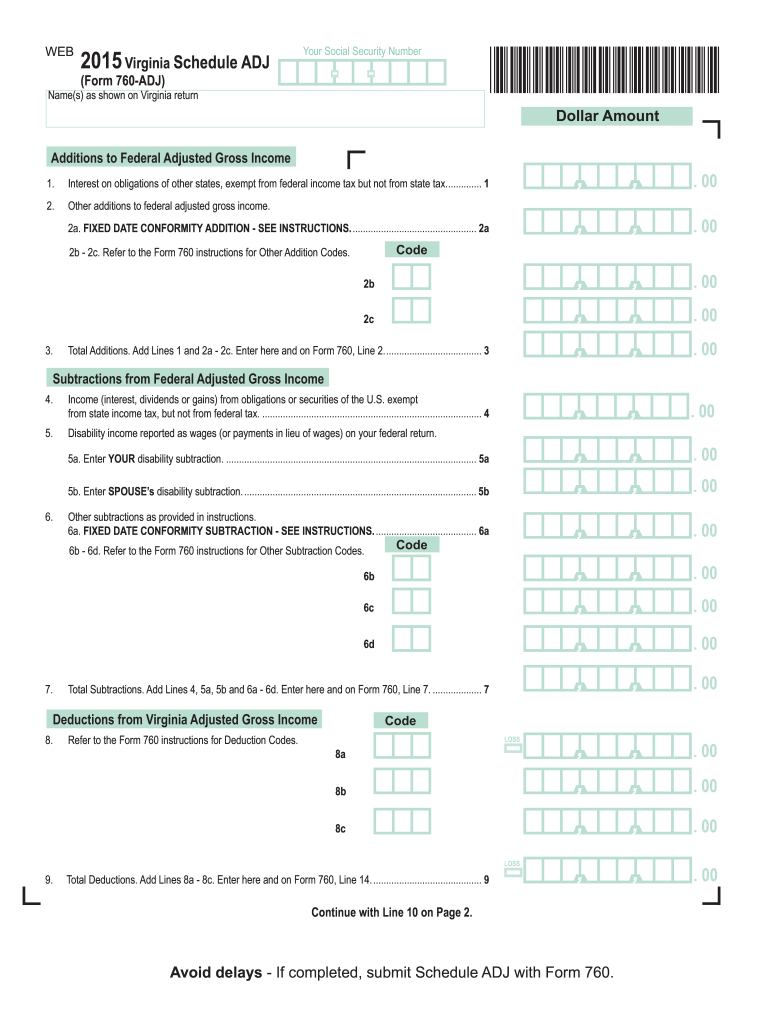

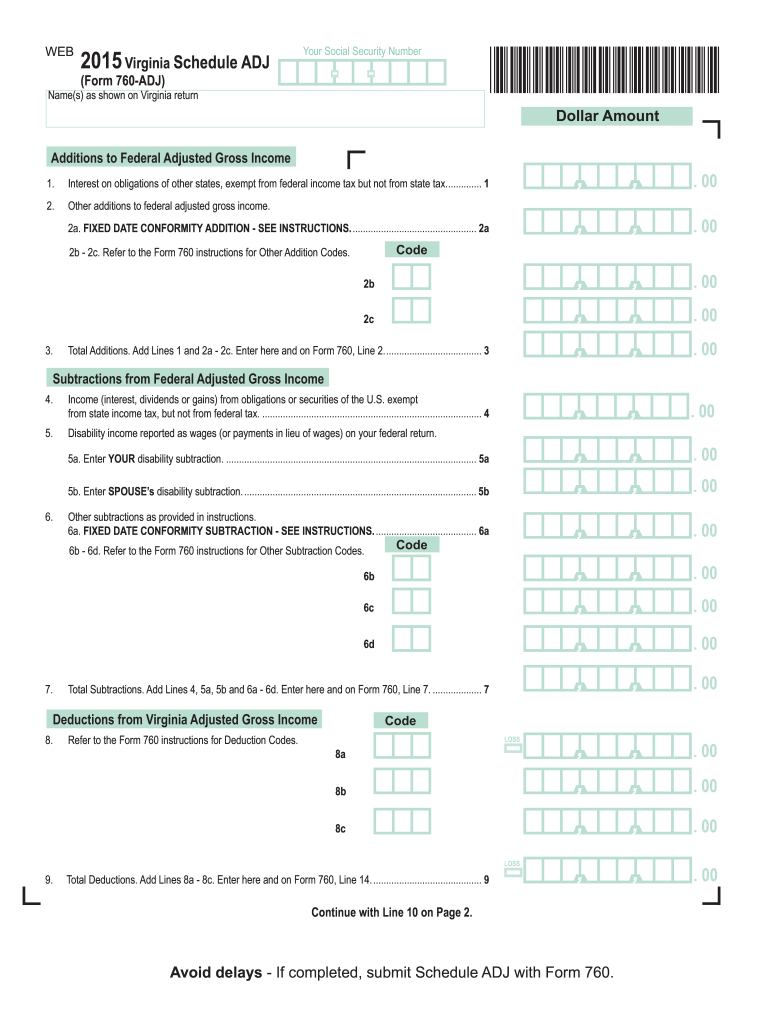

VA 760-ADJ 2015 free printable template

Get, Create, Make and Sign VA 760-ADJ

Editing VA 760-ADJ online

Uncompromising security for your PDF editing and eSignature needs

VA 760-ADJ Form Versions

How to fill out VA 760-ADJ

How to fill out VA 760-ADJ

Who needs VA 760-ADJ?

Instructions and Help about VA 760-ADJ

Let's go to the Lord in prayer. Father, I come before You in the name of your son, Jesus. I praise You for Your presence, for Your kindness, for Your smile, favor, grace abounding to the chief of sinners, mercy, a good portion of Your Spirit. Father, You know me. You know my great limitations. You have taught me to trust Thee, Oh God. Lord, I praise you and I love you. I worship You, Oh God. Let every tongue be silenced. Let Your presence be with us. Your presence, real and abiding, life giving, changing everything it touches. God help us. And help us Lord in such a way that men will know that we have been helped. In Jesus' name, Amen. It is always very difficult for me to come to a place like this. I don't really fit. I feel most comfortable in the bush, on the mission field. And I don't mean it as an insult. I feel more comfortable actually in large churches filled with people who've gathered in the name of Jesus but do not know Him. I'm here today, and well, Brother Riddle has forgotten more, probably, than I've ever learned. Some of you are better well read than I am. You know more. What can I tell you? But I can ask you this... How much did you pray this morning? How much do you tarry before the throne of God every day? There's a scary thing to me about this Reformed, Puritan, Biblical, sovereign grace resurgence. Oh, I love the doctrine. We rejoice in the Puritan doctrine, do we rejoice in the Puritan piety? Do we know the experience of David Brainerd? Have we cried out all night, in the snow, in the woods, exposing ourselves to the elements or whatever may be required. Do we even believe anymore, that the presence of God can come into a place and lay every person low? Do we know the power of the Holy Spirit? Do we know the presence of God in such a way that it seems to literally disintegrate us? And then put us back together again. Oh, dear