VA 760-ADJ 2013 free printable template

Show details

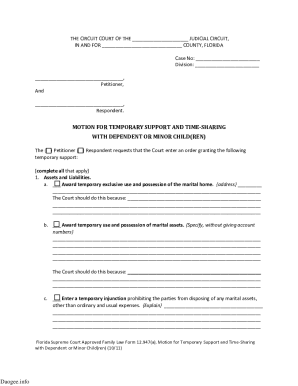

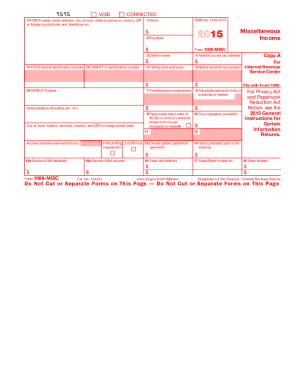

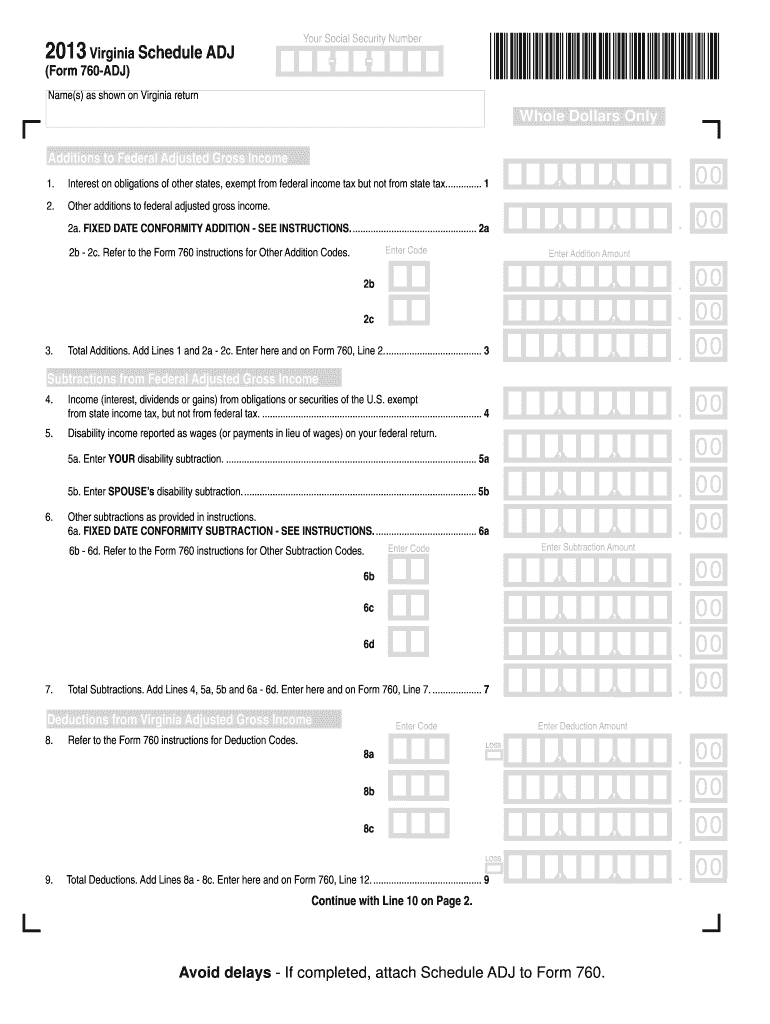

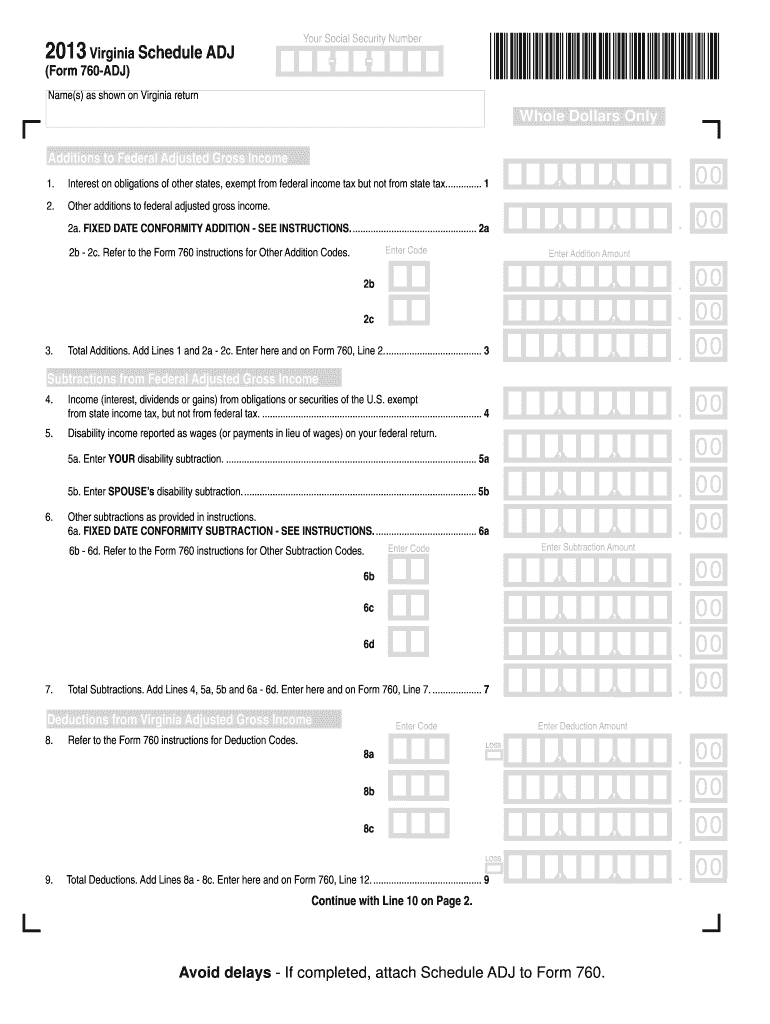

2013 Virginia Schedule ADJ Your Social Security Number - Form 760-ADJ Name s as shown on Virginia return Whole Dollars Only Additions to Federal Adjusted Gross Income Interest on obligations of other states exempt from federal income tax but not from state tax. 1 Other additions to federal adjusted gross income. 2a* FIXED DATE CONFORMITY ADDITION - SEE INSTRUCTIONS*. 2a Enter Code 2b - 2c* Refer to the Form 760 instructions for Other Addition Codes. Enter Addition Amount 2b 2c 5a*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA 760-ADJ

Edit your VA 760-ADJ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA 760-ADJ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA 760-ADJ online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit VA 760-ADJ. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 760-ADJ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA 760-ADJ

How to fill out VA 760-ADJ

01

Gather necessary documents such as W-2 forms and 1099s.

02

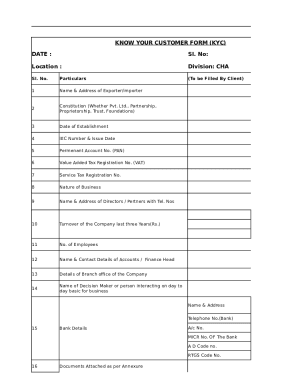

Start with personal information, including your full name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) on the form.

04

Report all income sources and total them accurately in the designated sections.

05

Claim any credits or deductions that apply to your situation.

06

Review the tax calculation section and ensure all figures are accurate.

07

Sign and date the form before submitting it.

Who needs VA 760-ADJ?

01

Any Virginia resident who has overpaid their state income tax during the year.

02

Individuals or married couples who wish to file for a refund on their Virginia state taxes.

Fill

form

: Try Risk Free

People Also Ask about

Is adjusted gross income my net income?

Your adjusted gross income is the amount of money you receive each month that is subject to taxes. AGI is only used on individual tax returns. Although AGI is typically referred to as net income, they are not exactly the same. Whereas net income refers to after tax income, AGI is total taxable income.

What is the spouse tax adjustment for VA form 760?

Married couples who file a joint Form 760 may be eligible for an adjustment of up to $259 against their joint income tax liability if each spouse received income during the taxable year.

