KY 51A260 2012 free printable template

Show details

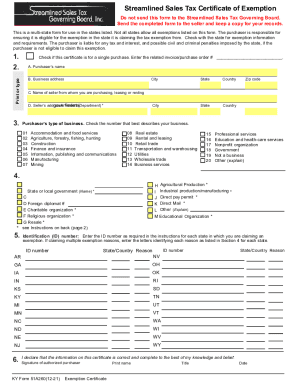

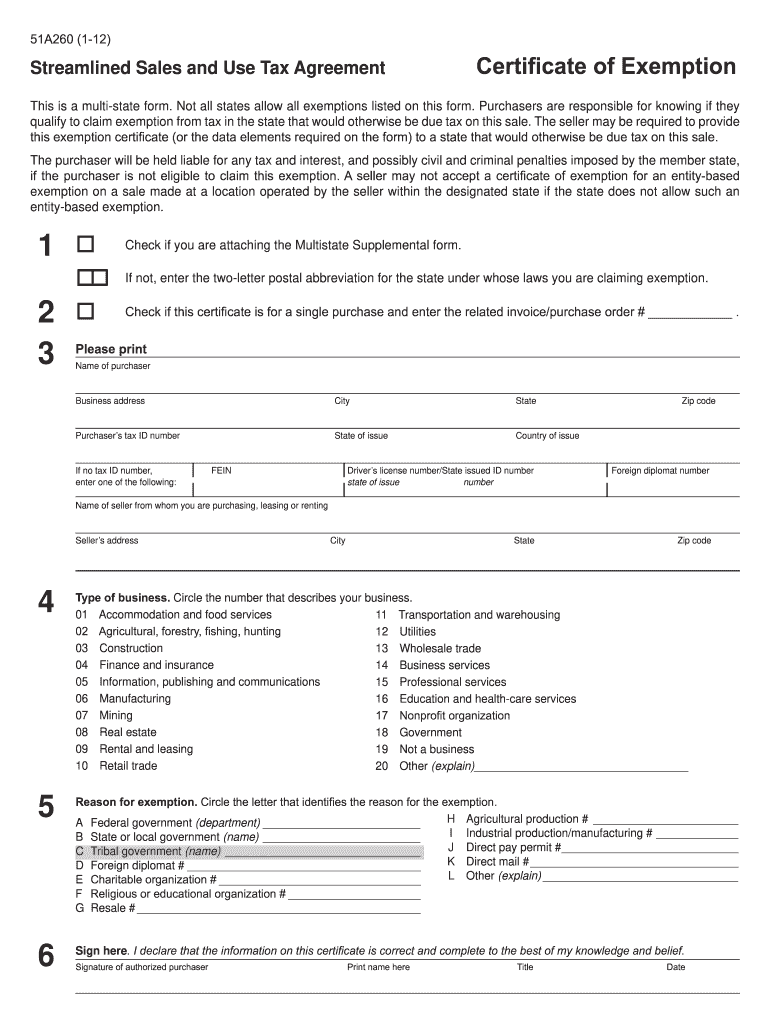

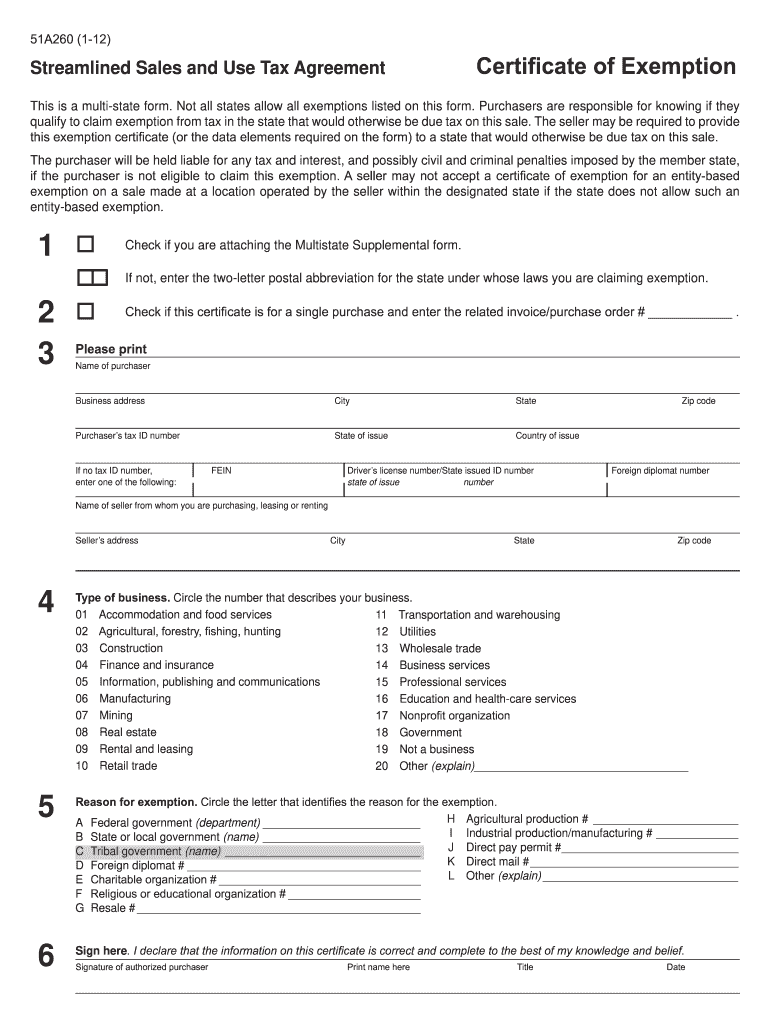

51A260 1-12 Streamlined Sales and Use Tax Agreement Certificate of Exemption This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The seller may be required to provide this exemption certificate or the data elements required on the form to a state that would otherwise be due tax on this sale. The purchaser will be held...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 51A260

Edit your KY 51A260 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 51A260 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY 51A260 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY 51A260. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A260 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 51A260

How to fill out KY 51A260

01

Obtain a copy of the KY 51A260 form from the appropriate agency or website.

02

Begin filling out the form with your personal information, such as your name, address, and social security number.

03

Provide details about the specific purpose for which you are filling out the form.

04

Fill in any relevant financial information as required by the form.

05

Review all the information you provided to ensure it is accurate and complete.

06

Sign and date the form as required.

07

Submit the completed form to the designated agency or department, either by mail or electronically if applicable.

Who needs KY 51A260?

01

Individuals applying for certain state benefits or programs in Kentucky.

02

Individuals who need to report specific financial or personal information to the state.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Kentucky sales tax?

While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Kentucky. CategoryExemption StatusFood and MealsGeneral Occasional SalesEXEMPTMotor VehiclesEXEMPT *Optional Maintenance Contracts19 more rows

Do I have to charge sales tax Kentucky?

Sales tax is a tax on tangible personal property and digital property that is sold, leased or rented in Kentucky and selected services. It is the seller's responsibility to collect the sales tax from the customers and to remit the sales tax to the Department of Revenue.

How do I become exempt from farm tax in Kentucky?

