KY 51A260 2020 free printable template

Show details

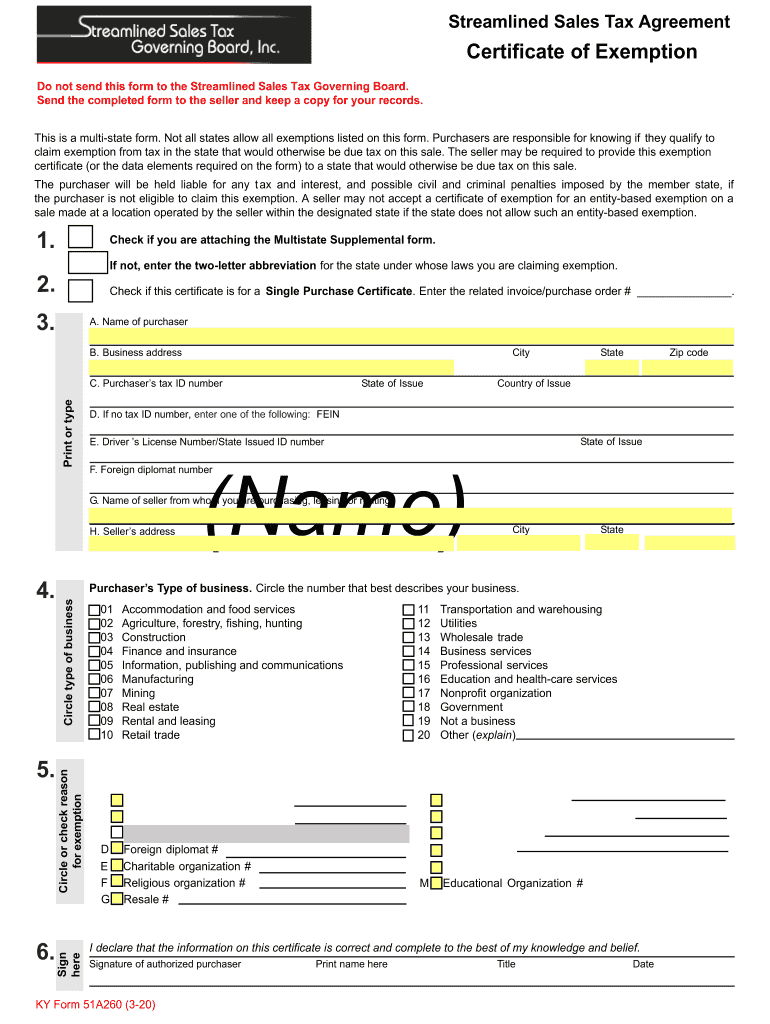

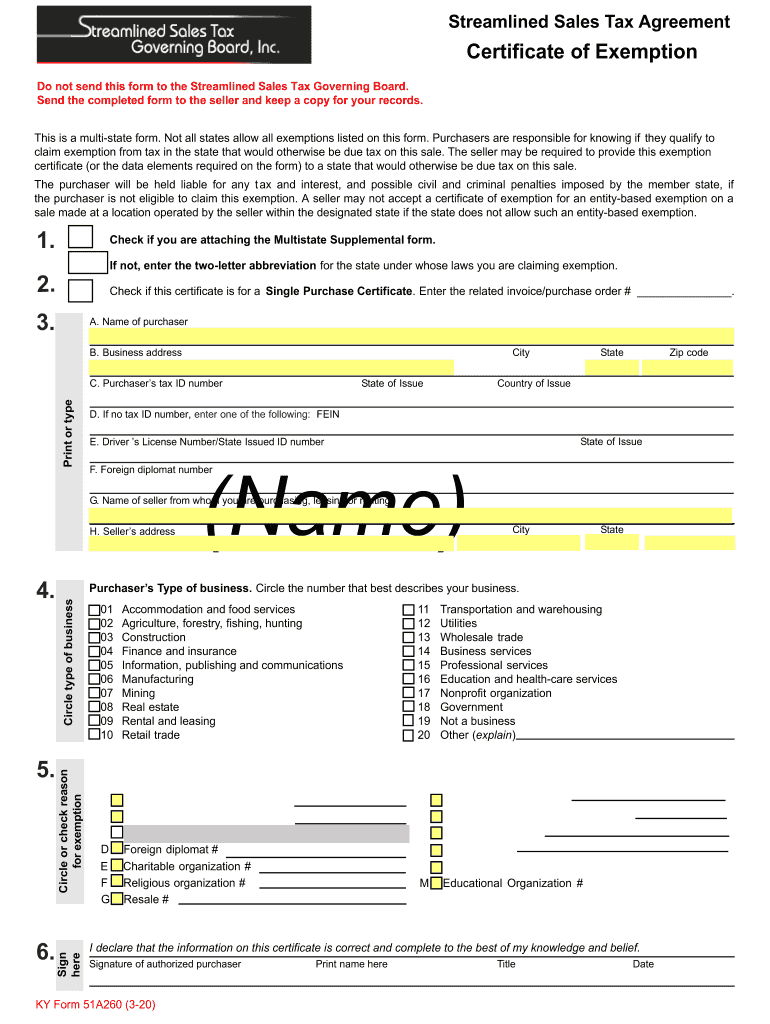

51A260 1-12 Streamlined Sales and Use Tax Agreement Certificate of Exemption This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The seller may be required to provide this exemption certificate or the data elements required on the form to a state that would otherwise be due tax on this sale. The purchaser will be held...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 51A260

Edit your KY 51A260 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 51A260 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY 51A260 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY 51A260. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A260 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 51A260

How to fill out KY 51A260

01

Obtain the KY 51A260 form from the Kentucky Department of Revenue website or a local office.

02

Fill in the personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of tax return you are filing by checking the appropriate box.

04

Complete the income section by reporting all applicable income sources as instructed on the form.

05

Deduct any eligible expenses or credits as specified in the form instructions.

06

Calculate your total tax liability or refund amount based on the provided calculation sections.

07

Sign and date the form at the bottom, certifying that all information is accurate and complete.

08

Submit the completed KY 51A260 form to the Kentucky Department of Revenue by mail or electronically, as directed.

Who needs KY 51A260?

01

Anyone who is a resident of Kentucky and is required to file a state income tax return.

02

Individuals who have income sourced in Kentucky and need to report their tax obligations.

03

Taxpayers seeking to claim deductions or credits available under Kentucky tax law.

Fill

form

: Try Risk Free

People Also Ask about

Is BVI tax free?

There is technically still income tax assessed in the British Virgin Islands for companies and individuals, but the rate of taxation has been set at zero. That means that individuals are not obliged to filling obligations on their income tax.

How to fill out PA exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What does an SSL certificate do?