brothers, there's so much to be done in this world and the power of the flesh will not accomplish it and the power of the intellect will not accomplish what must be done. It is the power of the living God, and I don't understand the mystery, I can't defend the reason, but I know this, that apart from prayer, abiding, enduring, believing prayer, we're as dead as a doorknob with all our doctrine. How I need God! I feel sometimes I can't breath! Unless I have Him! Some of you know. And maybe you have forgotten. You remember those times of tarrying in His presence. And you knew God was there, not just because of a doctrine that told you He was omnipresent, but that the presence of His was manifest in that room with you. Once that has touched your life, you can't live without that. I'm not talking about some charismatic experience. I'm not talking about something that was foreign to the fathers, theological fathers that we most love and honor. Read Edwards. Read Brainerd. Read my dearest, Charles Spurgeon. Read Flavel. We have Scripture and we are to be wise in it. Our people perish for a lack of knowledge,...

People Also Ask about

What is considered my adjusted gross income?

What forms do I need to file with my Virginia state taxes?

What is total adjusted gross income?

Is your AGI same on federal and state?

What is Virginia adjusted gross income?

How do I change my VA tax withholding?

Where do I find adjusted gross income on my taxes?

What is Virginia Schedule K 1?

How do you calculate Virginia adjusted gross income?

What is Virginia Schedule adj?

What is considered taxable income in Virginia?

Does Virginia use federal AGI?

How do I find my Virginia adjusted gross income?

What is Schedule Inc in Virginia?

Does Virginia have a state income tax form?

What is the purpose of the spouse tax adjustment on the Virginia tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit VA 760-ADJ from Google Drive?

How can I send VA 760-ADJ for eSignature?

Can I create an eSignature for the VA 760-ADJ in Gmail?

What is VA 760-ADJ?

Who is required to file VA 760-ADJ?

How to fill out VA 760-ADJ?

What is the purpose of VA 760-ADJ?

What information must be reported on VA 760-ADJ?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.