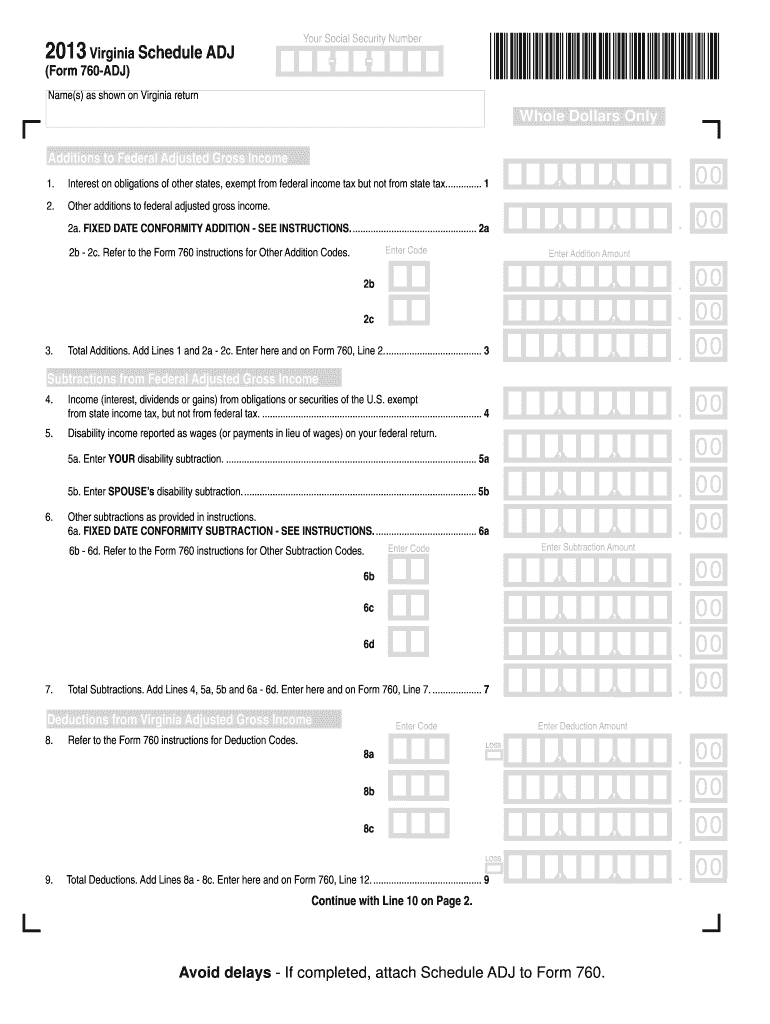

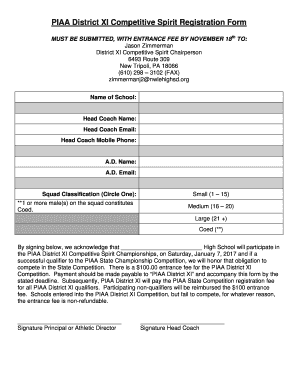

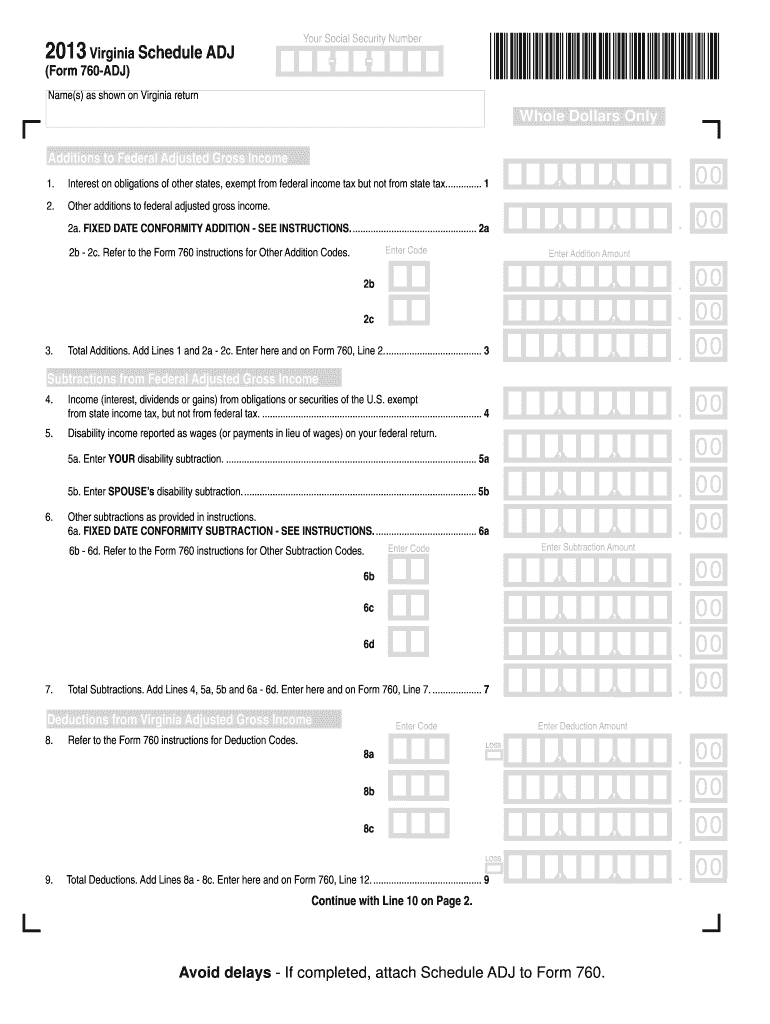

VA 760-ADJ 2013 free printable template

Get, Create, Make and Sign VA 760-ADJ

How to edit VA 760-ADJ online

Uncompromising security for your PDF editing and eSignature needs

VA 760-ADJ Form Versions

How to fill out VA 760-ADJ

How to fill out VA 760-ADJ

Who needs VA 760-ADJ?

Instructions and Help about VA 760-ADJ

Hi everyone Edgar Vernal here at a DJ, and I'm very excited to announce to you about three webinars that we will behave coming your way the first webinar will be this Friday, and it's going to be our PRE lid product sneak peek it'going to be friday, november 14th at 12pmpacific time adj will be revealing three brand-new products for you to see so make sure you check us out this fridayonce again November 14 at 12 p.m.pacific time after that we#39’re going Mohave webinar number two which will be on our CPU actives speaker series it Willie friday, december 5th at 12pm pacific time once again Tom and I will betake about the exciting features and give a sound demo a live sound demo in this webinar about the CPU series speakers webinar number three will be alive under the hood with our very own Chuck Greene, so you know that's going to be a lot of fun that#39’s going to take place on Friday December nineteenth at12 p.m. pacific time and the product instill to be announced we're going to announce the product after the lid show that Chuck green will be doing a life under the hood with webinar number three so once again three webinars coming your way so make sure you always check out a DJ calm or sign up for our newsletters, so you're always up to date with all of our live events thanks

People Also Ask about

Is adjusted gross income my net income?

What is the spouse tax adjustment for VA form 760?

What is form 760?

How do I calculate my adjusted gross income?

What is total adjusted gross income?

What is adjusted annual income on tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA 760-ADJ in Gmail?

How do I fill out VA 760-ADJ using my mobile device?

How do I edit VA 760-ADJ on an iOS device?

What is VA 760-ADJ?

Who is required to file VA 760-ADJ?

How to fill out VA 760-ADJ?

What is the purpose of VA 760-ADJ?

What information must be reported on VA 760-ADJ?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.