An SSL certificate is a bit of code on your web server that provides security for online communications. When a web browser contacts your secured website, the SSL certificate enables an encrypted connection. It's kind of like sealing a letter in an envelope before sending it through the mail.

How do I assign SSL 123 Reg?

Start by logging in to your 123 Reg Control Panel. From there, select SSL Certificates within the 'Manage active products' section and then select Manage opposite Manage SSL Certificates. This will take you to the SSL overview page, where you will see all your purchased SSL certificates.

What is a US tax exemption certificate?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

What is 123 SSL?

Thawte powered by DigiCert SSL123 Certificates have the fastest issuance time to quickly enable encrypted connections to your web server. This domain-only validation SSL Certificate provides up to 256-bit encryption for web-based applications that are not at risk for phishing or fraud.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY 51A260 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including KY 51A260, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute KY 51A260 online?

pdfFiller has made filling out and eSigning KY 51A260 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in KY 51A260?

With pdfFiller, it's easy to make changes. Open your KY 51A260 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is KY 51A260?

KY 51A260 is a form used by the state of Kentucky for reporting and remitting taxes related to various business activities and income.

Who is required to file KY 51A260?

Businesses and individuals engaged in activities subject to Kentucky income tax or other applicable taxes are required to file KY 51A260.

How to fill out KY 51A260?

To fill out KY 51A260, gather all necessary financial information, complete the required sections honestly, and ensure all income and deductions are accurately reported before submitting.

What is the purpose of KY 51A260?

The purpose of KY 51A260 is to ensure compliance with Kentucky tax laws by providing a standardized method for taxpayers to report their income and pay any owed taxes.

What information must be reported on KY 51A260?

KY 51A260 requires reporting of income, deductions, credits, and other relevant financial information necessary to calculate the tax liability.

Fill out your KY 51A260 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 51A260 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.