What is form 760?

2022 Virginia Resident Form 760 Individual Income Tax Return.

How do I calculate my adjusted gross income?

The AGI calculation is relatively straightforward. Using the income tax calculator, simply add all forms of income together, and subtract any tax deductions from that amount. Depending on your tax situation, your AGI can even be zero or negative.

What is total adjusted gross income?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.

What is adjusted annual income on tax return?

Your total (or “gross”) income for the tax year, minus certain adjustments you're allowed to take. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. Adjusted gross income appears on IRS Form 1040, line 11.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA 760-ADJ in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your VA 760-ADJ and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out VA 760-ADJ using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign VA 760-ADJ and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit VA 760-ADJ on an iOS device?

Create, edit, and share VA 760-ADJ from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is VA 760-ADJ?

VA 760-ADJ is a form used by Virginia taxpayers to amend their Virginia individual income tax return.

Who is required to file VA 760-ADJ?

Taxpayers who need to correct their previously filed Virginia income tax return or to claim a refund for an overpayment are required to file VA 760-ADJ.

How to fill out VA 760-ADJ?

To fill out VA 760-ADJ, taxpayers must provide their personal information, details of the original return, the changes being made, and any additional documentation supporting the amendment.

What is the purpose of VA 760-ADJ?

The purpose of VA 760-ADJ is to allow taxpayers to correct errors on their original tax returns, such as income, deductions, or credits, and to reconcile any differences.

What information must be reported on VA 760-ADJ?

The information that must be reported on VA 760-ADJ includes the taxpayer's name, social security number, the tax year being amended, the reasons for the amendment, and the corrected amounts for income, deductions, and credits.

Fill out your VA 760-ADJ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA 760-ADJ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.