A new Kentucky law requires that farmers apply for an Agriculture Exemption Number to make qualified purchases for the farm exempt from sales tax. Farmers may still use Forms 51A158 and 51A159 without an Agriculture Exemption Number through June 30, 2022, by using their driver's license number.

How do I get farm exemption in KY?

You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment (Form 51A159) to each of your vendors using your Agriculture Exemption Number.

How do you qualify as a farm in ky?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

What is the form for Kentucky consumer use tax return?

Consumer Use Tax Return - Form 51A113(O) may be filed during the year each time you make taxable purchases. You can report and pay use tax on an annual basis at the same time you file your Kentucky individual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KY 51A260 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your KY 51A260 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete KY 51A260 online?

pdfFiller has made it easy to fill out and sign KY 51A260. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit KY 51A260 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign KY 51A260 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is KY 51A260?

KY 51A260 is a tax form used in the state of Kentucky to report income earned by non-residents.

Who is required to file KY 51A260?

Non-residents of Kentucky who have earned income in the state are required to file KY 51A260.

How to fill out KY 51A260?

To fill out KY 51A260, gather your income information, complete the form by providing your personal details, income amounts, any applicable deductions, and sign the form before submission.

What is the purpose of KY 51A260?

The purpose of KY 51A260 is to facilitate the reporting of income earned by non-residents and to ensure they pay the appropriate amount of tax on their Kentucky-sourced income.

What information must be reported on KY 51A260?

The information that must be reported on KY 51A260 includes the taxpayer's name, address, Social Security number, total income earned in Kentucky, and any deductions that apply.

Fill out your KY 51A260 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 51A260 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.