthose three up and you compute based onthe limitation as the screen shows we'relooking on this for if you're a marriedcouple we're looking at it jointly ifyou're married and you don't file jointwith your spouse you're going to get alower limitation and if you're singleyou get another one now this isinteresting because your wagewithholding is going to be based solelyon whether you're paid more than twohundred thousand dollars from a singleemployer during the yearso the first hint you have to have isthe withholding will be wrong in many ifnot most cases for a married couplefiling a joint return we're gonna lookat combined wages Medicare wages fromboth spouses of $250,000 if they'refiling separate returns each spouse has125,000 which they're going to use onthis form for all others but is theunmarried we're going to have $200,000to work with here yes that is a northernmarriage penalty on line 6 if your wagesdon't exceed that level you don't payany of this tax and you're doneat least unless you have self-employmentincome if you do exceed that number wecompute the additional Medicare tax onwages on line 7 and you hold that for awhile because we have to check if we oweany on self-employment income orrailroad retirement Act income part 2computes the additional Medicare taxthat may be due this is based on thesame limitations as...

People Also Ask about

How do I claim excess Medicare tax withheld?

What was the Medicare tax in 2017?

What is a 8959 form used for?

Who needs to file form 8959?

How do you calculate the additional Medicare tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 8959 tax 2017 form straight from my smartphone?

How do I edit 8959 tax 2017 form on an iOS device?

How do I edit 8959 tax 2017 form on an Android device?

What is IRS 8959?

Who is required to file IRS 8959?

How to fill out IRS 8959?

What is the purpose of IRS 8959?

What information must be reported on IRS 8959?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.